Abstract

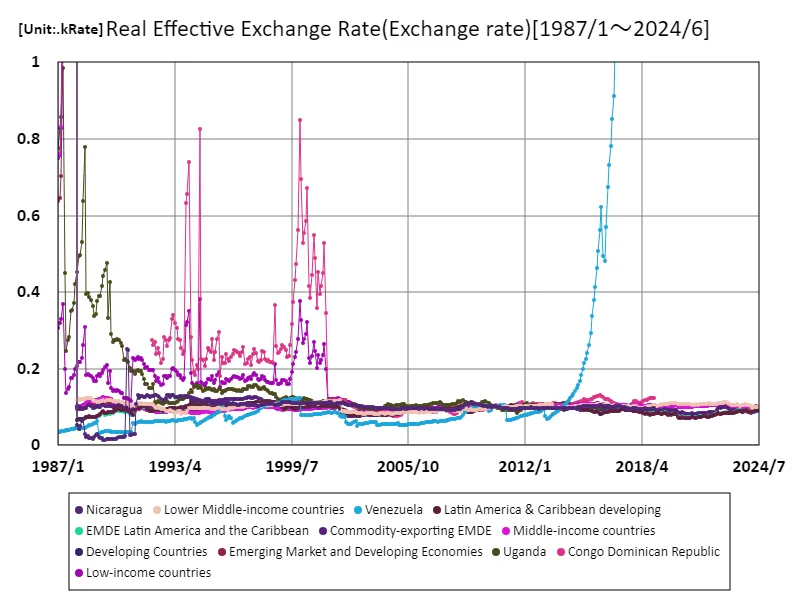

The real effective exchange rate (REER) reflects the value of a country’s currency relative to others, adjusted for inflation. Emerging market and developing countries have seen fluctuating REERs, often reflecting shifts in trade balances, inflation rates, and global demand. A REER of 101 in June 2024 indicates a relatively stronger performance compared to past periods when emerging markets typically faced depreciation pressures due to external shocks, inflation, or weaker currencies. These countries’ REERs are influenced by both domestic policy choices and global economic trends, like commodity price changes.

Real effective exchange rate

Nicaragua’s record real effective exchange rate (REER) of 10.1 million in December 1987 reflects an extraordinary anomaly, likely linked to hyperinflation and severe economic instability during that period. Since then, Nicaragua’s REER has significantly depreciated, reaching just 961% of its peak as of June 2024. This long-term decline mirrors broader trends in emerging markets where high inflation, external shocks, and changes in global demand impact currency stability. Nicaragua’s REER trend underscores the challenges faced by small economies with limited diversification and vulnerability to external financial pressures.

The maximum is 10.1MRate[1987年12月] of Nicaragua, and the current value is about 961μ%

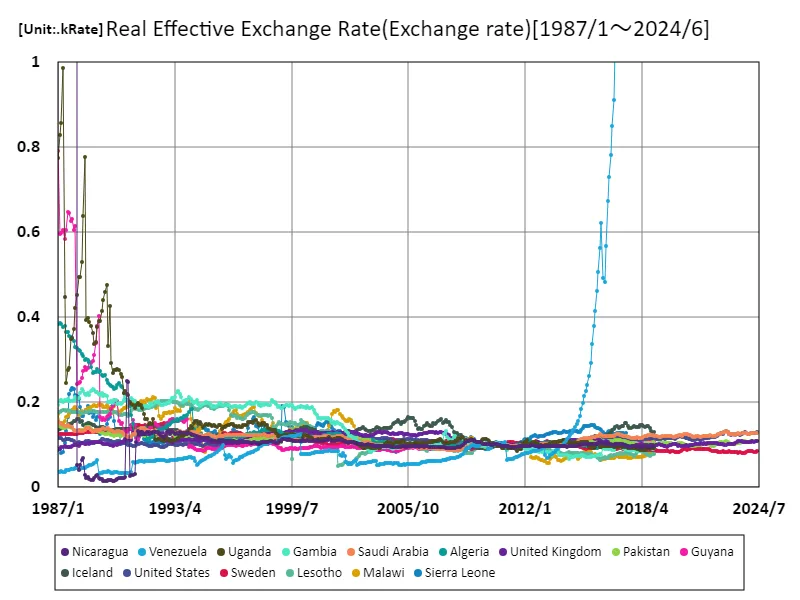

Real effective exchange rates (worldwide)

Nicaragua’s peak real effective exchange rate (REER) of 10.1 million in December 1987, driven by hyperinflation and severe economic disruption, remains an extreme outlier. Since then, the country has seen a dramatic depreciation, with its current REER at 961% of the peak as of June 2024. This decline reflects broader trends in emerging economies, where factors like inflation, political instability, and external economic pressures often lead to currency weakness. The long-term trend highlights the challenges faced by smaller economies in maintaining currency stability amidst volatile global conditions.

The maximum is 10.1MRate[1987年12月] of Nicaragua, and the current value is about 961μ%

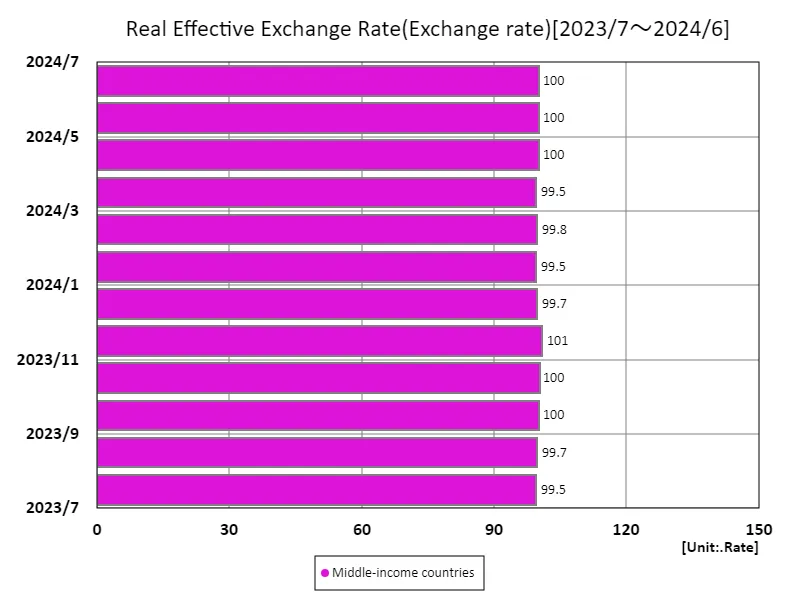

Real effective exchange rate (by income, latest year)

As of July 2023, high-income countries recorded a maximum real effective exchange rate (REER) of 108, with an average of 103, reflecting strong currency performance compared to global peers. The REER for these nations tends to be higher due to stable inflation, robust economic policies, and strong trade positions. The total REER of 414 highlights diverse global performance, with emerging markets often facing lower rates due to inflationary pressures, political instability, and external economic shocks. Over time, high-income countries have generally maintained competitive exchange rates, supporting their global trade positions.

The maximum is 101Rate[2023年11月] of Middle-income countries, and the current value is about 99.2%

Comments