Abstract

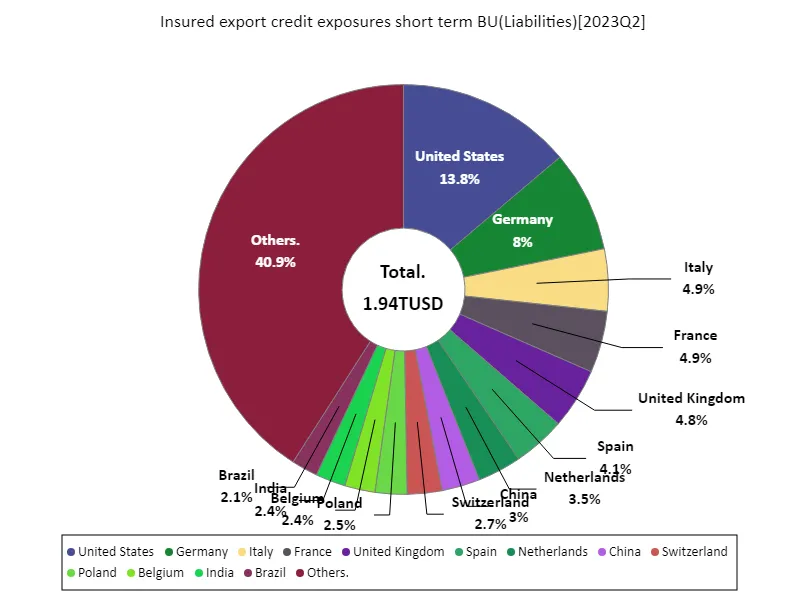

The insured export credit exposures short term BU data is an important indicator in assessing a country’s external debt and economic health. According to 2023 data, the United States has the largest exposure, reaching 268 gusd. This reflects the strength of America’s international commercial activity, particularly as U.S. companies use insurance as part of their risk management. Over the past few years, the United States has maintained steady economic growth and has stepped up support for exporters. This trend is striking when compared with the external debt profiles of other countries, particularly European and emerging market economies, which often have relatively low exposures. Additionally, the increase in insured exposure reflects the changing global trade environment and policy influences. The high US exposure may also be due to the US-China trade war and restructuring of supply chains. Overall, while America’s strong export credit indicates its competitive position in the international market, it also requires caution from the perspective of external debt management.

Insured export credit exposures short term bu

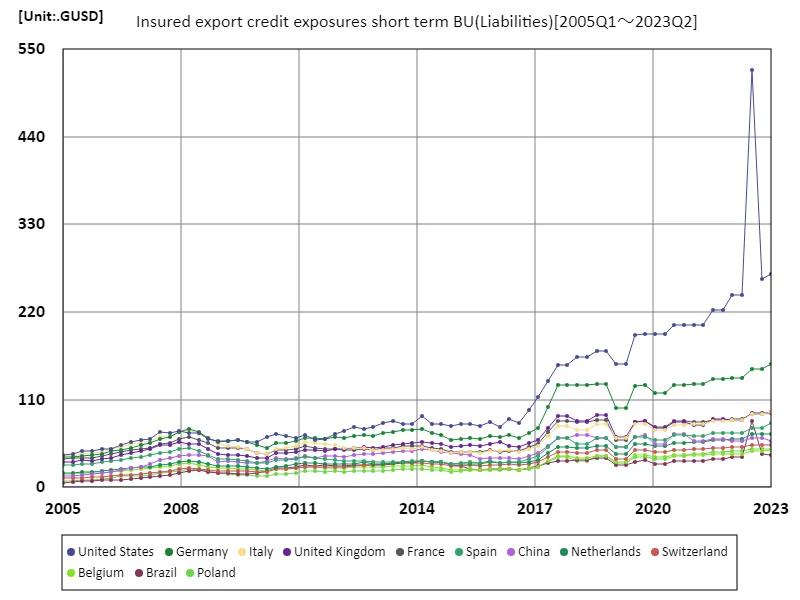

Insured export credit exposures short term BU are positioned as an important indicator of a country’s liability structure and risk management. Looking at data from 2005 to 2023, the United States recorded a peak of 523 GUSD in July 2022, but has now declined to 51.2% of that figure. This fluctuation reflects the influence of U.S. economic policies and the international trade environment. The high exposure to the United States was due to rapid economic growth and expanding exports, but the decline from 2022 onwards is likely due to supply chain disruptions, trade friction between the United States and China, and rising interest rates. In particular, restructuring of supply chains and increased competition in international markets are driving changes in companies’ risk management strategies and affecting the use of insured exposures. Compared to other countries, the US’s exposure remains high, but its declining trend suggests sustainability in future economic growth. It also shows the increasing importance of liability management from the perspective of international credibility and competitiveness. Overall, developments in the US will provide an important case study in risk management in the global economy.

