Abstract

External debt is an important indicator in the international economy, with the United States’ liabilities standing out in particular. In 2023, Japan’s cumulative consolidated liabilities to the Bank for International Settlements will reach US$4.49 trillion, maintaining its position as the world’s largest external debtor country. This trend has continued for the past few decades and is influenced by the size of the US economy and the dollar’s role as the reserve currency. An increase in external debt serves as a means of raising funds for governments and companies, and tends to promote investment, especially in a low interest rate environment. However, excessive liabilities carry risks, and repayment burdens could increase if interest rates rise or economic uncertainty increases. This could slow economic growth and call for a cautious approach to fiscal policy and economic management. Compared to other countries, America’s foreign debt remains prominent, strengthening its influence in international financial markets. Meanwhile, other economies, particularly emerging markets, are working to manage liabilities and mitigate risks, and are demonstrating their commitment to sustainable growth. Overall, external debt is an important factor in understanding trends in the international economy.

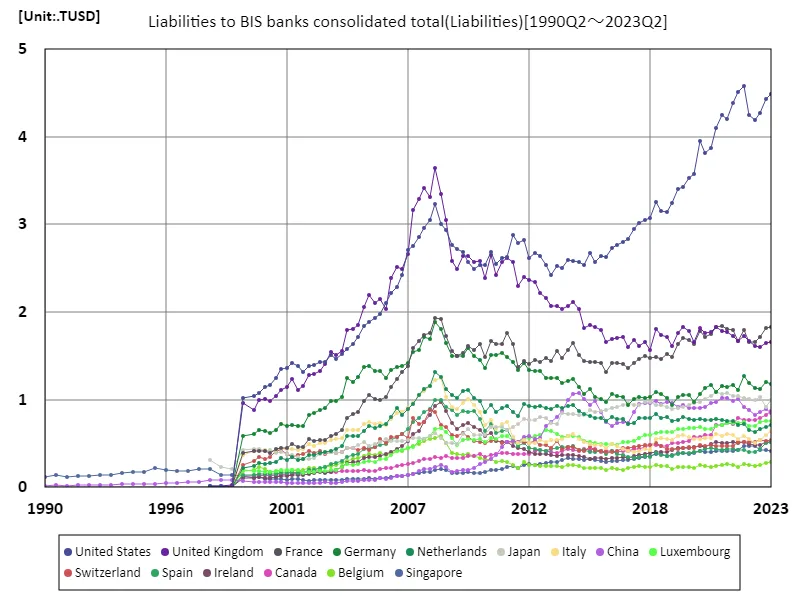

Liabilities to bis banks consolidated total

Data on consolidated cumulative liabilities to the Bank for International Settlements from 1990 to 2023 is a key indicator of changes in the global economy. The United States in particular is set to hit a historic peak of US$4.58 trillion in 2022. This figure reflects America’s influence in international financial markets, due in large part to the size of the country’s economy and the dollar’s status as the world’s reserve currency. Currently, America’s liabilities have fallen to 98% of their peak, and efforts are being made toward sustainable fiscal management. Since the 1990s, the United States’ external debt has risen gradually, especially during periods of low interest rates and favorable economic growth. On the other hand, following economic crises such as the Lehman Shock and the COVID-19 pandemic, the management of liabilities has become increasingly important. While emerging countries are also seeing an increase in liabilities, they are taking a more cautious approach compared to developed countries. Overall, the evolution of external debt reflects changes in economic policies and the global financial environment and will continue to pose challenges to sustainable growth. In particular, managing liabilities has emerged as an important topic amid rising interest rates and geopolitical risks.

The maximum is 4.58TUSD[2022] of United States, and the current value is about 98%

Liabilities to bis banks consolidated total (worldwide)

Data on consolidated cumulative liabilities to the Bank for International Settlements from 1990 to 2023 mirrors trends in the global economy. The United States in particular demonstrated its influence with record liabilities of US$4.58 trillion in 2022. Current liabilities are at 98% of their peak and remain high compared to historical levels. During this period, US liabilities gradually increased under economic growth and low interest rate policies, and were particularly affected by the financial crisis. After the Lehman shock, there was a surge in fundraising to stimulate economic recovery, which resulted in an expansion of external debt. However, signs of rising interest rates have emerged in recent years, calling for a review of fiscal policy. Compared to other countries, emerging countries also tend to have increasing liabilities, but the influence of the United States stands out. Due to changes in the international financial environment and economic policies, the management and sustainability of liabilities has become an increasingly important topic. How the United States controls its liabilities and maintains economic growth in the future will have an immeasurable impact on the global economy.

