Abstract

As of July 2023, Argentina’s IMF short-term multilateral loans reached $743 million, making it a significant part of its external debt. Argentina has been battling economic instability for many years, with soaring inflation and a falling currency being particularly serious challenges. As a result, short-term loans from the International Monetary Fund (IMF) are urgently needed. The recent trend is for multilateral loans to be provided primarily to countries facing economic crisis, with countries like Argentina increasingly relying on them as a means of financing. Compared to other countries, Argentina’s external debt has been rising, which has contributed to its increasing reliance on short-term loans. There are also criticisms that the IMF’s assistance is a temporary emergency measure and will not provide a long-term solution unless sustainable economic policies are put in place. Therefore, the balance between Argentina’s future economic policies and international support will be a key factor in achieving sustainable growth.

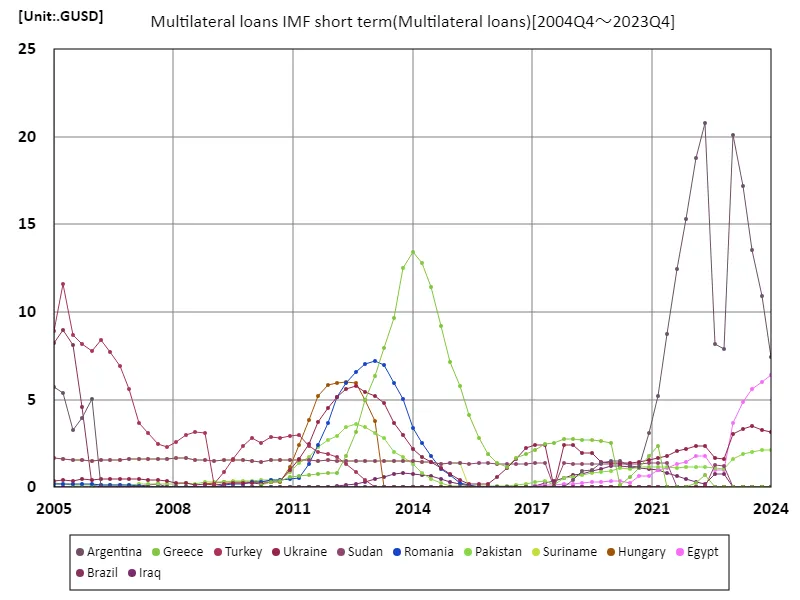

Multilateral loans imf short term

Data from IMF short-term multilateral loans for the period 2004-2023 provide a clear picture of external debt dynamics, particularly in Argentina. Argentina received $2.08 billion in loans in 2022, its highest amount ever, but that figure has now fallen to just 35.7% of that amount. The decline is likely due to the severe inflation and currency instability facing Argentina’s economy. Overall, IMF short-term loans are an important financing tool for countries facing economic crises, and the use of multilateral loans is increasing. In particular, countries like Argentina, which have received large amounts of loans in the past, are forced to rely on short-term financing, which poses a challenge to sustainable economic growth. This trend highlights the risks faced by emerging economies, which are particularly vulnerable to international monetary policy uncertainty and fluctuations in the global economy. Therefore, how to balance future economic policies with international support will be a crucial challenge for these countries.

The maximum is 20.8GUSD[2022] of Argentina, and the current value is about 35.7%

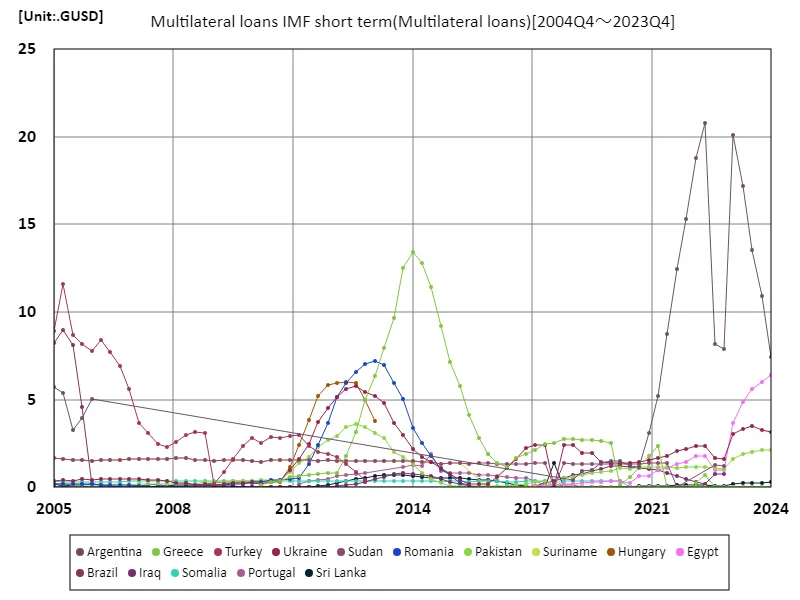

Multilateral loans imf short term (worldwide)

Data from IMF short term multilateral loans from 2004 to 2023 sheds light on Argentina’s economic situation in particular. In 2022, Argentina will receive $2.08 billion in loans, its highest amount ever. However, current lending stands at just 35.7% of that amount, reflecting the fragility of the economy. This comes against a backdrop of soaring inflation and currency depreciation, signaling increased reliance on short-term funding. While short-term IMF loans have been an important relief tool, especially for countries experiencing economic crisis, they do not lead to sustainable economic growth. Countries like Argentina are in urgent need of long-term economic policies, affected by the effects of past high-cost loans. While lending is increasing, so are concerns about debt sustainability and economic reconstruction. Overall, IMF short-term lending highlights the economic risks facing emerging countries, with international monetary policies and fluctuations in the global economy having a major impact on their future. The future direction of economic policies and the coordination of international assistance will be key challenges for these countries.

