Abstract

Data for the second quarter of 2023 shows that America’s cross-border loans from bis banks to nonbanks will reach $1.56 trillion, making it still the largest external debtor nation. This trend reflects the fact that the United States is a major player in international financial markets and has overwhelming financing capacity compared to other countries. In recent years, the United States’ foreign debt has been on the rise, driven by a demand for funds to maintain economic growth, invest in infrastructure, and promote consumption. In addition, the US dollar’s high credibility and its role as the reserve currency in international transactions facilitate external lending. On the other hand, an increase in external debt also carries the risk of causing higher interest rates and destabilizing financial markets. In particular, an increase in U.S. debt could lead to increased capital outflows and exchange rate risks in other countries, increasing uncertainty in the international economy. Addressing this will require sustainable fiscal policies and economic reforms. Monitoring external debt trends is also important for understanding international financial stability.

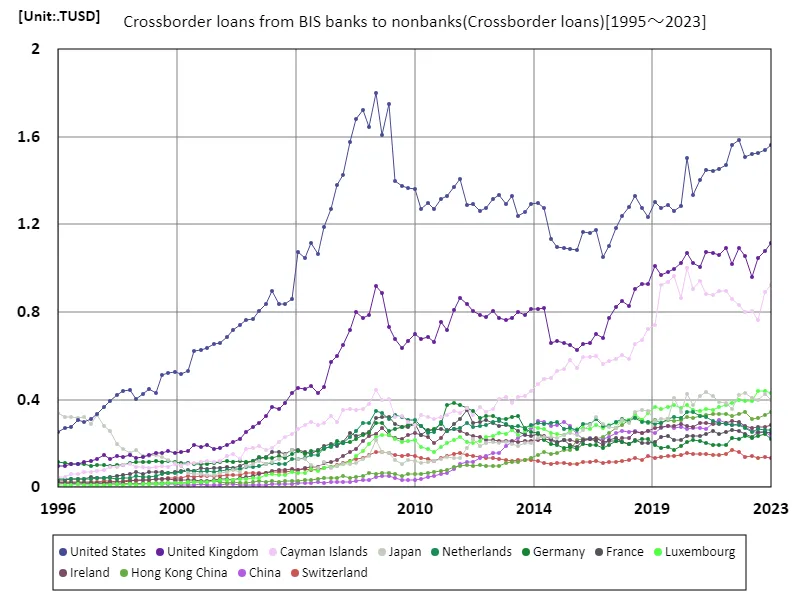

Crossborder loans from banks to nonbanks

Looking at data on cross-border loans from bis banks to nonbanks from 1995 to 2023, the United States peaked at $1.8 trillion in 2008. This period reflected the economic prosperity before the Lehman Shock, with American financial institutions actively supplying funds internationally. After that, following the economic crisis, external lending declined, falling to $1.56 trillion in 2023, 86.9% of its peak. This downward trend is due to stricter financial regulations and reviews of risk management. Fluctuations in interest rates and slowing economic growth may also be contributing factors. In particular, in recent years, the American economy has been facing inflation and rising interest rates, which has led to a decrease in the supply of money. On the other hand, the recovery of U.S. foreign lending will depend on global economic trends and increased investment opportunities, so in order to maintain its role in the international financial market in the future, sustained economic growth and strengthened international competitiveness will be necessary. As such, U.S. cross-border lending fluctuates depending on the economic environment and policies, and keeping a close eye on these trends is important in understanding the international economy.

The maximum is 1.8TUSD[2008] of United States, and the current value is about 86.9%

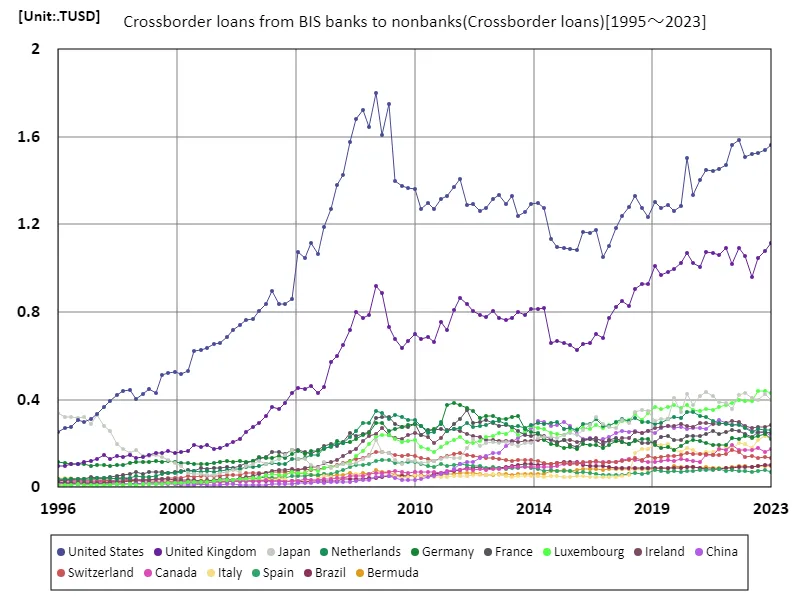

Cross-border loans from bis banks to nonbanks (around the world)

Analyzing data on cross-border loans from banks to nonbanks from 1995 to 2023, the United States recorded a peak of $1.8 trillion in 2008. During this period, global financial markets were active and American financial institutions led the international supply of funds. However, the subsequent economic crisis caused by the Lehman Shock had a serious impact on foreign lending, and US foreign lending continues to decline. By 2023, it will be $1.56 trillion, just 86.9% of its peak. The decline is due to factors such as increased financial regulation, revised risk management, and slowing economic growth. In particular, the recent rise in inflation and interest rates have contributed to the constraints on money supply. Additionally, changes in the international investment environment and the rise of emerging market countries are also having an impact, changing the competitiveness of U.S. foreign lending. Going forward, sustainable economic growth and international monetary policy coordination will be important, and a careful strategy will be required for the United States to regain its leadership position in international financial markets. Monitoring trends in cross-border lending is important for understanding the overall picture of the international economy.

