Abstract

Special Drawing Rights (SDR) data on aggregate external debt is a key indicator of the international financial system. The latest data for 2023 shows the United States as the largest debtor nation at $154 billion, reflecting the strength of the American economy and the international demand for dollars. Over the past few decades, America’s foreign debt has been on the rise, driven by trade and budget deficits. In particular, as a result of the financial crisis and economic stimulus measures following the pandemic, SDRs have been issued in greater numbers to secure international liquidity, which has had a significant impact on countries’ external debt. SDRs have also become an important means of financing for emerging and developing countries and play a role in mitigating international financial instability. Rising American debt helps maintain the US dollar’s status as a reserve currency while also increasing its influence over other economies. Going forward, strategies for the use of SDRs and debt management will be important, taking into account the impact of geopolitical risks and environmental issues on the economy.

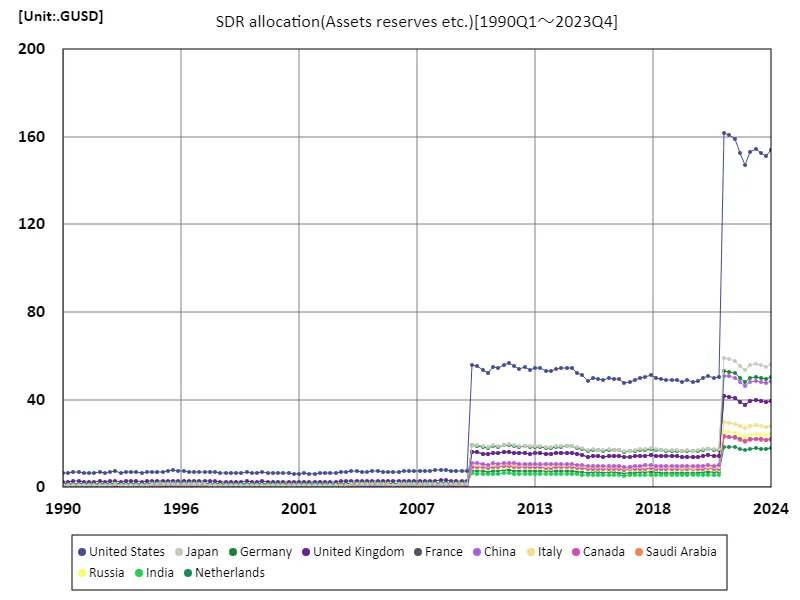

Sdr allocation

Data on special drawing rights (SDRs) for cross-border loans are an important indicator of fluctuations in the international financial system. Looking at data from 1990 to 2023, the United States in particular recorded a peak of $162 billion in May 2021. This comes against the backdrop of pandemic-induced economic stimulus measures and the securing of international liquidity. However, as of 2023, that figure has fallen by 95.2% to just $154 billion. This trend is thought to be due to tightening of money supply as the US economy gradually recovers. Evidence from the past few decades shows that SDRs have become an increasingly important financing tool for emerging and developing countries. SDRs have served as a means of providing liquidity particularly during international financial crises and unstable economic environments. In addition, changes in the United States’ share indicate the influence of its international status and policies, and while the dollar maintains its status as a reserve currency, it also affects economic relations with other countries. Going forward, measures will be required that take into account sustainable economic growth and geopolitical risks.

The maximum is 162GUSD[2021.5] of United States, and the current value is about 95.2%

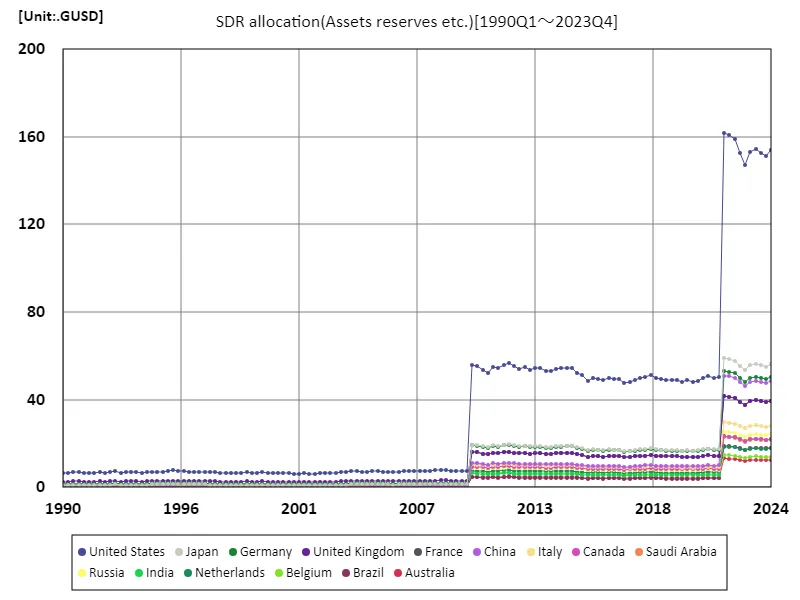

Sdr allocation (worldwide)

Special Drawing Rights (SDRs) play an important role as an international financing instrument, and data from 1990 to 2023 shows their fluctuations. The $162 billion the United States recorded in May 2021 was the result of an increase in SDRs as an emergency economic measure to combat the pandemic. However, by 2023, that figure will fall by 95.2% to $154 billion. The decline reflects a tightening of liquidity supplies as the U.S. economy recovers. SDRs are also an important source of funding, especially for emerging and developing countries, and are used by these countries as a means to raise funds in times of financial crisis or economic instability. As the U.S. share fluctuates, the SDR has strengthened its role as a tool to provide liquidity in response to changes in the international economy and maintain economic stability. Going forward, new approaches will be required that take into account sustainable growth and geopolitical risks.