The maximum is 4.58TUSD[2022] of United States, and the current value is about 98%

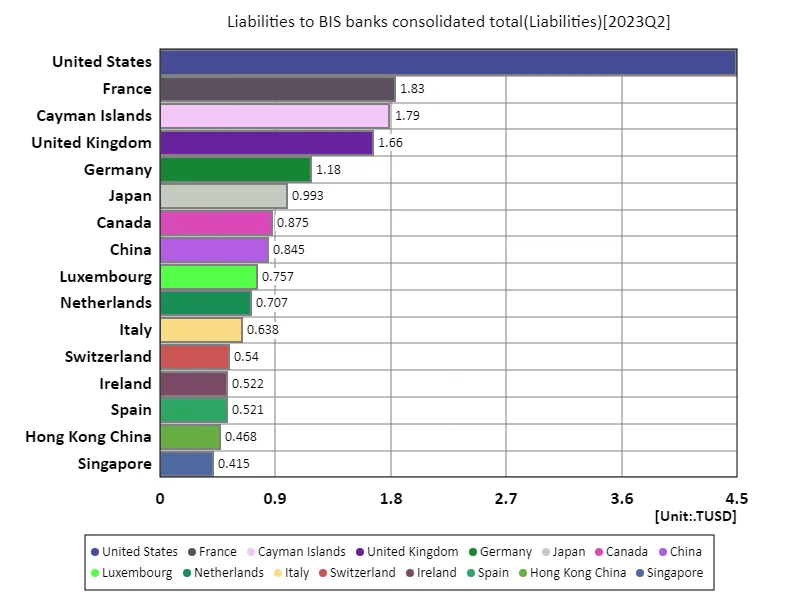

Liabilities to bis banks consolidated total (worldwide, latest year)

Data on consolidated cumulative liabilities to the Bank for International Settlements for 2023 is an important indicator of trends in the global economy. That year, US liabilities reached US$4.49 trillion, the highest figure of all. The total liabilities for the whole country was US$23.4 trillion, with an average of US$10.7 billion, highlighting the fact that many countries have liabilities. Over the past few decades, America’s foreign debt has been on the rise, especially in the wake of the financial crisis and the pandemic. This increase in liabilities serves as a means for governments and companies to raise funds and support economic growth, but it also entails risks. In particular, fluctuations in interest rates and geopolitical instability may affect future repayment capacity and fiscal policies. On the other hand, emerging countries are also seeing an increase in liabilities, but they require more careful management than developed countries. Overall, the liabilities to the Bank for International Settlements are positioned as a key element in responsiveness to changes in economic policy and international relations, and in the pursuit of sustainable growth. It will be necessary to keep a close eye on future developments.

The maximum is 4.49TUSD of United States, the average is 107GUSD, and the total is 23.4TUSD

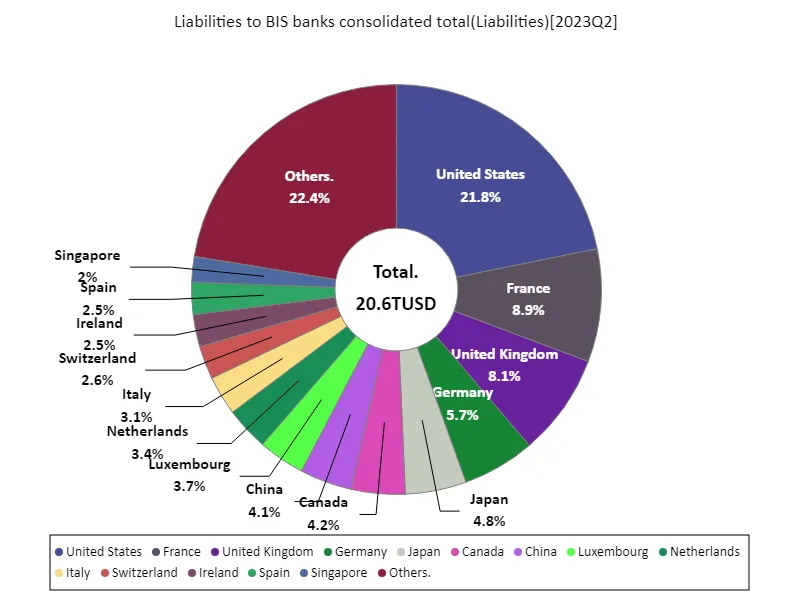

Liabilities to bis banks consolidated total (worldwide, latest year)

Data on consolidated cumulative liabilities to the Bank for International Settlements for 2023 provides an important indicator of the global economy. That year, the United States had the most liabilities at US$4.49 trillion, with the overall total reaching US$20.6 trillion and the average US$10.5 billion. This figure reflects America’s central role in international financial markets. America’s foreign debt has been on the rise for many years, and has especially surged during the financial crisis and the pandemic. These liabilities serve as a means for governments and companies to raise capital and promote economic growth, but they can also be affected by rising interest rates and geopolitical risks. Emerging countries are also seeing an increase in liabilities, and competition in the global economy is intensifying. The increase in overall liabilities highlights the challenges to sustainable economic growth. Each country will need to review its liability management and fiscal policies, and it is particularly important to reconsider fund-raising strategies in a low interest rate environment. Going forward, developments in liabilities to the Bank for International Settlements will require close monitoring, as they will have a major impact on economic policies and changes in international relations.

The maximum is 4.49TUSD of United States, the average is 106GUSD, and the total is 20.6TUSD

Comments