Abstract

China has consistently been a major player in global official bilateral loans, particularly through its Belt and Road Initiative (BRI), which has expanded since the early 2000s. By 2021, China’s share of official bilateral loans reached 1.15 trillion USD, reflecting its growing role as a lender to developing nations. This increase marks a shift from traditional Western financial institutions like the World Bank, with China offering loans for infrastructure projects across Asia, Africa, and Latin America. The loans are often tied to strategic interests, though critics raise concerns over debt sustainability in recipient countries.

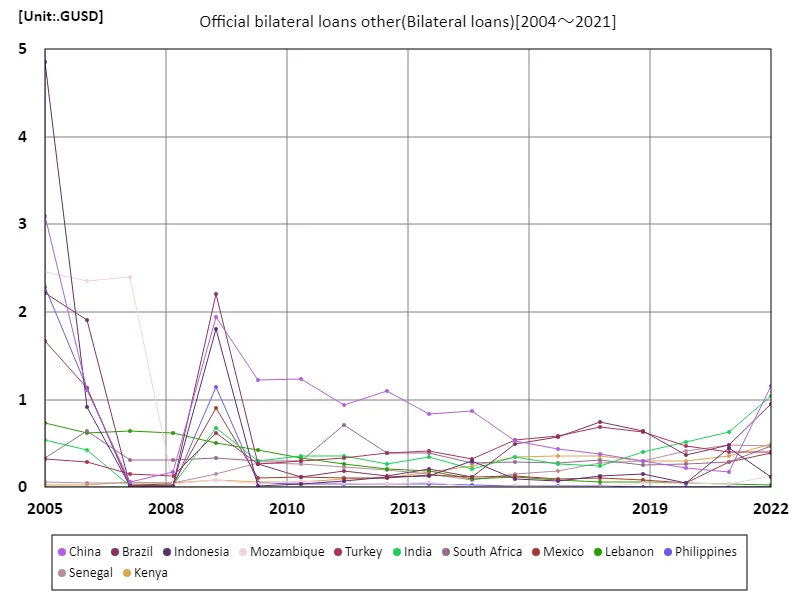

Official bilateral loans other

Public bilateral lending for cross-border financing has evolved significantly since 2004, with Indonesia reaching a peak of 4.86 trillion USD in official loans. By 2021, Indonesia’s debt stood at 2.35% below this peak, highlighting a trend of steady borrowing, albeit at a slightly lower rate. Historically, these loans have been used for large-scale infrastructure projects and development initiatives, often supported by countries like Japan and China. Over time, the focus has shifted towards more sustainable financing models, with growing concerns over debt management and repayment capacity in borrowing nations.

The maximum is 4.86GUSD[2004.75] of Indonesia, and the current value is about 2.35%

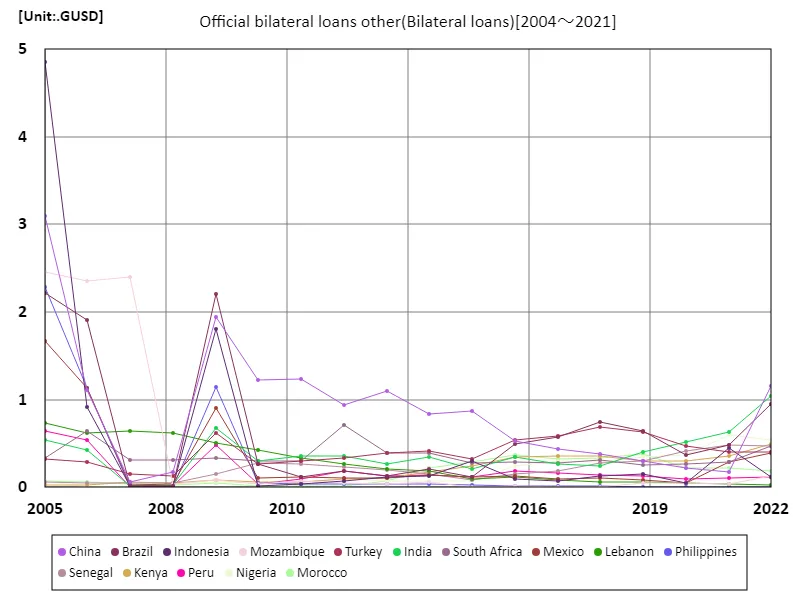

Official bilateral loans other(worldwide)

Official bilateral loans in the world economy have seen notable fluctuations from 2004 to 2021, with Indonesia peaking at 4.86 trillion USD in 2004. By 2021, its loans were 2.35% below this maximum, reflecting a trend of stable borrowing, albeit at a slower pace. These loans have often been directed towards infrastructure and development projects, primarily funded by countries like Japan and China. Over time, lending patterns have shifted towards more strategic and sustainable financing, with increased scrutiny on debt sustainability and repayment challenges in borrowing nations.