The maximum is 162GUSD[2021.5] of United States, and the current value is about 95.2%

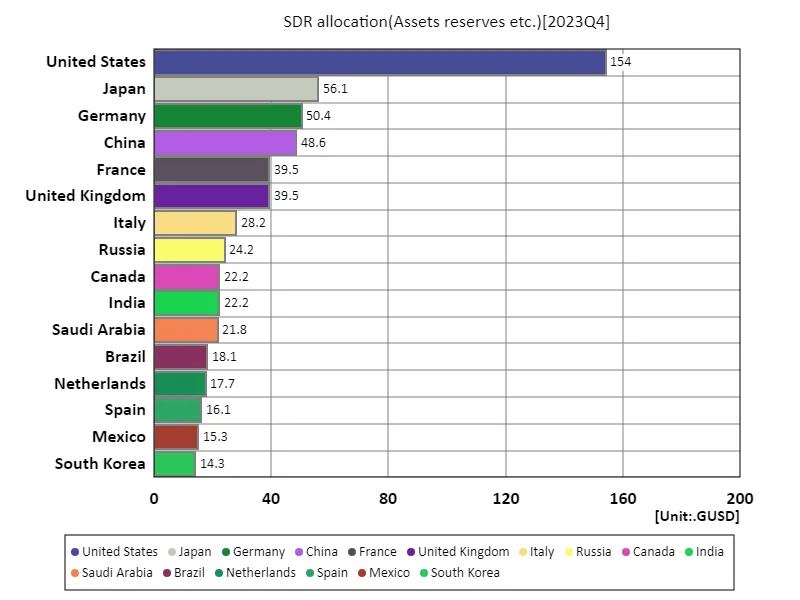

SDR allocation (worldwide, latest year)

Special Drawing Rights (SDRs) serve as an important liquidity tool in the international financial system. According to the latest data for 2023, the U.S. SDR accounts for the largest share overall at $154 billion, reflecting the strength of the U.S. economy and international demand for the dollar. These figures also show the diversity of international funding, with the average SDR standing at $467 million and the total reaching $886 billion. In recent years, SDRs have become increasingly important as a means of financing, especially for emerging and developing countries, helping them achieve sustainable growth amid growing financial crises and economic instability. The allocation of SDRs is also an indicator of each country’s role in international cooperation and policy-making, and its importance is increasing as economic globalization progresses. In the future, along with measures to address geopolitical risks and environmental issues, it will be necessary to optimize the use and allocation of SDRs. This is expected to help create a more stable international economic system.

The maximum is 154GUSD of United States, the average is 4.67GUSD, and the total is 886GUSD

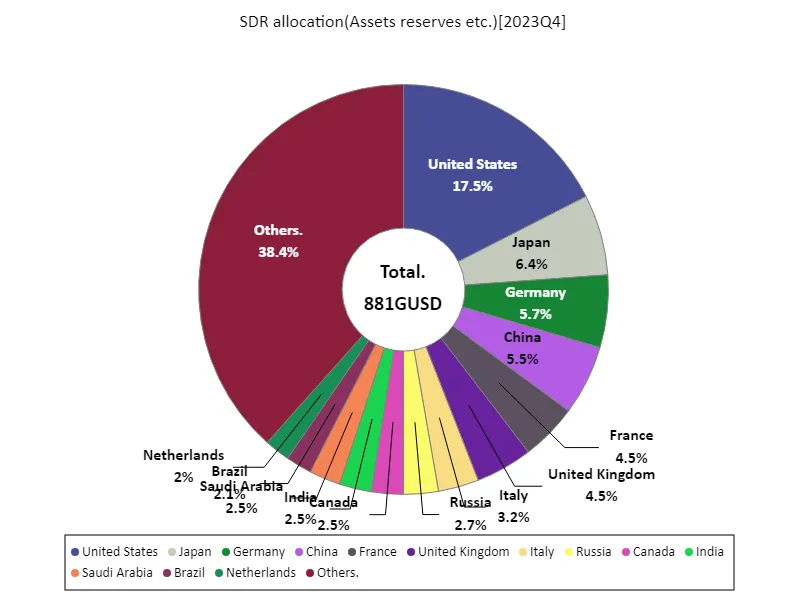

SDR allocation (worldwide, latest year)

Special Drawing Rights (SDRs) serve as an important financing instrument in international finance, with the United States holding the largest share at $154 billion as of 2023. This figure reflects the strength of the US economy and international demand for dollars, and plays an important role in keeping cross-border loans liquid. With an overall total of $882 billion and an average of $469 million, these figures show how SDRs are being used in international fundraising. In recent years, SDRs have become increasingly important, especially for emerging and developing countries, and are seen as a means of raising funds in times of financial crisis or economic instability. SDRs are also a tool for promoting international cooperation and contribute to international economic stability. In addition, it is noteworthy that the allocation and use of SDRs are changing, influenced by international policy decisions and geopolitical risks. In the future, strategic use of SDR will be required, taking into account sustainable economic growth and addressing environmental issues. This is expected to enhance international economic stability and sustainability.

The maximum is 154GUSD of United States, the average is 4.71GUSD, and the total is 881GUSD

Comments