The maximum is 20.8GUSD[2022] of Argentina, and the current value is about 35.7%

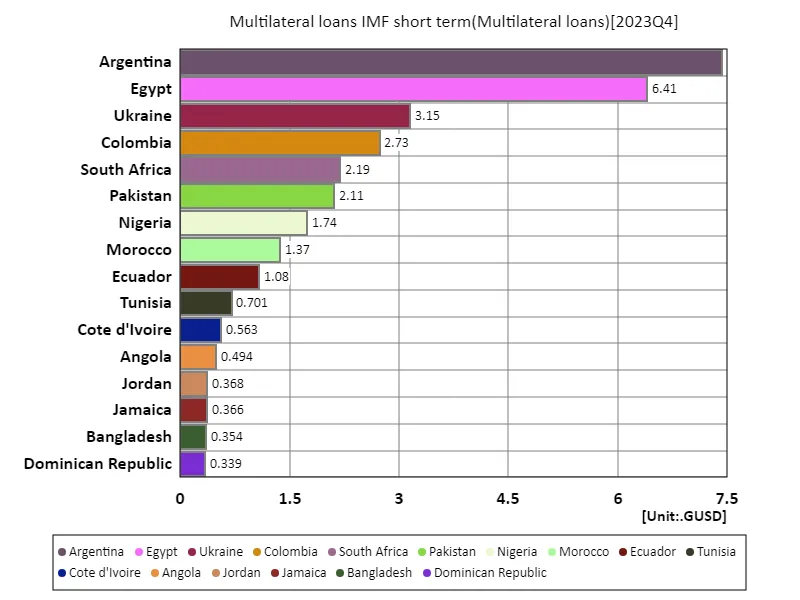

Multilateral loans imf short term (worldwide, latest year)

Multilateral loans imf short term data as of july 2023 highlights the importance of lending in the international economy. Argentina received the largest loan at $743 million, reflecting the effects of economic instability and high inflation. The fact that certain countries are receiving disproportionate amounts of loans indicates the severity of the economic crisis. With an average loan size of $290 million and a total of $3.65 billion, multilateral loans have become an important source of financing for emerging and economically challenged countries. These data show that the IMF’s short-term loans serve as emergency relief, especially for countries seeking to rebuild their economies. The use of short-term financing also highlights the need for sustainable economic policies. With many countries relying on short-term financing, there is a need to advance longer-term solutions and structural reforms. As the international financial environment and economic trends change, a key issue going forward will be how each country utilizes loans to stabilize its economy.

The maximum is 7.43GUSD of Argentina, the average is 290MUSD, and the total is 36.5GUSD

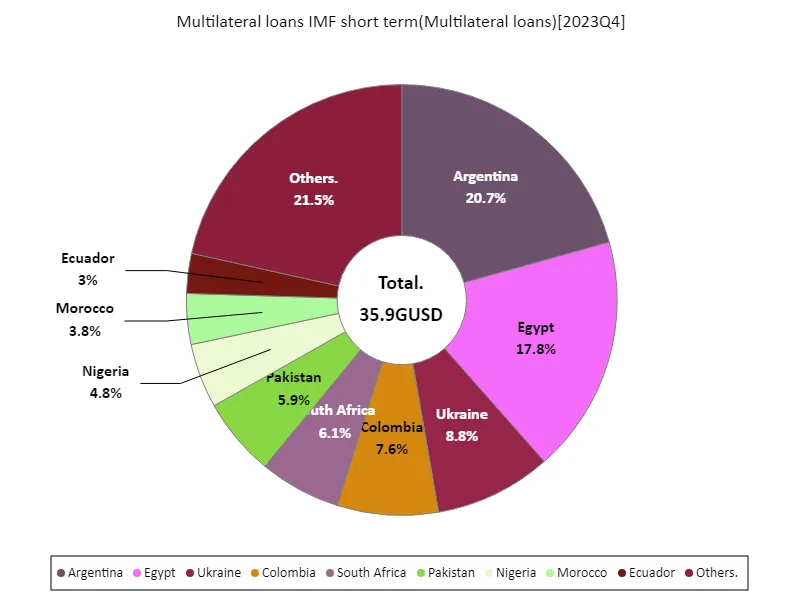

Multilateral loans imf short term (worldwide, latest year)

Data on multilateral loans imf short term as of july 2023 highlights the importance of lending in the international economy. Argentina received the largest loan of $743 million, reflecting the country’s severe economic crisis and high inflation rates. This situation indicates a high degree of dependency on international financial markets and shows how short-term financing can affect a country’s stability. Overall, the average loan amount was $292 million and the total was $3.65 billion, demonstrating the role of multilateral loans as a vital resource for emerging countries to overcome economic difficulties. In particular, support from the IMF is essential for countries experiencing sudden economic change or policy shifts. Moreover, reliance on short-term financing highlights the need for sustainable economic policies. With many countries seeking short-term relief measures, it is clear that long-term growth strategies and structural reforms are becoming increasingly important. Going forward, how each country will utilize loans to stabilize its economy will likely become an important issue in the international financial environment.

The maximum is 7.43GUSD of Argentina, the average is 290MUSD, and the total is 35.9GUSD

Comments