The maximum is 4.86GUSD[2004.75] of Indonesia, and the current value is about 2.35%

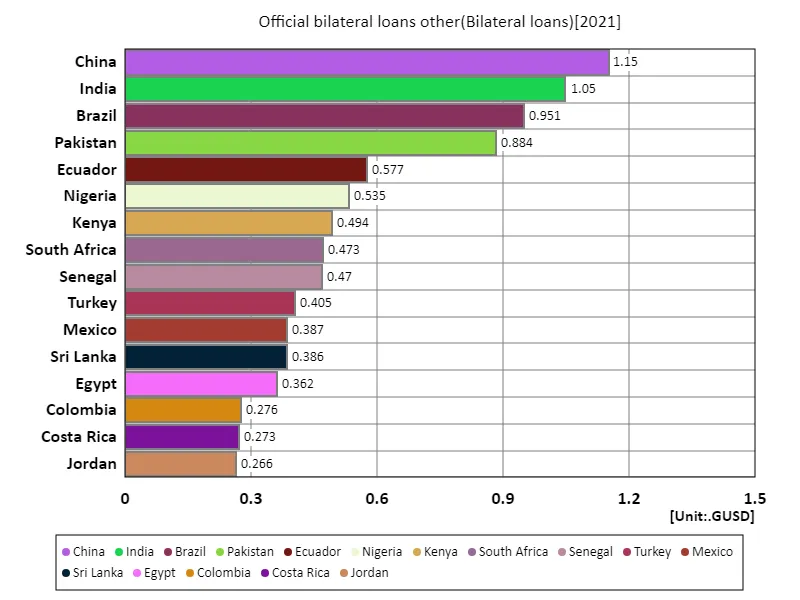

Official bilateral loans other (worldwide, latest year)

As of 2021, China leads global official bilateral loans with 1.15 trillion USD, far surpassing the average of 160 billion USD and contributing to a total of 14.2 trillion USD in such loans worldwide. This trend reflects China’s expanding influence through initiatives like the Belt and Road Initiative, positioning it as the dominant lender to developing nations. The surge in China’s lending contrasts with a more modest role for other countries, signaling a shift toward state-driven financial diplomacy. Critics, however, have raised concerns over debt sustainability and geopolitical implications for borrowing nations.

The maximum is 1.15GUSD of China, the average is 160MUSD, and the total is 14.2GUSD

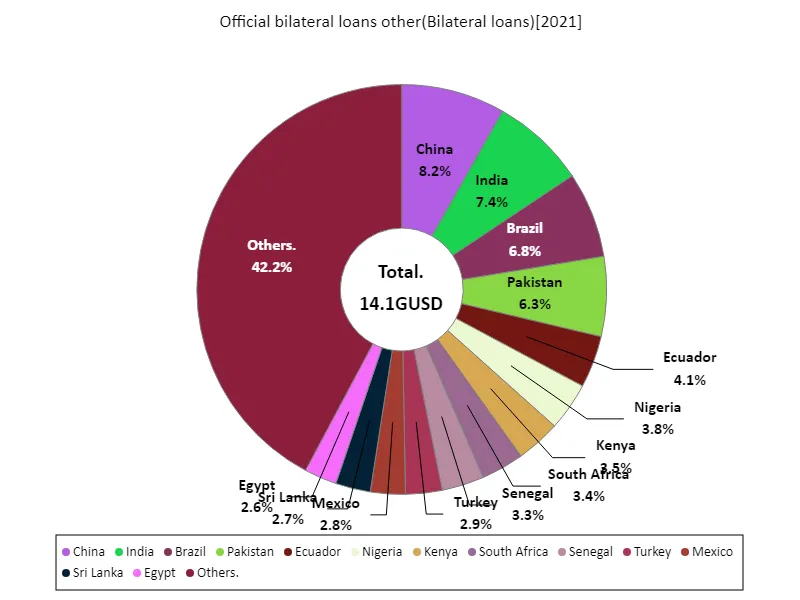

Official bilateral loans other (worldwide, latest year)

As of 2021, China stands out as the largest provider of public bilateral loans for cross-border financing, with 1.15 trillion USD, a significant lead over the global average of 161 billion USD and contributing to a total of 14.2 trillion USD in such loans. This trend reflects China’s strategic approach, primarily through its Belt and Road Initiative, targeting infrastructure and development in emerging markets. While China’s dominance continues to grow, concerns about debt sustainability and its geopolitical influence are increasingly scrutinized by international observers.

The maximum is 1.15GUSD of China, the average is 162MUSD, and the total is 14.1GUSD

Comments