Abstract

According to May 2024 data, total reserves of emerging market and developing countries will reach US$8.28 trillion, reflecting the trend over the past few years. This increase indicates that these countries are building up their foreign exchange reserves to boost their economic growth. In particular, Asian and Latin American countries are accumulating foreign exchange reserves due to trade surpluses and increasing foreign direct investment. Over the past few years, central banks have placed great importance on foreign exchange reserves to ensure exchange rate stability and monetary policy flexibility. This has made emerging economies more resilient to external shocks. However, on the other hand, increasing reserves also carries the risk of increasing the economy’s dependence on external capital. Careful management is required, especially as rising interest rates and exchange rate fluctuations have an impact. The impact of emerging market and developing economies on the global economic environment is expected to increase in the future, and trends in foreign exchange reserves will continue to be an important indicator.

Total reserves (USD)

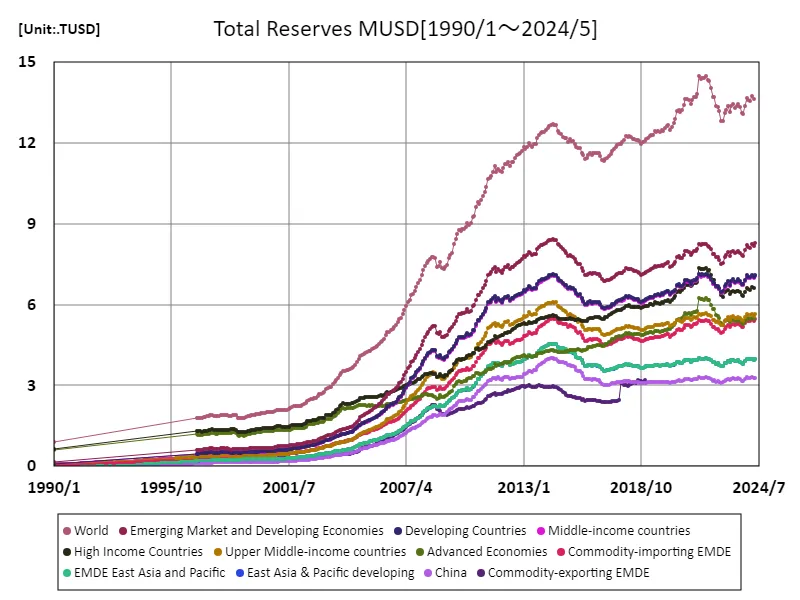

Looking back at the data on total reserves (in USD) from January 1990 to May 2024, especially the USD 14.5 trillion recorded in August 2021, shows the rapid growth of the global economy and the impact of monetary policy. This peak was driven by central banks increasing their reserves as a result of emergency economic measures and low interest rate policies in response to the pandemic. Total reserves currently stand at 94.1% of their peak, suggesting a correction amid an ongoing economic recovery. Over the past few decades, reserves of emerging market and developing countries have grown rapidly and play a significant role in the composition of global foreign exchange reserves. In particular, these countries place a high value on foreign exchange reserves to ensure financial stability and increase their resilience to external shocks. Rising reserves are also associated with increased international trade and investment, making risk management in the global economic environment increasingly important. Going forward, trends in total reserves will likely continue to be closely watched as an important indicator of reliability and stability in the global economy.

The maximum is 14.5TUSD[2021年8月] of World, and the current value is about 94.1%

Total reserves (USD) (worldwide)

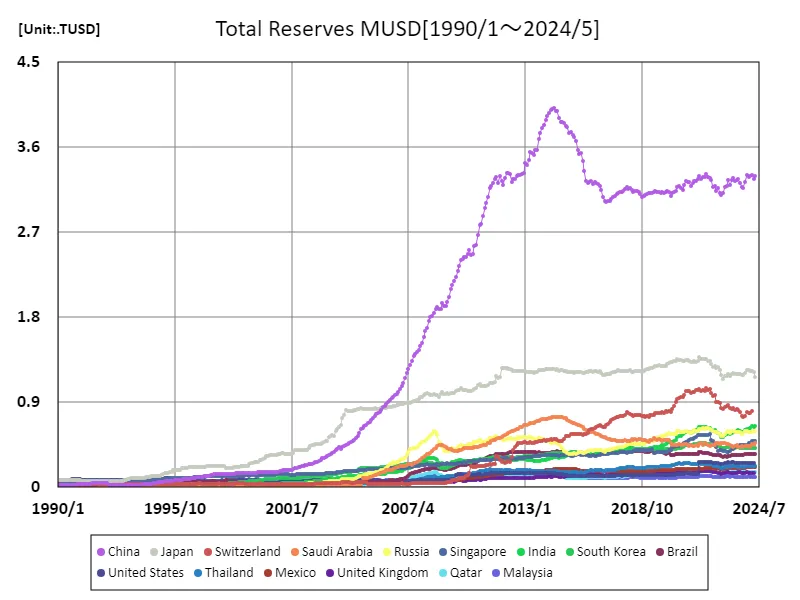

According to data covering the period from January 1990 to May 2024, China’s total reserves peaked at US$4.01 trillion in June 2014. This high level reflects China’s rapid economic growth, increasing exports, and inflows of foreign direct investment. In particular, as China played the role of the world’s factory, foreign exchange reserves became a factor in increasing its international influence. However, current reserves remain at 82.2% of their peak, a result of the maturity of the economy and changes in the external environment. In recent years, China has faced trade tensions and slowing economic growth, which has led to a decline in its reserves. In addition, as the internationalization of the renminbi progresses, the composition and strategy of foreign exchange reserves are also being reviewed. In addition, the Chinese government is focusing on expanding domestic demand and promoting the service industry in order to balance the economy. Against this background, foreign exchange reserves will likely play an important role in future economic policies. Overall, developments in China’s total reserves will continue to be closely watched as an important indicator of domestic and international economic conditions and policy changes.

