Abstract

External debt, especially debt securities held by nonresidents, is an important indicator of a country’s creditworthiness and international capital flows. According to data for 2023, America’s external debt is USD 9.03 trillion, still the largest in the world. Historically, the United States has a strong economic foundation, liquid financial markets and has been an open source source of foreign investment. As a result, foreign investors are pouring money into U.S. government and corporate debt. On the other hand, an increase in external debt is also a risk factor. In particular, rising interest rates and economic uncertainty could have an impact, raising borrowing costs and shaking investor confidence. Compared to other countries, the US is buoyed by its dollar’s status as the world’s reserve currency, but its expanding debt is always an issue that requires attention. Furthermore, trends in other countries are also important. Japan and China also have large external debts, and their respective economic policies and international relations have an impact on these. Overall, data on debt securities held by nonresidents is key to understanding the dynamics of the international economy.

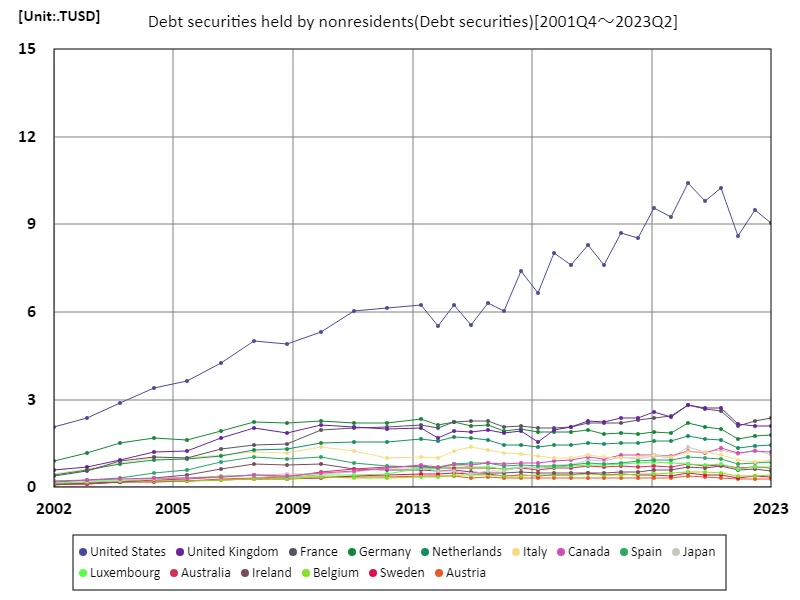

Debt securities held by nonresidents

Data on debt securities held by nonresidents is an important indicator of international capital flows and economic health. From 2001 to 2023, the United States was consistently the largest debt holder, peaking at USD 10.4 trillion in 2020. During this period, the United States attracted significant foreign investment as its economy grew, and government bonds and corporate debt in particular became popular. However, by 2023, that amount will fall by 86.6% to approximately USD 9.03 trillion. This decline can be attributed primarily to rising interest rates and inflation, as well as changes in economic policies. In particular, the Fed’s tightening of monetary policy may have made the country less attractive to foreign investors, slowing investment inflows. Furthermore, trends in other countries cannot be ignored. Economies such as Japan and China also play an important role in the debt securities market, and each country’s economic policies and international relations influence the holdings of debt securities. How America’s foreign debt develops in the future will be key to understanding the dynamics of the global economy. It is important to keep a close eye on trends in debt securities in order to understand the health of the overall economy.

The maximum is 10.4TUSD[2020.75] of United States, and the current value is about 86.6%

Debt securities held by nonresidents (nations around the world)

Data on debt securities held by nonresidents is an important indicator of international investment trends and the health of the economy. From 2001 to 2023, the United States was consistently the largest debt holder, peaking at USD 10.4 trillion in 2020. This is due to America’s strong economic foundation and highly liquid financial markets. In particular, there was a strong inflow of foreign capital, and U.S. government bonds and corporate debt became popular with investors. However, by 2023, that amount will fall to approximately USD 9.03 trillion, only 86.6% of its peak. This decline is likely due to rising interest rates and inflation, as well as changes in economic policy, particularly the Federal Reserve’s tightening of monetary policy. As America became less attractive to investors and foreign capital inflows slowed, holdings of debt securities fell. Furthermore, trends in other countries such as Japan and China will also have an impact. These countries also play an important role in the debt securities market, and their economic policies and international relations influence debt movements. Future trends in debt securities will be an important indicator for understanding changes in the global economy.