The maximum is 523GUSD[2022.75] of United States, and the current value is about 51.2%

Insured export credit exposures short term bu (worldwide)

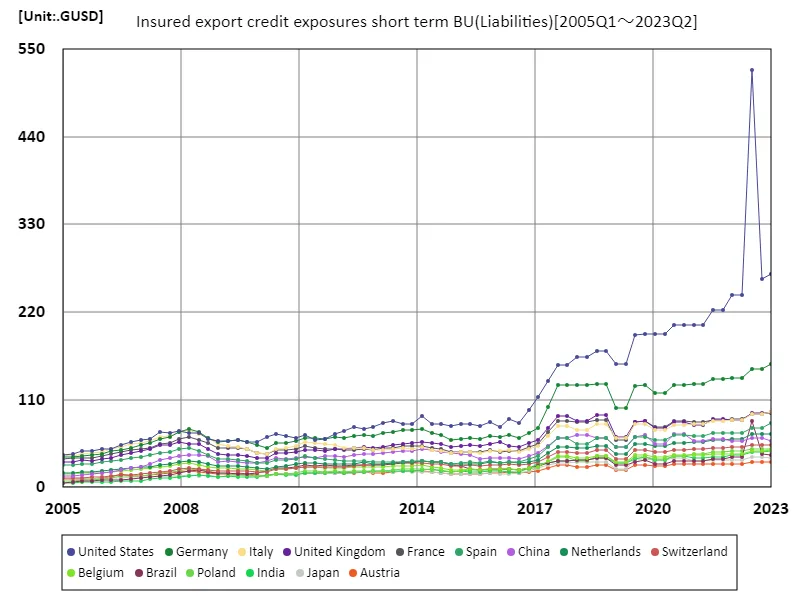

Insured export credit exposures short term BU are an important indicator of a country’s economic health and international risk management. Analysing data from 2005 to 2023, the US recorded its highest ever exposure of 523 gusd in July 2022, but has now fallen to 51.2% of that amount. The changes reflect the risks facing U.S. exporters and the impact of the international economic environment. The surge in U.S. exposure was driven by expanding global trade and a growing domestic economy. However, the recent decline has been driven by a variety of factors, including supply chain disruptions, US-China trade tensions and rising interest rates. In particular, there is an increasing need for companies to reassess risks and adopt prudent business strategies. Although the United States’ exposure remains high compared to other countries, the declining trend has important implications for international competitiveness and credit risk management. In order to achieve future economic growth, companies and governments will need to reassess their risk management strategies and establish sustainable liability structures. Overall, the US developments offer strategic lessons for the global economic environment.

The maximum is 523GUSD[2022.75] of United States, and the current value is about 51.2%

Insured export credit exposures short term bu (worldwide, latest year)

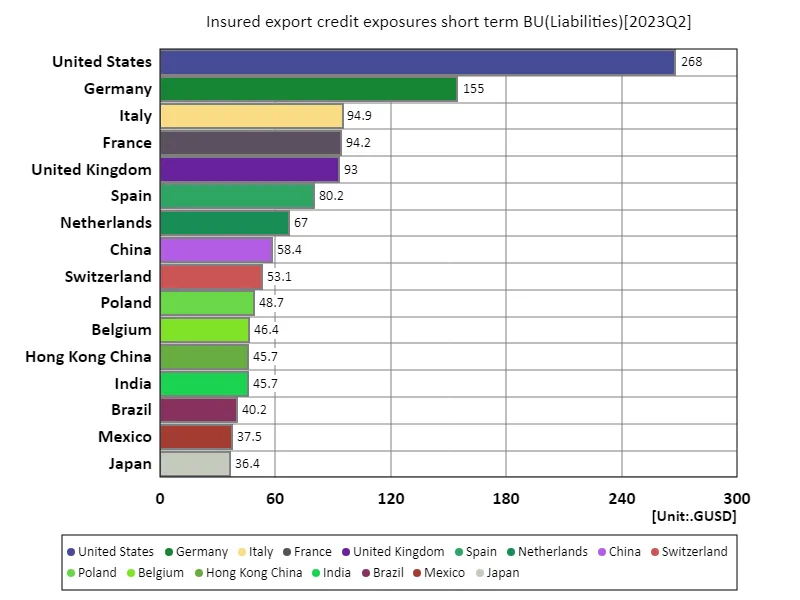

Insured export credit exposures short term BU is an important indicator of risk management in international trade. According to the 2023 data, the United States recorded the highest exposure of 268 gusd, indicating the strong international commercial activity of the United States. On the other hand, the overall average is 8.8 gusd and the total is 2.03 tusd, reflecting the situation of different countries in the global trade environment. The US’s high exposure is a result of economic growth and expanding exports, with insured credit playing an important role as companies look to hedge their risks. In contrast, other countries have relatively low exposure and economic uncertainty, particularly in emerging markets, is leading them to be more cautious in managing risks. This trend suggests differences in countries’ ability to adapt to fluctuations in the international economy and their competitiveness. Also, the large total exposure of 2.03tusd indicates high demand for export credit globally. As the international economic environment changes in the future, countries will be required to further improve risk management and strategic approaches.

The maximum is 268GUSD of United States, the average is 8.8GUSD, and the total is 2.03TUSD

Insured export credit exposures short term bu (worldwide, latest year)

Insured export credit exposures short term BU is an important indicator of a country’s liabilities management and risk hedging in international trade. According to data for 2023, the United States recorded the largest exposure of 268 gusd, indicating the robustness of American international trade activity. Additionally, the overall average was 9.69 gusd and the total was 1.94 tusd, which are important figures for understanding global credit risk trends. The high exposure to the US is due to its strong economic fundamentals and diverse export markets. Companies use insured credit as part of their risk management to protect their business, especially in an uncertain international environment. In contrast, exposure in other countries is relatively low and economic fragility, particularly in emerging markets, means risk management tends to be more cautious. The overall total of 1.94tusd indicates that countries around the world remain in high demand for export credit. This will require businesses and governments to strengthen their strategic approach to prepare for future economic fluctuations. Overall, exposure data provides a valuable indicator for understanding risks and opportunities in the international economy.

The maximum is 268GUSD of United States, the average is 9.68GUSD, and the total is 1.94TUSD

Comments