Abstract

In terms of aggregate external debt, paris club claims non oda data is important for understanding economic trends, particularly in developed and emerging countries. The latest data for 2022 shows that Greece has the largest external debt at 46.2 gusd, reflecting the impact of past debt crises. Since the financial crisis of 2008, Greece has been forced to implement severe austerity measures, and the road to economic reconstruction remains difficult. This trend is being replicated elsewhere, with countries with particularly high debt levels facing increasing debt-service burdens at a time of slowing economic growth. In emerging countries in particular, fluctuations in resource prices and rising interest rates are making external debt management even more difficult. This has resulted in an increasing number of cases where debt sustainability is being called into question, and in some cases the support of international financial institutions is required. Overall, external debt trends are easily affected by each country’s economic policies and external shocks, and require continued close monitoring. In particular, as the risk of debt hindering economic growth increases, countries are being called upon to manage their economies in a sustainable manner.

Paris club claims no oda

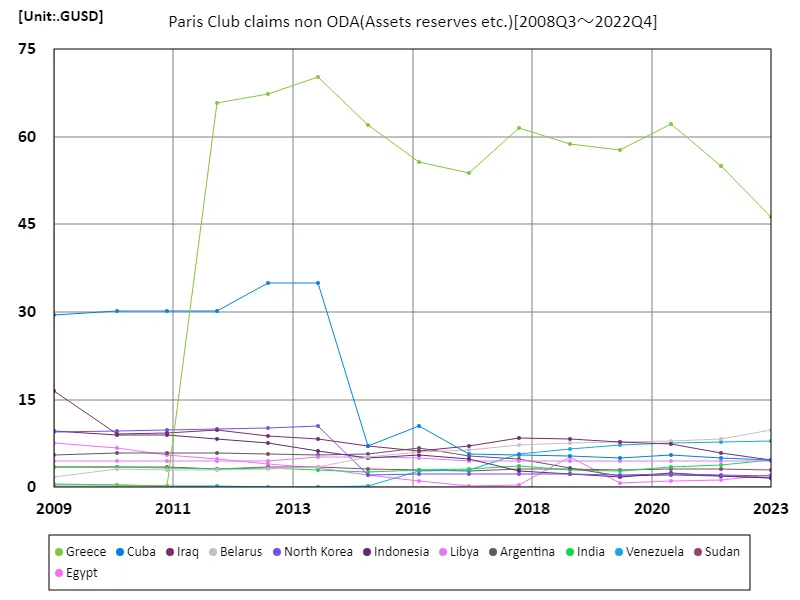

Paris Club Claims Non ODA data on cross-border loans is a key indicator of economic fragility, particularly through Greece’s debt situation. Between May 2008 and July 2022, Greece recorded a peak in external lending capital of 70.3 gusd in July 2013, but has since declined to 65.8% of that level in 2022. The decline is likely a result of the harsh austerity measures and economic reforms that Greece adopted to overcome its debt crisis. A trend during this period has been that highly indebted countries such as Greece have struggled to raise funds from international markets, with changes in financial conditions having an immediate impact. In addition, debt in resource-rich and emerging countries is also increasing, making these countries vulnerable to external economic shocks and interest rate fluctuations. Furthermore, the gap in debt quality between developed and emerging countries is becoming more apparent, placing increased emphasis on sustainable debt management. Overall, the Paris Club data is a valuable source of information for considering national economic policies and international economic trends, and deserves to be closely monitored in the future. Trends in cross-border loans are an important issue for policymakers in each country, as they have a significant impact on economic growth and stability.

