Abstract

According to data for 2023, America’s portfolio investment assets will reach $14.7 trillion, occupying a significant position in global external debt. This trend has continued for the past few decades, with the United States attracting foreign investment thanks to its stable economic base and liquid financial markets. In particular, foreign investors have shown strong interest in the U.S. stock and bond markets, which has fueled the rise in external debt. In addition, US interest rate policy is also having an impact, with a low interest rate environment making investment more attractive and ultimately encouraging the inflow of foreign capital. In contrast, other countries are diversifying their assets while economic uncertainty is having an impact and changing the composition of their portfolios. As such, U.S. external debt is a complex phenomenon that reflects both risks and opportunities in the global economy and requires continued monitoring.

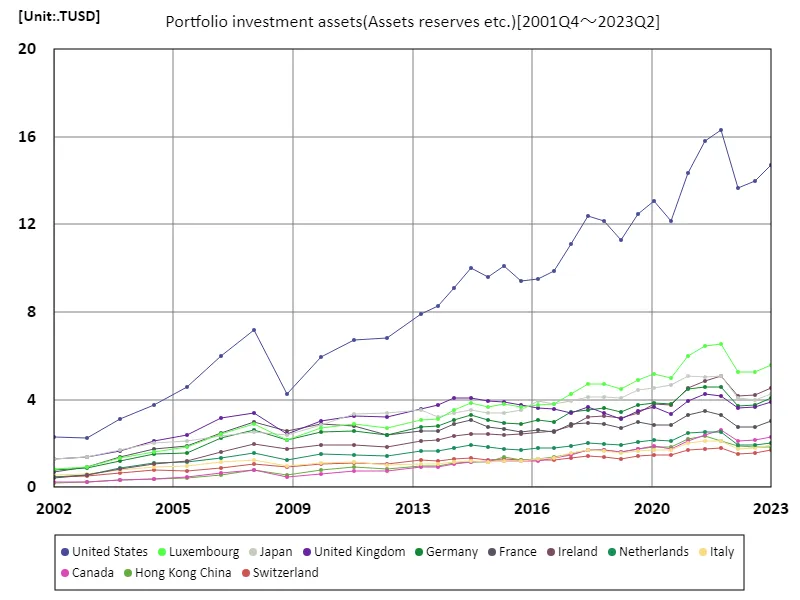

Portfolio investment assets

Looking back at data from 2001 to 2023, portfolio investment assets of U.S. cross-border loans peaked at $16.3 trillion in 2021. However, by 2023, that level declines by 90.1% to $14.7 trillion, reflecting external factors and domestic policy changes. In particular, rising global interest rates and geopolitical risks have had an impact, changing foreign investors’ appetite for investing in the U.S. market. Economic uncertainty caused by the pandemic since 2020 has also impacted asset flows. In contrast, China and European countries are becoming increasingly attractive as growth markets, which is diversifying the composition of global portfolios. The United States still holds the largest portfolio investment assets in the world, but we must continue to monitor the impact of future economic conditions and policy changes. These trends signal a shift in the balance of the global economy and will have a significant impact on international capital flows.

The maximum is 16.3TUSD[2021.75] of United States, and the current value is about 90.1%

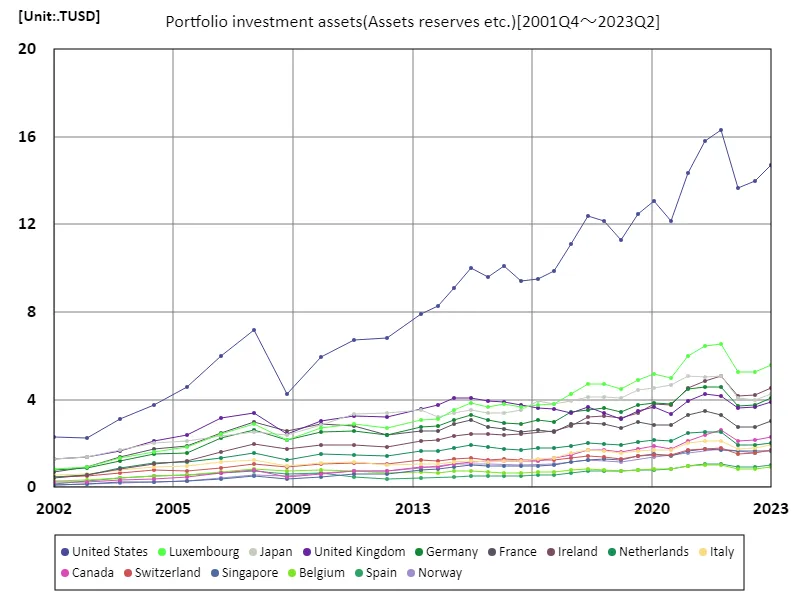

Portfolio investment assets (worldwide)

Looking at trends in portfolio investment assets from 2001 to 2023, the United States reached a historic peak of $16.3 trillion in 2021. However, in 2023, that level will fall to 90.1%, or about $14.7 trillion. The decline reflects market volatility due to rising global interest rates, geopolitical instability and the impact of the pandemic. In particular, rising interest rates in recent years have affected investors’ risk appetite, leading to a shift away from US assets and towards other growth markets. In addition, emerging markets such as China and Europe are becoming increasingly attractive investment destinations, which is diversifying the composition of global portfolios. It is also notable that growth in the technology and green energy sectors is providing new investment opportunities. As a result, American portfolio investments are required to be flexible in adapting to domestic and international economic conditions and policy changes. Future developments could have a significant impact on international capital flows and economic dynamics.

