Abstract

Data on ”exports of goods for sale (USD)” in trade exports is an important indicator of the international dynamics of economic activity. The evolution of global supply chains and economic recovery in each country are factors behind the world’s total exports reaching USD 23.9 trillion in 2023. Looking at data over the past decade, Asian markets in particular have grown rapidly, with China and India emerging as major export players. Digitalization and technological innovation are also making export operations more efficient and creating new market opportunities. On the other hand, geopolitical risks and trade wars are also having an impact, and these factors are intricately intertwined.

Sales exports (USD)

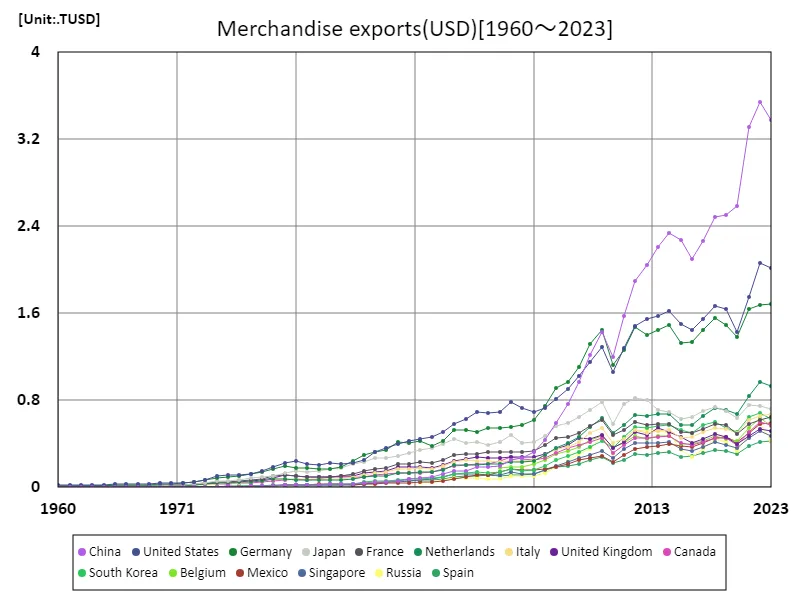

From 1960 to 2023, data on goods sold exports (usd) reflects the growth and changes in the global economy. In 2022, global merchandise exports will reach a peak of USD 25 trillion, before declining to a 95.4% level in 2023. This peak came on the back of recovery from the COVID-19 pandemic and growth in the digital economy, but the subsequent decline is likely due to supply chain issues, geopolitical tensions, and inflation. From the 1960s to the present, the rise of Asian markets, particularly the rapid growth of China, has marked a geographic shift in exports. Furthermore, technological advances and globalization have promoted the expansion of export markets and increased the international competitiveness of various industries. However, attention is focused on how recent economic uncertainties and trade policy fluctuations will affect export trends going forward.

The maximum is 25TUSD[2022] of World, and the current value is about 95.4%

Sales exports (USD) (worldwide)

From 1960 to 2023, China’s sales exports (usd) have experienced remarkable growth. In particular, China’s exports are expected to reach a record high of 3.54 trillion USD in 2022, establishing an important position in the global export market. However, by 2023, it will fall to 95.4% of its peak. The decline is likely due primarily to fluctuations in the global economy, supply chain issues, and geopolitical tensions. Since the 1960s, China has significantly expanded its share of the global export market, driven by rapid economic growth and industrialization. Especially since the 2000s, international trade has increased rapidly following China’s accession to the WTO, and China has played the role of ”the world’s factory.” Its growth was fuelled by low-cost manufacturing and an extensive export network. In recent years, China’s export growth has temporarily slowed due to the impact of tougher environmental regulations and geopolitical tensions. Additionally, domestic consumption is increasing and there is a shift towards medium to high-end products, which is changing the structure of the export market. Given this background, domestic and international policies and economic conditions will likely have a major impact on China’s future export trends.

