- Abstract

- Employment rate in the business finance sector for men aged 15-64 (percentage of working-age males in the workforce)

- Employment rate in the business finance sector for men aged 15-64 (percentage of working-age male employment population) (Worldwide)

- Employment rate in business finance for men aged 15-64 (percentage of working-age male employment population) (Worldwide, latest year)

- Reference

Abstract

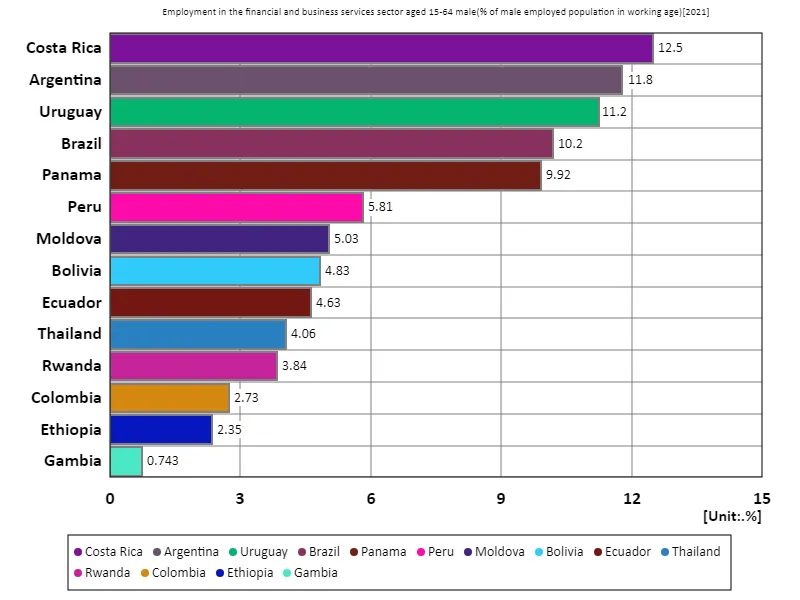

Employment rates for men aged 15-64 in the business finance sector vary widely across countries. In 2021 data, Costa Rica recorded the highest employment rate at 12.5%. This high figure suggests that Costa Rica is particularly active in the financial industry and is expanding its financial sector as part of its economic growth. Costa Rica has a relatively stable political and economic environment in Latin America, and foreign investment is encouraged. This is likely to lead to increased employment opportunities in the financial sector, resulting in a high employment rate. Generally, employment rates in the business finance sector depend on a country’s level of economic development and the maturity of its financial markets. Employment in this sector is low in developing countries and tends to increase as economies mature. Additionally, countries with a status as international financial centers, such as the United States and the United Kingdom, have a high employment rate in this sector, which is largely influenced by the size of their economies and industry specialization. The example of Costa Rica illustrates the impact that region-specific economic strategies and policies have on the job market, demonstrating that each country’s economic background and policies are directly linked to employment rates in the business finance sector.

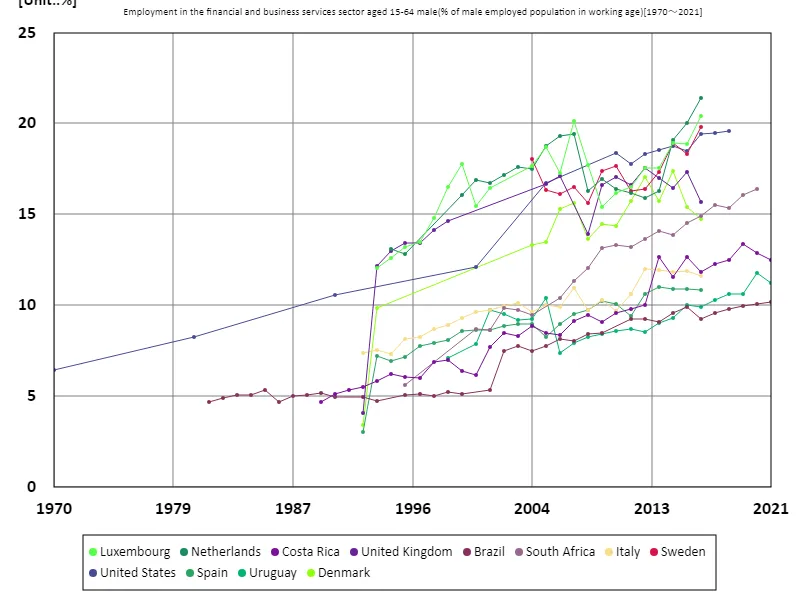

Employment rate in the business finance sector for men aged 15-64 (percentage of working-age males in the workforce)