The maximum is 1.8TUSD[2008] of United States, and the current value is about 86.9%

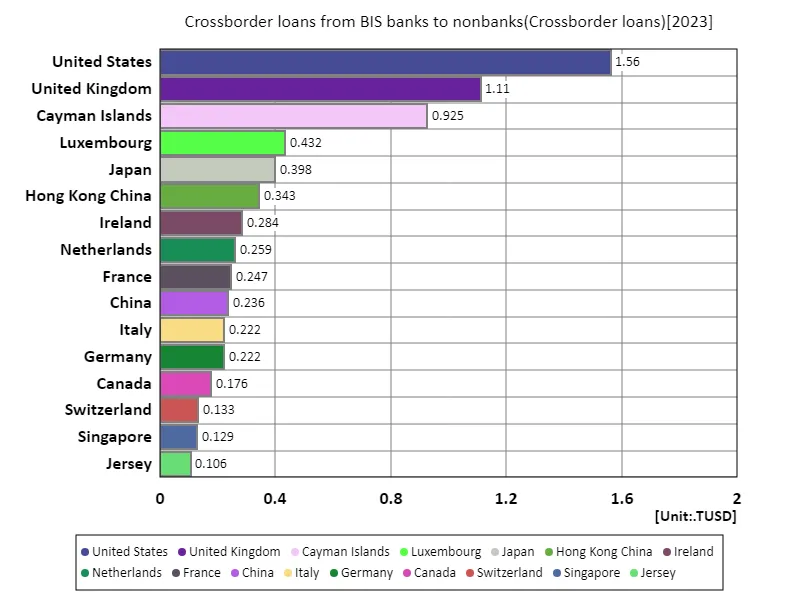

Crossborder loans from bis banks to nonbanks (worldwide, latest year)

Looking at cross-border loans from banks to nonbanks data for the second quarter of 2023, the United States is the largest external lender with $1.56 trillion and continues to play an important role in the international financial market. With an overall total of $9 trillion and an average of $4.11 billion, these figures serve as important indicators of international financial trends. Recent trends indicate that U.S. cross-border lending remains at a high level, but global liquidity is shifting. In particular, capital flows are diversifying due to the rise of emerging market countries and the impact of digital currencies. This has led to stricter risk management and regulations, forcing financial institutions to adopt a more cautious stance. Rising inflation and interest rates are also having an impact, increasing the cost of financing. This could especially lead to higher borrowing costs and pose financing challenges for emerging markets. Going forward, there will be a demand for sustainable growth and the creation of investment opportunities, and it will be important for the United States and other major countries to adopt strategic approaches to maintain their competitiveness in international financial markets. Trends in cross-border lending are a barometer of the health of the global economy.

The maximum is 1.56TUSD of United States, the average is 41.1GUSD, and the total is 9TUSD

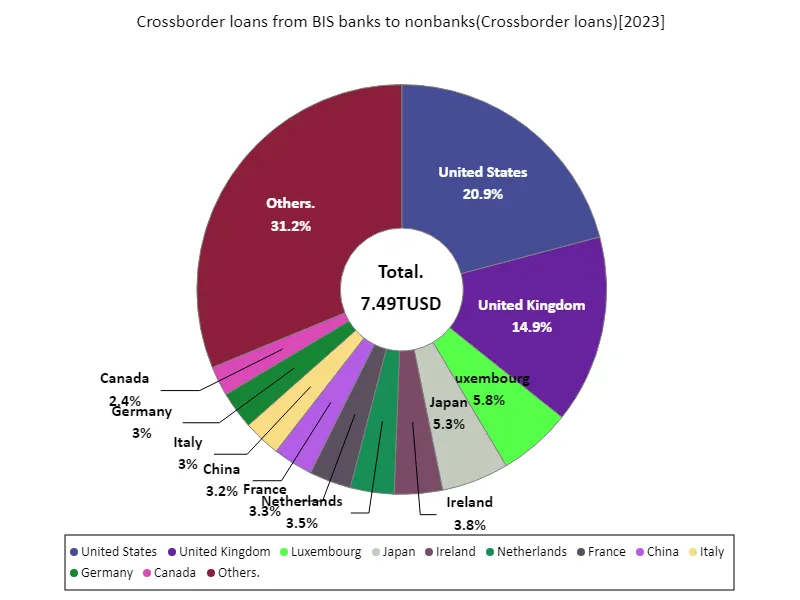

Crossborder loans from bis banks to nonbanks (worldwide, latest year)

Looking at data on cross-border loans from bis banks to nonbanks for the second quarter of 2023, the United States is the largest external lender with $1.56 trillion, for an overall total of $7.5 trillion and an average of $3.83 billion. These figures show that American financial institutions remain central to international financing. Recent trends suggest that while U.S. cross-border lending has remained stable, global liquidity has shifted. In particular, the growth of emerging markets and advances in digital finance are influencing capital flows and creating diverse investment opportunities. This makes risk management more important and requires financial institutions to adopt a more cautious approach. In addition, inflation and rising interest rates are also affecting the supply of funds, and there are concerns that fundraising costs will increase, especially in emerging countries. Looking ahead, policies and international cooperation will be required to promote sustainable economic growth, and major countries, including the United States, will need to explore strategies to remain competitive in international financial markets. Trends in cross-border lending will be an important indicator of the health of the global economy.

The maximum is 1.56TUSD of United States, the average is 38.4GUSD, and the total is 7.49TUSD

Comments