The maximum is 70.3GUSD[2013.75] of Greece, and the current value is about 65.8%

Paris club claims non oda (worldwide)

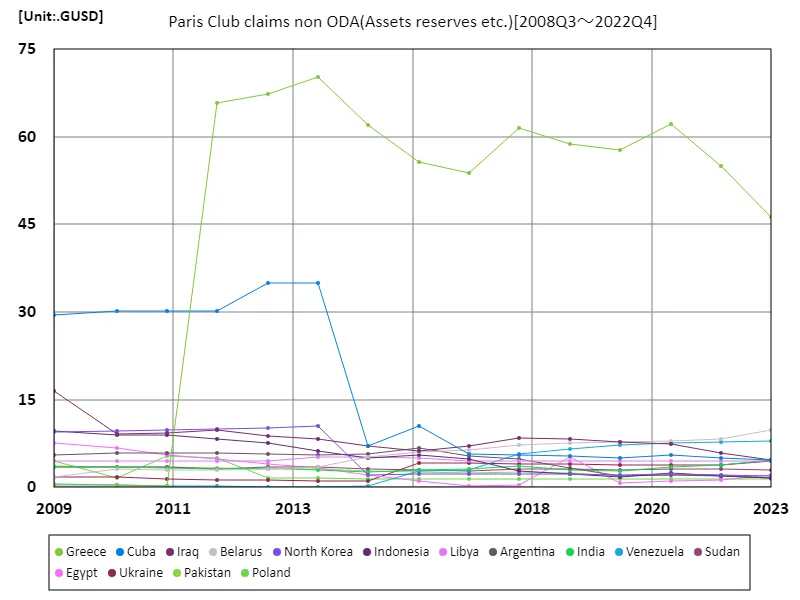

The paris club claims non oda data is an important indicator for understanding international debt structure. Within the data range from May 2008 to July 2022, Greece recorded its highest external loan capital in July 2013 at 70.3 gusd, but in 2022 it had fallen to 65.8% of that level. The decline is being attributed to the tough austerity measures and economic reforms that Greece adopted to overcome its debt crisis. A defining feature throughout this period has been that highly indebted countries have been their weaker growth rates and their sensitivity to external shocks and interest rate fluctuations. The Greek case in particular shows how important sustainable debt management is. Similar trends are also being seen in other emerging and resource-rich countries, where economic stability continues to have a direct impact on debt levels. Moreover, there is an increased need for assistance from international financial institutions and coordinated debt restructuring, calling into question the sustainability of cross-border lending. Overall, the Paris Club data provides a valuable tool for measuring the impact of countries’ economic policies and deserves continued attention. Sound fiscal management is required while adapting to changes in the international economy.

The maximum is 70.3GUSD[2013.75] of Greece, and the current value is about 65.8%

Paris club claims non oda (worldwide, latest year)