The example of the Netherlands stands out as a distinctive feature in employment rates in the business finance sector for men aged 15-64 from 1970 to 2021. The Netherlands recorded a record high of 21.4% in 2016, confirming the relatively high employment rate in the business finance sector. This increase is the result of the Netherlands seeing a significant increase in job opportunities in the financial industry as its economy internationalizes and financial services develop. The Dutch economic policy and regulatory environment also fostered the growth of the financial sector. The current employment rate of 100% compared to the peak may be due to changes in the economic structure and the maturity of the financial industry. The Dutch financial sector is highly developed and continues to attract domestic and international investment, offering stable employment opportunities. Overall, developed countries tend to have higher employment rates in the business finance sector, driven by developing financial markets and economic globalization. Data dating back to the 1970s show that the specialism and international competitiveness of the financial industry directly affect employment rates, with employment distribution fluctuating in response to changes in the economy.

The maximum is the latest one, 21.4% of Netherlands

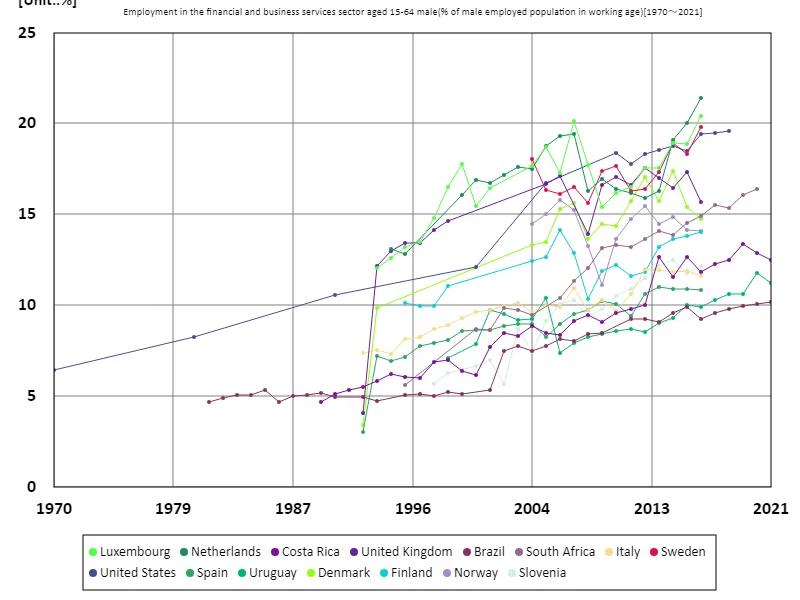

Employment rate in the business finance sector for men aged 15-64 (percentage of working-age male employment population) (Worldwide)

Looking at data from 1970 to 2021, there is a clear trend in the fluctuations in employment rates for men aged 15-64 in the business finance sector. The Netherlands’ peak of 21.4% in 2016 was largely due to the rapid growth of its financial sector and the internationalisation of its economy. The Dutch financial industry has achieved high employment rates due to financial innovation and increasing international investment. Labor market efficiency and policy support also play a role. The expression “100%” for post-peak data indicates a relative change and implies that the Dutch financial sector is already mature. This suggests that peak employment rates are no longer continuing to remain high. In general, the business finance sector has a high employment rate in developed countries, and is expected to grow in emerging countries. As a general trend, the high employment rate in developed countries is due to increased employment opportunities associated with a developing financial sector. Additionally, global economic trends and advances in financial technology have also had a significant impact on the employment structure of the business finance sector.

The maximum is the latest one, 21.4% of Netherlands

Employment rate in business finance for men aged 15-64 (percentage of working-age male employment population) (Worldwide, latest year)

According to 2021 data, Costa Rica recorded the highest employment rate for men ages 15-64 in the business finance sector at 12.5%. This indicates that Costa Rica is achieving high employment rates along with a growing financial sector. Costa Rica’s high employment rate is due to a stable economic environment and increasing foreign investment, leading to a developing financial sector. With an overall average of 6.4%, employment rates in the business finance sector vary widely across countries, particularly between developed and emerging economies. Developed countries tend to have mature financial sectors and relatively high employment rates. On the other hand, financial markets in emerging and developing countries are currently developing, and further growth is expected. The total employment rate of 89.6% indicates that the business finance sector plays a vital role in many countries, and that the internationalization of the economy and the development of the financial industry have an impact on the job market. Overall, employment rates in the financial sector vary depending on the stage of economic development and national policies, with local economic conditions and the maturity of the industry being a major factor.

The maximum is 12.5% of Costa Rica, the average is 6.4%, and the total is 89.6%

Comments