The maximum is 4.01TUSD[2014年6月] of China, and the current value is about 82.2%

Total reserves (USD) (by income, latest year)

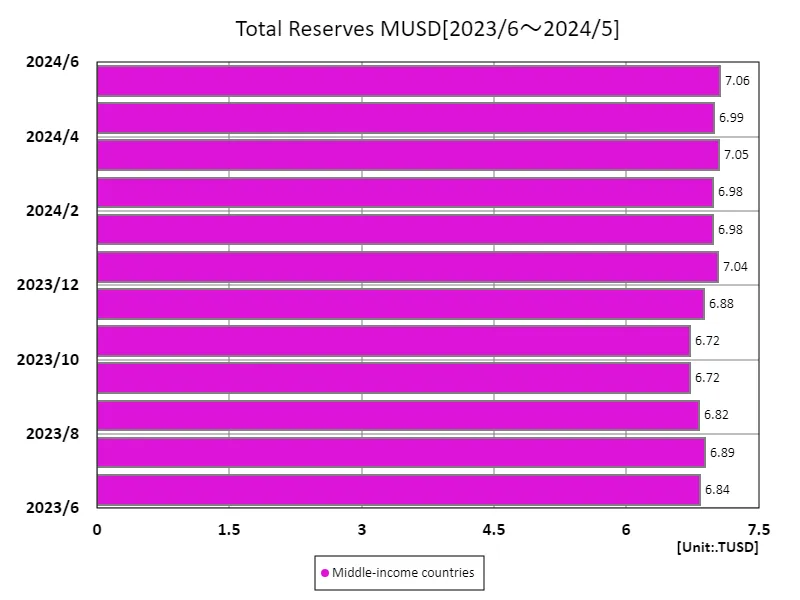

According to June 2023 data, total reserves of middle-income countries reached USD 7.06 trillion, with the overall total at USD 19.4 trillion and the average at USD 6.45 trillion. The results indicate that middle-income countries are playing an increasingly important role in the global economy. The increase in reserves among middle-income countries is due to economic growth and external capital inflows, particularly in Asia and Latin America. These countries’ foreign exchange reserves help ensure financial stability and increase their resilience to international shocks. The accumulation of reserves also contributes to an improvement in the trade balance and an increase in foreign direct investment. Over the past few years, central banks have used interest rate and exchange rate policies to manage reserves, and monetary policy flexibility has been required, especially during the post-pandemic economic recovery. However, increasing foreign exchange reserves also comes with risks of economic dependency and concerns about capital outflows. Going forward, trends in middle-income countries’ foreign exchange reserves will likely remain an important indicator of their influence in the international economy. How the reserves of these countries evolve is a key factor for global economic stability and growth prospects.

The maximum is the latest one, 7.06TUSD of Middle-income countries

Total reserves (USD) (region, latest year)

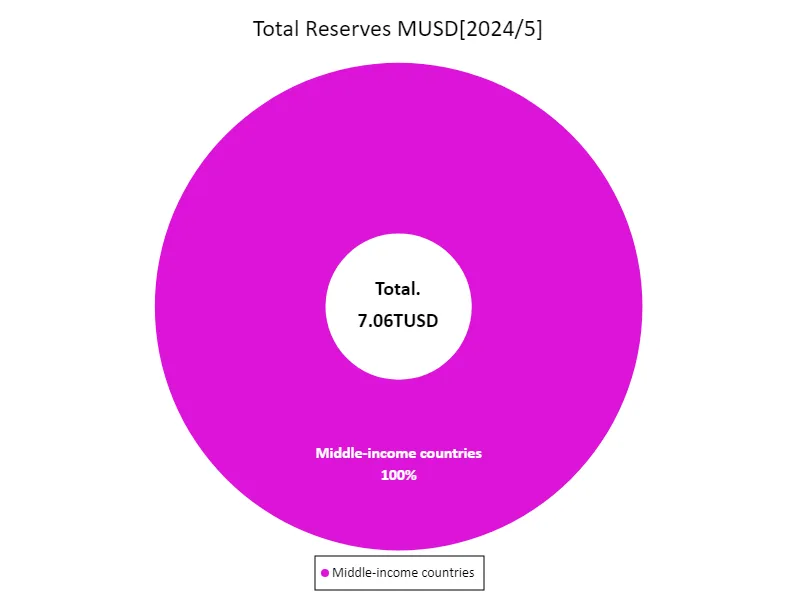

According to May 2024 data, total reserves will total US$12.7 trillion, of which middle-income countries account for the largest amount at US$7.06 trillion. With average reserves of US$6.35 trillion, these figures reflect the economic growth and growing international influence of middle-income countries. The increase in reserves among middle-income countries is due to rising exports and foreign direct investment inflows. This gives these countries the financial resources they need to ensure economic stability and improve their resilience to external shocks. In addition, central banks’ use of exchange rate and monetary policies to manage reserves helps to improve the credibility of financial markets. However, while total reserves will increase, excessive external reliance also entails risks. In particular, the impact of rising interest rates in the United States and changes in the international situation on middle-income countries cannot be ignored. This has raised concerns about possible capital outflows and exchange rate instability, urging countries to properly manage their reserves. Overall, the development of total reserves in 2024 will be closely watched as it is an important indicator reflecting changes in the international economy and the growth of middle-income countries. How the reserves of these countries change will have direct implications for global financial markets and economic stability.

The maximum is 7.06TUSD of Middle-income countries, the average is 7.06TUSD, and the total is 7.06TUSD

Comments