Abstract

Venezuela’s highest value on the stock market (lcu) of 71.3klcu reflects the country’s extreme inflation and economic instability. Over the past few years, Venezuela has been facing an economic crisis that has caused its currency to lose value significantly. As a result, while the stock market is experiencing a nominal rise, real purchasing power is declining. Compared to other countries, the Venezuelan stock market is less attractive to market participants and is considered a high-risk investment destination. The divergence between the stock market (USD) and LCU indicates the impact of different economic environments and monetary policies, and investors should consider currency risk. These data are important indicators for international investment decisions and are key to understanding trends, especially in emerging markets. Overall, the Venezuelan stock market has a complex structure in the context of economic instability and requires careful analysis.

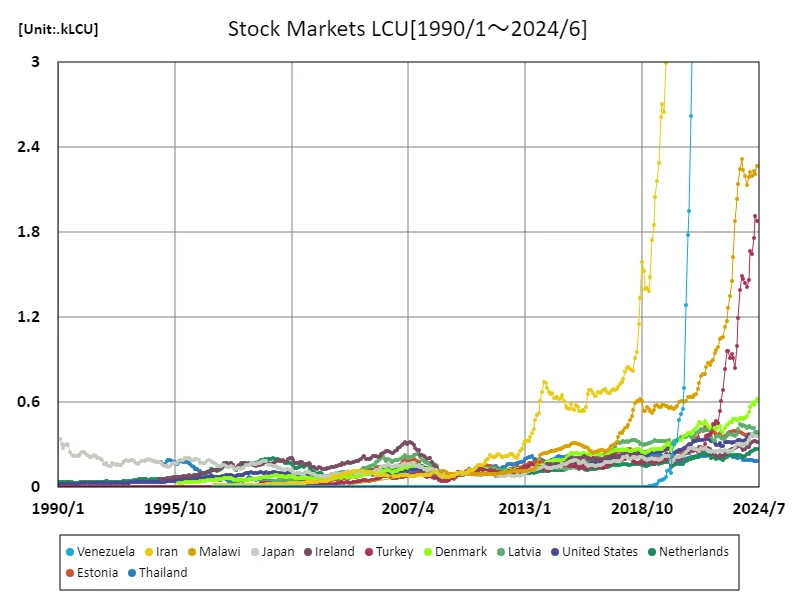

Stock market (lcu)

Stock market (lcu) data from 1990 to 2024 sheds light on Venezuela’s economic situation in particular. The 71.3 klcu recorded in June 2024 marks a sharp nominal increase and comes at a time when the country is facing extreme inflation. This value suggests that Venezuela’s economy is at 100% of its peak, but in real terms, the currency has lost a lot of value and investors’ purchasing power has been greatly reduced. Looking back at data from the past few decades, the Venezuelan stock market has been affected by economic crises and political instability, and its performance has been very uneven. In particular, changes in economic policies and external factors since the 2000s have had a strong impact on the market, increasing volatility in the stock market. Compared to other countries, Venezuela’s stock market has a riskier investment environment, forcing foreign investors to tread with caution. This, along with expectations of an economic recovery, are important considerations in long-term investment decisions. Overall, Venezuela’s stock market has some unique characteristics that reflect economic instability and require careful monitoring.

The maximum is the latest one, 71.3kLCU of Venezuela

Stock market (USD) (worldwide)

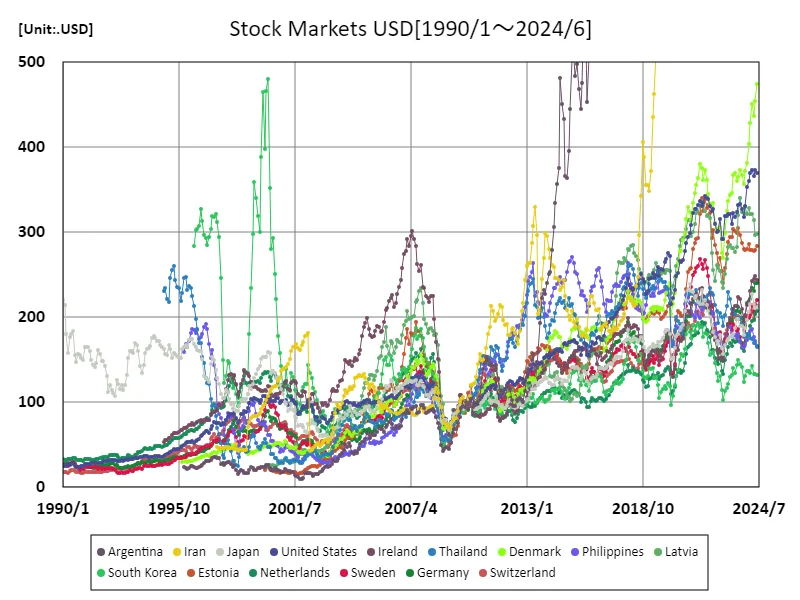

Stock market (USD) data from 1990 to 2024 shows the evolution of the Argentine economy in particular. The 66.9 kusd recorded in June 2024 meant Argentina had reached 100% of its peak, but this reflects a nominal rise against the backdrop of economic instability in the country. Argentina has been plagued by high inflation and currency crises over the past few decades. Especially since the economic crisis of the early 2000s, policy uncertainty has affected the market and stock markets have shown great volatility. In addition, with the introduction of foreign exchange controls and restrictions on capital outflows, stock market trends have become an important indicator for domestic and foreign investors. Given this background, Argentina’s stock market is positioned as a risky investment destination, and investors need to monitor its developments carefully. Compared to other countries, the Argentine market is more affected by economic instability, particularly as it is directly affected by external factors and political decisions. Overall, Argentina’s stock market has a complex structure that reflects economic challenges and requires careful analysis in any investment strategy.

The maximum is the latest one, 66.9kUSD of Argentina

Comments