The maximum is 3.54TUSD[2022] of China, and the current value is about 95.4%

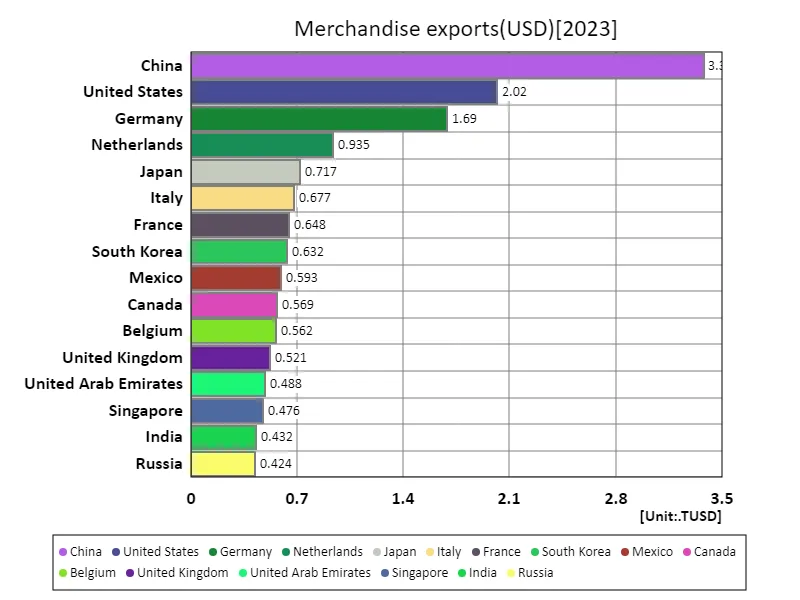

Sales exports (USD) (world countries, latest year)

According to data for 2023, the world total for merchandise exports (USD) was USD 22.8 trillion, with an average of USD 119 billion, with China recording the largest export value at USD 3.38 trillion. These figures show the dynamics of the global economy and the importance of trade. China has established itself as the ”world’s factory” and is achieving large-scale exports, particularly in the manufacturing industry. Over the past few decades, China’s exports have grown rapidly, bolstered by its ability to supply a wide variety of goods to the world at low cost. At the same time, disruptions to global supply chains, geopolitical risks, and strengthened environmental regulations are also having an impact. The average global export value is USD 119 billion, with large variations in export values between countries. Developed and emerging market countries, each with their own unique characteristics, are contributing to the expansion of international trade. In addition, advances in the digital economy and emerging technologies are changing trade forms and patterns, and future trends require close monitoring.

The maximum is 3.38TUSD of China, the average is 119GUSD, and the total is 22.7TUSD

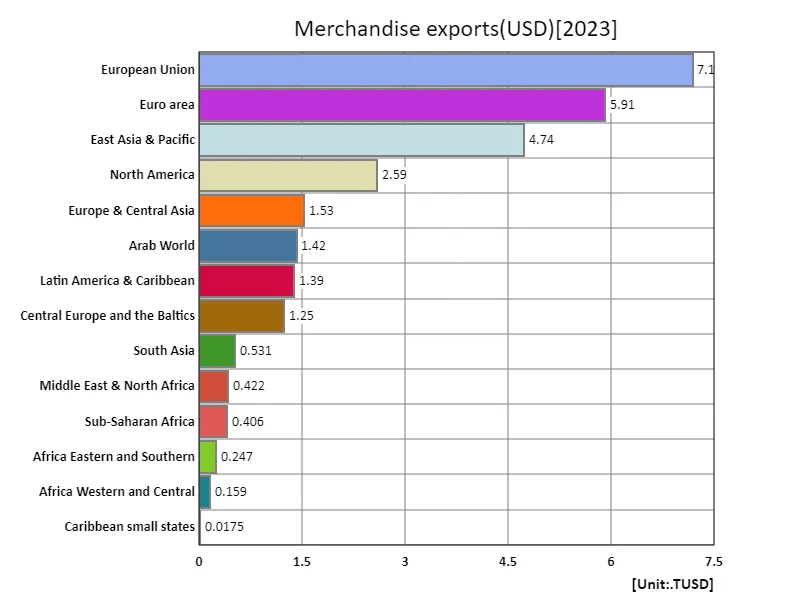

Sales exports (USD) (region, latest year)

According to data for 2023, the total global merchandise exports (USD) will be USD 27.8 trillion, with an average of USD 1.85 trillion and the largest being the European Union (EU) at USD 7.19 trillion. This data is a key indicator of current conditions and trends in global trade. For many years, the European Union has maintained its position as a strong player in global export markets, due to the diversity and quality of its products. EU exports include a wide range of products, including machinery, chemicals and automobiles, and are characterised by advanced technological capabilities and economies of scale. As the average export value of USD 1.85 trillion shows, major economies and countries play a key role in global trade, with developed and emerging markets adopting different trade strategies. To date, as globalization has progressed, manufacturing and high-tech industries have become the core of trade. However, more recently, stronger environmental regulations and advances in digitalization have had an impact on trade patterns. In addition, geopolitical risks and fluctuations in economic policies are affecting trade trends, and countries are focusing on developing new markets and rebuilding supply chains. This will continue to change trade dynamics.

The maximum is 7.19TUSD of European Union, the average is 1.85TUSD, and the total is 27.8TUSD

Comments