The maximum is 16.3TUSD[2021.75] of United States, and the current value is about 90.1%

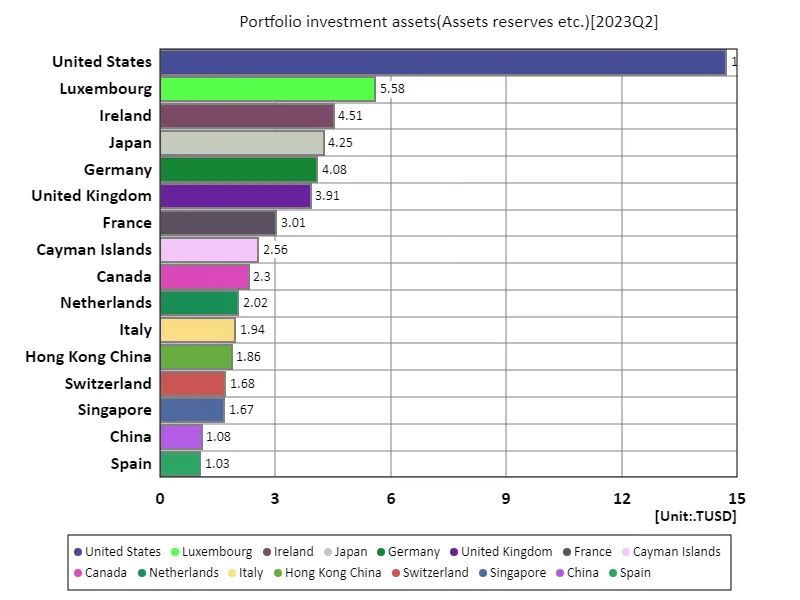

Portfolio investment assets (worldwide, latest year)

According to data on portfolio investment assets in 2023, the United States holds the largest assets at $14.7 trillion, followed by an average of $832 billion and a total of $63.3 trillion. This trend reflects the strength and liquidity of the American economy over the past few decades. In particular, the American market is an attractive investment destination for foreign investors, and investment in stocks and bonds is increasing in pursuit of stable returns. On the other hand, the fact that global portfolio investment assets have reached $63.3 trillion indicates a diversification of investment destinations. Investment in emerging markets and the technology sector is on the rise, reducing reliance on traditional destinations. In addition, due to concerns about climate change and social responsibility, ESG (environmental, social, and governance) investment is attracting attention and is taking root as a new trend. These trends are changing international capital flows and investor behavior, shaping economic dynamics. In the future, the composition of portfolio investment assets will likely change in response to changes in economic conditions and policies.

The maximum is 14.7TUSD of United States, the average is 832GUSD, and the total is 63.3TUSD

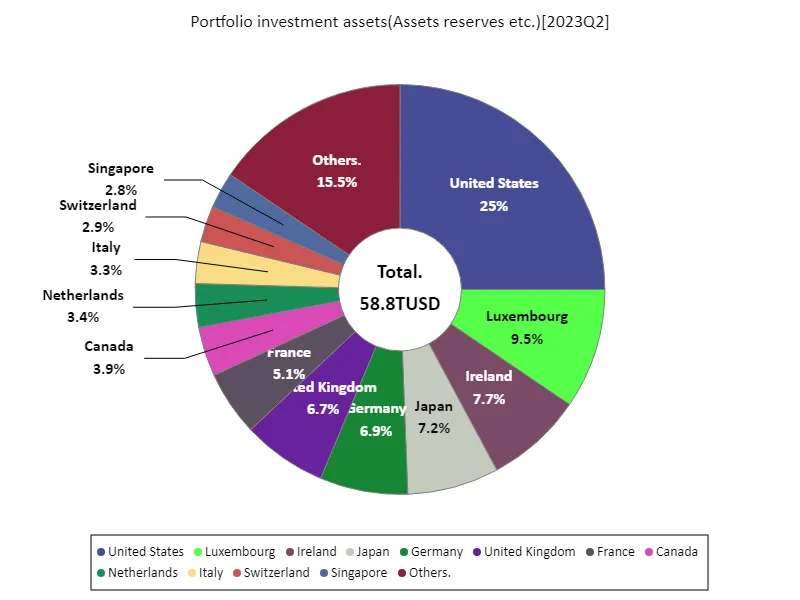

Portfolio investment assets (worldwide, latest year)

According to data for 2023, the United States holds the largest share of portfolio investment assets for cross-border loans, at $14.7 trillion. The overall total reached $58.8 trillion and the average $828 billion, reflecting global capital flows. America’s strong financial markets and economic fundamentals provide an attractive environment for foreign investors, attracting many of them looking for stable returns. In recent years, investments outside the United States, particularly in emerging markets, have also increased, helping to diversify the portfolio. There is growing interest in the technology and renewable energy sectors, which are offering new opportunities for investors. Additionally, geopolitical risks and fluctuations in interest rate policies are seen as important factors influencing investment decisions. Overall, cross-border loans as a portfolio investment asset have become an important option for investors seeking both stability and growth, and are worth keeping an eye on in the future. Investment destinations and strategies are expected to evolve in response to changes in the international economic environment.

The maximum is 14.7TUSD of United States, the average is 828GUSD, and the total is 58.8TUSD

Comments