Abstract

Based on data for 2023, America’s external debt will reach USD 837 billion, with the largest portion being short-term bonds held by non-residents. This trend reflects the United States’ dominant position in international financial markets. The US economy is characterized by high liquidity and many assets that are attractive to investors, resulting in strong demand for short-term bonds. Furthermore, the United States is the world’s reserve currency, and it is common for foreign governments and companies to hold assets denominated in dollars. This is one of the reasons for the increase in external debt. In contrast, countries such as Japan and Europe have different external debt structures and generally tend to have a higher proportion of long-term debt. Additionally, factors such as rising interest rates and slowing economic growth could also affect future debt trends. Short-term bonds are sensitive to interest rate fluctuations and are subject to the risk of significant fluctuations in value due to changes in monetary policy. Therefore, future market trends for debt securities will be an area that investors should pay close attention to.

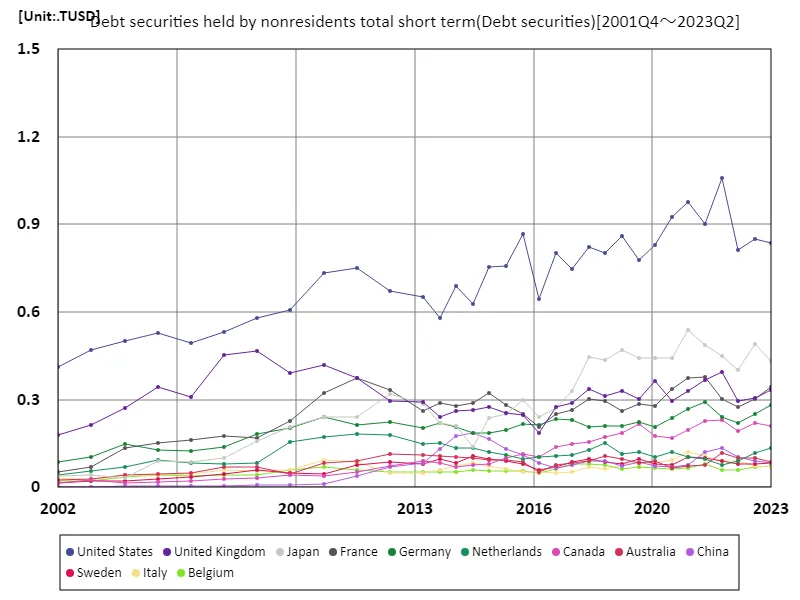

Debt securities held by nonresidents total short term

Looking at data from 2001 to 2023, short-term bonds held by non-residents in the United States peaked at USD 1.06 trillion in 2021, but have now fallen to 79.1% of that level. This trend suggests that US monetary policy and economic conditions are influencing it. In particular, economic stimulus measures and changes in interest rate policies due to the pandemic in the early 2020s had a significant impact on the short-term bond market. As interest rates remained low, demand for short-term bonds increased. However, with interest rates recently rising, investors have become more risk averse and holdings of short-term bonds have tended to decrease. The U.S. external debt structure also reflects the dollar’s status as a reserve currency, making short-term U.S. bonds an attractive option for foreign investors. However, with interest rates rising and economic growth slowing, the debt securities market is likely to face unstable factors going forward, and investors will need to tread cautiously. It will be necessary to keep a close eye on future developments while taking this background into consideration.

The maximum is 1.06TUSD[2021.75] of United States, and the current value is about 79.1%

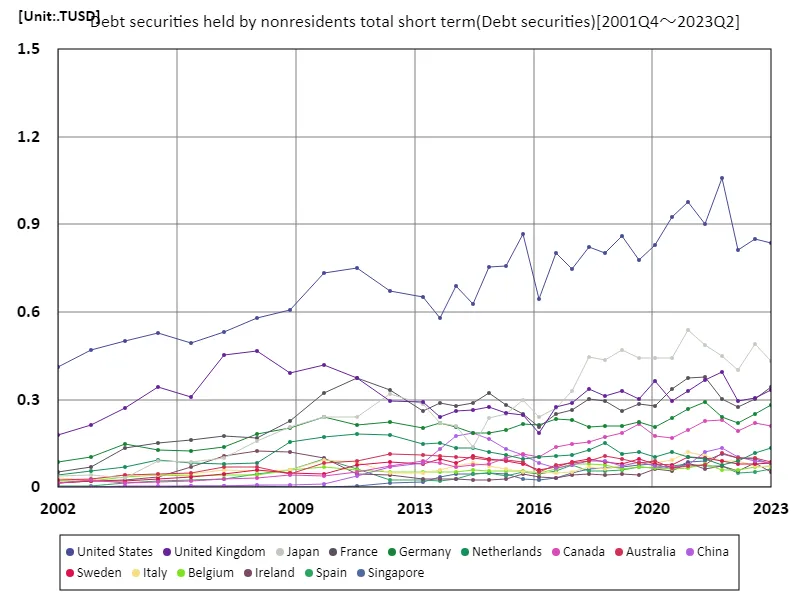

Debt securities held by nonresidents total short term (nationwide)

According to data from 2001 to 2023, the market for short-term bonds held by non-residents in the United States peaked at USD 1.06 trillion in 2021, but has now fallen to 79.1% of that level. These fluctuations are influenced by changes in US economic policies and the international interest rate environment. In particular, low interest rate policies were introduced as an economic measure in response to the pandemic since 2020, leading to a temporary increase in investment in short-term bonds. However, rising interest rates and inflationary pressures in recent years have led to a shift in investors’ appetite for lower-risk assets. As a result, demand for short-term bonds has decreased and the U.S. debt securities market is entering a period of adjustment. And while short-term U.S. bonds remain attractive to foreign investors because they are denominated in dollars, growing economic uncertainty could lead to a decline in their holdings. The future debt securities market will need to be monitored closely as it will be greatly influenced by trends in monetary policy and international situations. It is important to consider these factors when considering your investment strategy.