The maximum is 10.4TUSD[2020.75] of United States, and the current value is about 86.6%

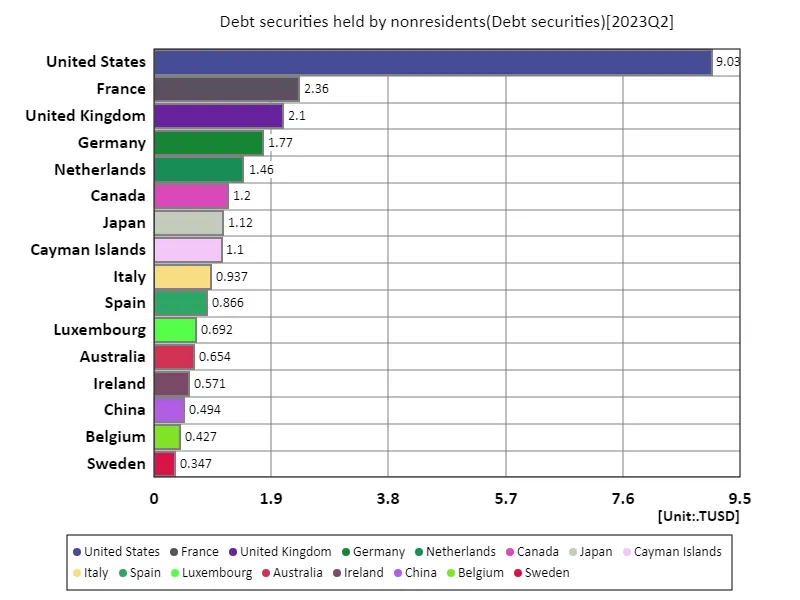

Debt securities held by nonresidents (worldwide, latest year)

Debt securities held by nonresidents are an important indicator of international capital flows and economic health. According to data for 2023, US debt securities are USD 9.03 trillion, the global total is USD 29.3 trillion, and the average is USD 12.3 billion. The United States remains the largest debt holder, a position supported by a strong economy and liquid financial markets. Over the past few decades, the United States has been an attractive market for foreign investors, due in part to its strong reputation for foreign investment and the high level of confidence in its government and corporate debt. For this reason, American debt securities are widely held around the world and have a major impact on trends in the international economy. On the other hand, an increase in debt securities can also be a risk factor. In particular, rising interest rates and inflationary pressures could have an impact and shake investor confidence. Trends in other countries are also important, with Japan and China also having a strong presence in the debt securities market. Since the economic policies and international relations of these countries affect the holdings of debt securities, it is necessary to keep a close eye on trends in debt securities in order to understand the dynamism of the global economy. Future changes will provide important clues for understanding the structure of the international economy.

The maximum is 9.03TUSD of United States, the average is 123GUSD, and the total is 29.3TUSD

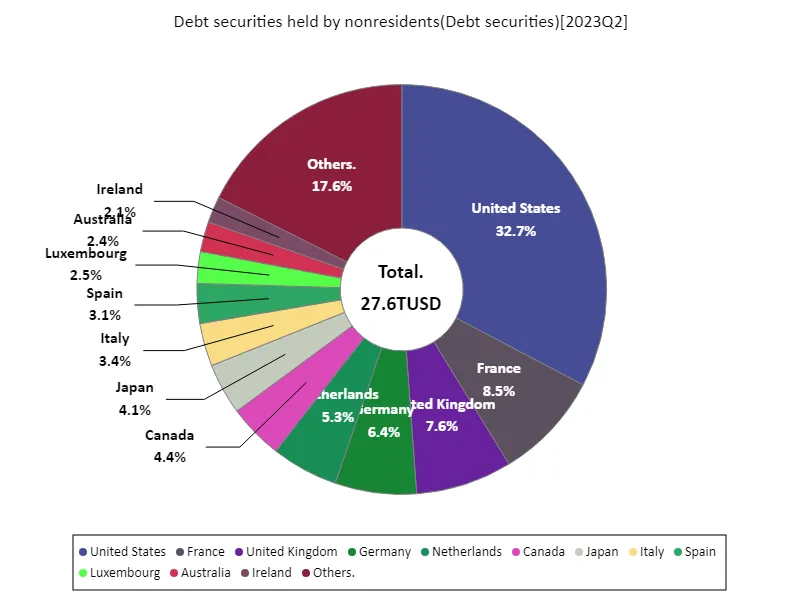

Debt securities held by nonresidents (worldwide, latest year)

Based on 2023 data, debt securities held by nonresidents are a key indicator of international capital flows and economic health. That year, US debt securities were $9.03 trillion, with a total of $27.6 trillion and an average of $13.5 billion. America remains the largest debtor nation and its economic position is strong. As a trend going forward, American debt securities have remained popular among foreign investors due to their high creditworthiness, and U.S. Treasury bonds in particular are widely recognized as safe assets. This has resulted in a robust inflow of foreign capital, which has supported the stability of the economy. However, rising interest rates and inflationary pressures in recent years have affected the attractiveness of debt securities. In particular, changes in Fed policy could increase the cost of debt and shake investor confidence. Furthermore, economic trends in other countries, particularly Japan and China, cannot be ignored. These countries also play an important role in the debt securities market, and their respective economic policies and international relations affect their debt holdings. In the future, trends in debt securities will become an important factor in understanding changes in the global economy. Investors and policymakers need to keep a close eye on the movements of these debt securities and adapt to the international economic environment.

The maximum is 9.03TUSD of United States, the average is 135GUSD, and the total is 27.6TUSD

Comments