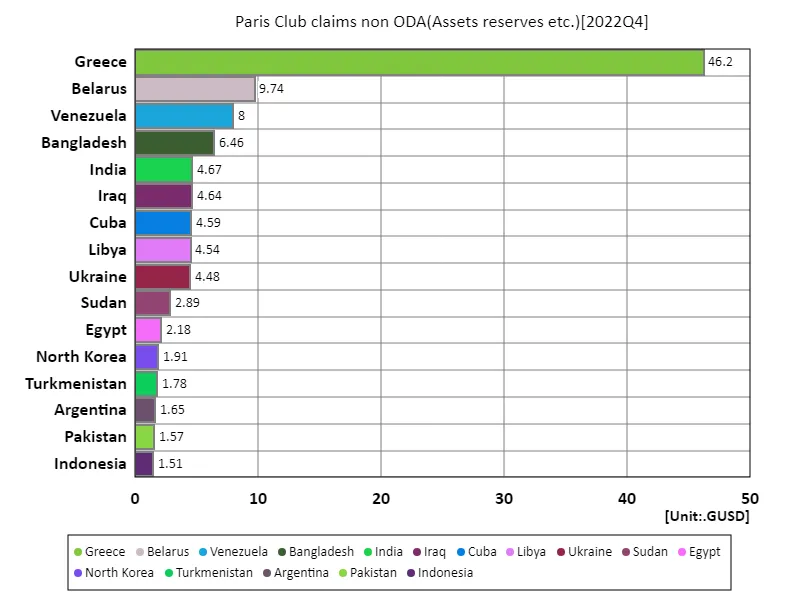

Paris club claims non oda’s july 2022 data provides an important indicator for assessing the international debt structure and economic health. According to the data, Greece has the largest external debt reserve at 46.2 gusd, reflecting the impact of past debt crises. On the other hand, the overall average is 1.21 gusd and the total is 134 gusd, indicating that many countries have relatively small amounts of debt. This trend suggests that advanced economies are enjoying relatively stable debt conditions, especially at a time when emerging and low-income countries are struggling to raise funds from international markets. Moreover, countries with high debt levels, such as Greece, are more vulnerable to slowing economic growth and external shocks, making sustainable debt management essential. Moreover, the Paris Club data highlights the importance of international debt restructuring and financial assistance. Countries need to explore policies to promote economic growth while ensuring debt sustainability. Overall, Paris Club information is a valuable resource for understanding national economic policies and trends in international financial markets, and provides a basis for preparing for future economic changes.

The maximum is 46.2GUSD of Greece, the average is 1.21GUSD, and the total is 134GUSD

Paris club claims non oda (worldwide, latest year)

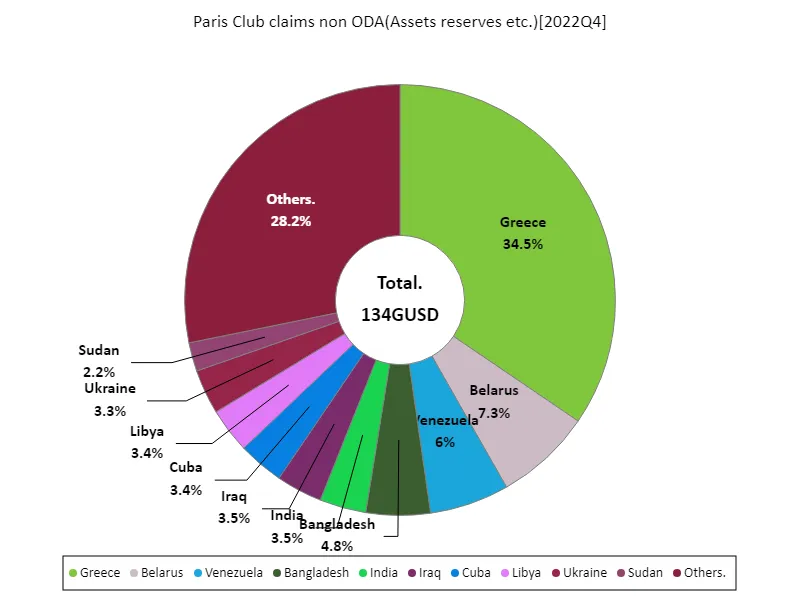

Paris Club Claims Non ODA’s July 2022 data is a key indicator of the state of international cross-border loans. At this point, Greece has the largest external debt at 46.2 gusd, reflecting past debt crises. The overall average is 1.24 gusd and the total is 134 gusd, indicating that many other countries have relatively small amounts of debt. The data highlights differences in debt structures between developed and emerging countries. While developed countries have relatively stable economic fundamentals, emerging and low-income countries are becoming increasingly vulnerable to external shocks and interest rate fluctuations. In particular, highly indebted countries like Greece are facing stagnant economic growth and increasing debt repayment burdens, making sustainable debt management an urgent issue. The role of international financial institutions is also important, with the need for debt restructuring and financial assistance increasing. Overall, the Paris Club data are a valuable source of information for understanding international economic policy and financial market developments and contribute to the formulation of national economic strategies. We will need to continue to closely monitor developments in cross-border loans and seek ways to manage the economy in a healthy manner.

The maximum is 46.2GUSD of Greece, the average is 1.25GUSD, and the total is 134GUSD

Comments