Abstract

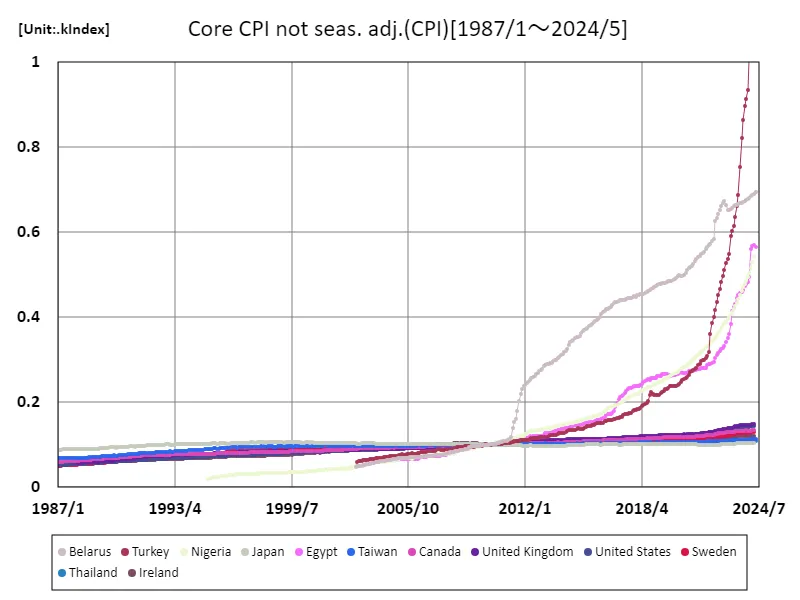

According to data for May 2024, Turkey recorded the highest index of 1,160 in the overall index excluding fresh food (not seasonally adjusted). This indicator is an important indicator reflecting the health of economic activity and inflationary pressures, and Turkey’s particularly high figure may be due to persistent inflation and a weak currency. Turkey is experiencing rising prices due to a combination of economic instability and political factors, which is having a direct impact on consumer purchasing power. Compared to other countries, Turkey’s index shows a unique trend, as developed countries such as Japan and the United States usually maintain lower indices with stable inflation rates. Emerging economies like Turkey often face strong economic growth but also rapid price increases, which has led to an increase in the overall index. In order for Turkey to achieve sustainable economic growth in the future, policies aimed at curbing inflation and stabilizing the currency will be important. In this way, the overall index is a very useful indicator for understanding the economic situation of each country.

Overall index excluding fresh food (not seasonally adjusted)

Considering data from 1987 to May 2024, the composite index excluding fresh food (not seasonally adjusted) is a key indicator of the health of the economy and the impact of inflation. Turkey’s 1160 index is very high compared to other countries, especially since it peaked in May 2024. The increase reflects the effects of rapid inflation and a weak currency facing Türkiye’s economy. Turkey has a strong economic growth but is vulnerable to political instability and external factors, which has led to the index reaching 100% of its peak value. In contrast, other countries have maintained relatively stable indices, with developed countries in particular experiencing sustained low inflation rates and relatively stable consumer purchasing power. Over the past few decades, Turkey’s economic indicators have fluctuated significantly, and anti-inflation and monetary policies have become increasingly important, especially since the economic crisis of the early 2000s. The overall index excluding fresh food also serves as an indicator to measure the effectiveness of Turkey’s economic policies, and efforts are needed to stabilize the economy in the future. As such, indexes are key data for understanding economic trends, and the case of Turkey is a good example of this.

The maximum is the latest one, 1.16kIndex of Turkey

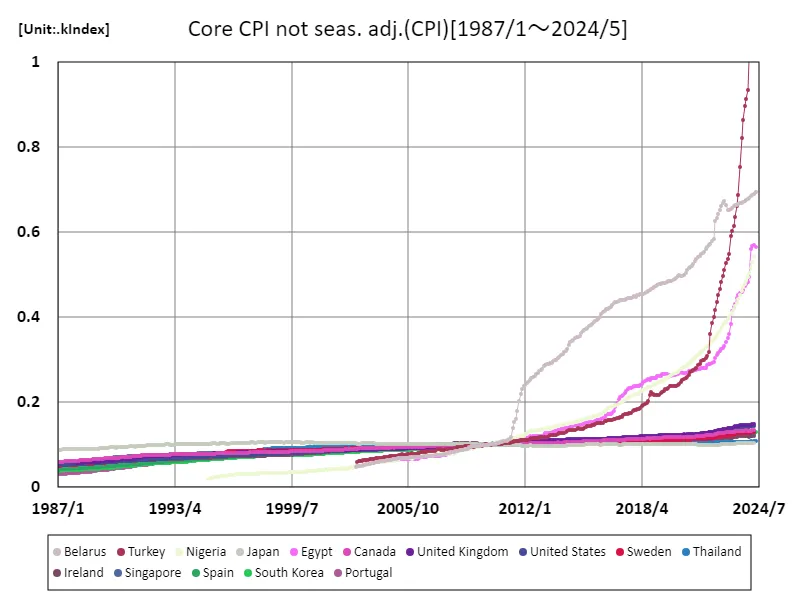

Overall index excluding fresh food (not seasonally adjusted) (worldwide)

The composite index excluding fresh food (not seasonally adjusted) from 1987 to May 2024 is an important indicator of fluctuations in the global economy, with Turkey’s 1160 index standing out in particular. The figure reflects the severe inflation and currency depreciation facing Turkey’s economy, which peaked at 100%, signaling continued economic fragility. Turkey’s economy has experienced significant ups and downs over the past few decades, and especially since the economic crisis of the early 2000s, there has been an urgent need to combat inflation. As a result, fluctuations in inflation rates have a large impact on the overall index, with sharp increases in food and energy prices in particular helping to push the index up. Compared to other countries, Turkey’s index is at a high level, while developed countries have maintained stable inflation rates. This reflects differences in economic policies and the influence of external factors. The case of Turkey shows the risks of simultaneous economic growth and rising prices, and calls for stringent economic policies and a stable environment to achieve sustainable growth. As such, the composite index excluding fresh food is a key indicator for understanding Türkiye’s economic trends.

The maximum is the latest one, 1.16kIndex of Turkey

Comments