The maximum is 1.06TUSD[2021.75] of United States, and the current value is about 79.1%

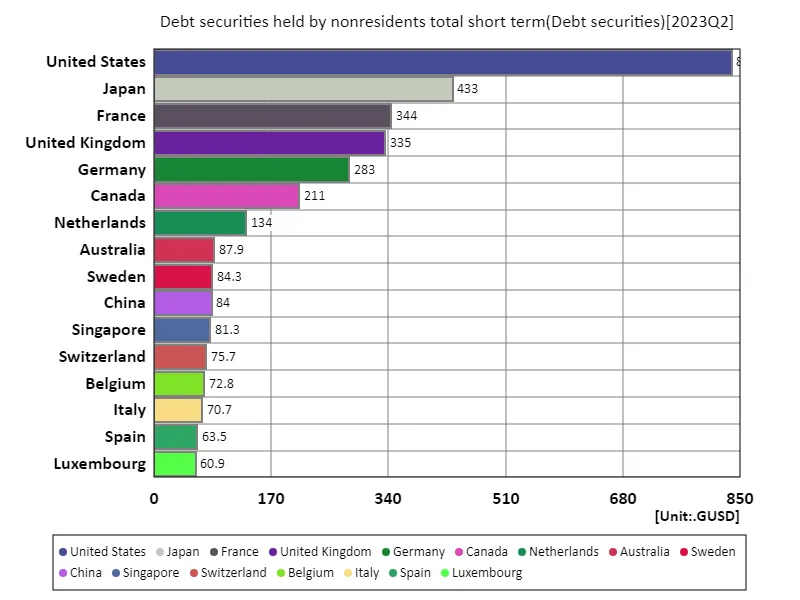

Debt securities held by nonresidents total short term (worldwide, latest year)

According to data from 2023, American debt securities hold the largest amount of short-term bonds held by non-residents, at USD 837 billion. With an overall total of USD 3.66 trillion and an average of USD 1.53 billion, it is clear that the United States accounts for the majority of the market. This trend indicates that the United States continues to maintain its dominant position in international financial markets. Short-term U.S. bonds are highly attractive to foreign investors due to the country’s status as the dollar’s reserve currency. Because of their low risk and high liquidity, they are popular with investors who want to deploy their funds quickly. On the other hand, rising interest rates and inflation concerns in recent years may affect the attractiveness of short-term bonds. Additionally, compared to other countries, the United States tends to have a higher proportion of short-term debt, which is largely due to economic policies and market liquidity. Future market trends will depend on interest rate policies, economic growth prospects, and international situations, so investors need to carefully assess the situation. Given these factors, it is important to keep a close eye on developments in the short-term bond market.

The maximum is 837GUSD of United States, the average is 15.3GUSD, and the total is 3.66TUSD

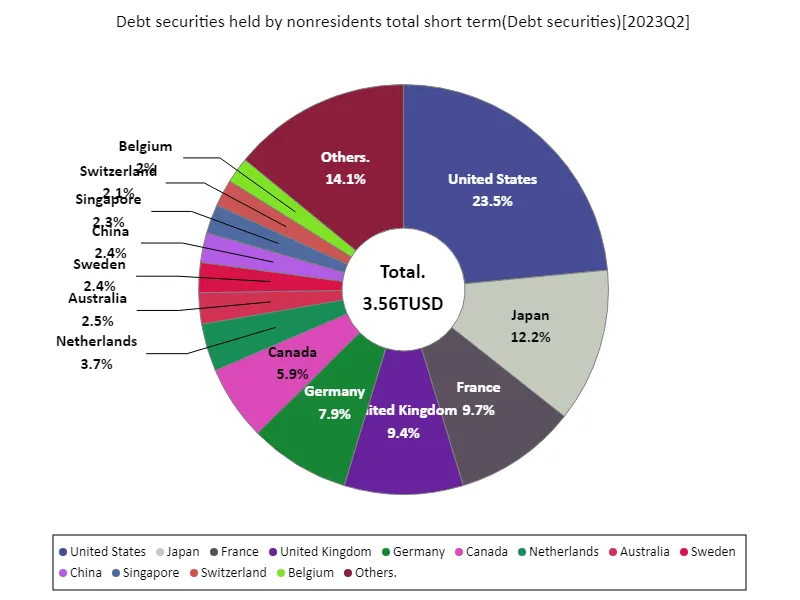

Debt securities held by nonresidents total short term (worldwide, latest year)

According to data for 2023, the United States has the largest market for short-term bonds held by non-residents at USD 837 billion, with a total of USD 3.56 trillion and an average of USD 1.75 billion. This trend indicates that the United States has a dominant presence in international financial markets. Short-term U.S. bonds are attractive to foreign investors because of their high liquidity and relatively low risk. In particular, since the dollar is the base currency, demand is high in international transactions. This is also why America has a higher proportion of short-term debt than other countries. Additionally, changes in monetary policy over the past few years, particularly the low interest rate environment following the pandemic, have had a significant impact on short-term bond markets. However, recent interest rate hikes and inflation concerns have posed new challenges to the market, forcing investors to remain cautious. The debt securities market is expected to fluctuate due to these factors in the future, so investors need to keep a close eye on interest rate trends and economic conditions. This is likely to impact demand and prices for short-term bonds, making this an important time to reassess your investment strategy.

The maximum is 837GUSD of United States, the average is 17.4GUSD, and the total is 3.56TUSD

Comments