Abstract

The consumer price index (cpi) is a key indicator of the health of the economy and is widely used as a way to measure the rate of inflation. Turkey’s CPI stood at a staggering 1,310 in May 2024 data, reflecting the country’s serious inflation problems. Over the past few years, Turkey has faced high inflation rates, which have been affected by the depreciation of its currency, the lira, and unstable economic policies. In countries other than Turkey, the CPI is also influenced by various factors, particularly fluctuations in energy and food prices. For example, in the United States and the eurozone, supply chain issues and increased demand as the economies recover from the COVID-19 pandemic are impacting CPI. In contrast, in developing countries, slowing economic growth and political instability are contributing to inflation. Overall, trends in the CPI reflect economic policies and the international economic environment and require careful monitoring, especially in countries with high inflation, where rising living costs have a direct impact on people’s lives. Looking ahead, stabilizing the CPI will be a key challenge as countries strive for sustainable growth.

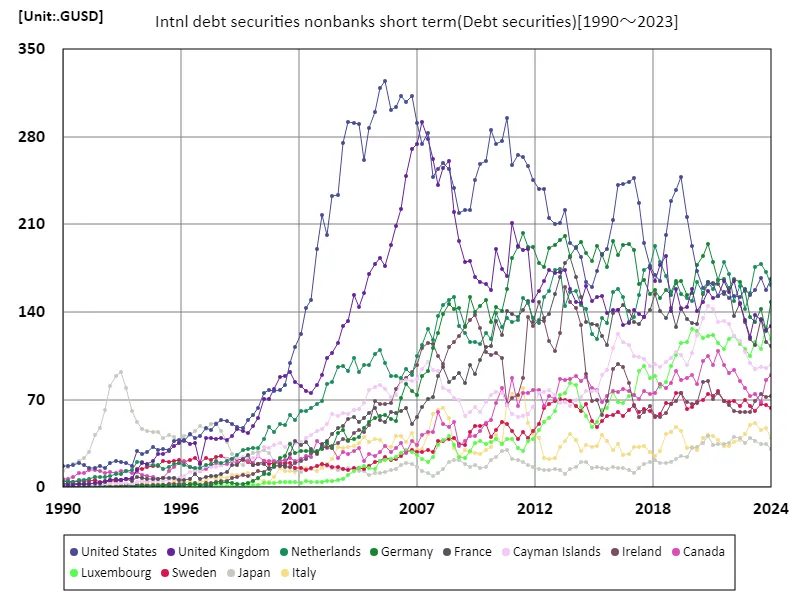

Intnl debt securities nonbanks short term

The consumer price index (cpi) is a key indicator for measuring the inflationary situation in an economy, especially in countries experiencing extreme inflation such as venezuela. Considering data from 1987 to 2024, Venezuela’s 746 million index recorded in April 2019 is the result of economic collapse and political instability. The current situation, which is still 100% compared to the peak, indicates that the situation is still very serious. As the example of Venezuela shows, trends in the CPI over the past few decades have often been driven by a combination of poor economic policies, plummeting oil prices, and social unrest. In addition, while in developed countries the CPI is usually stable and inflation of around 2% is considered desirable, in developing countries and unstable economies, rapid inflation is often the norm, leading to a decline in living standards and increased poverty. In these circumstances, international and domestic policies need to ensure economic stability through the management of CPI. In particular, to achieve sustainable growth, concrete policies are needed to curb inflation and improve the lives of the people. Overall, CPI trends serve as a barometer for measuring the health of each country’s economy and need to continue to be closely monitored.

The maximum is 325GUSD[2005.25] of United States, and the current value is about 51.4%

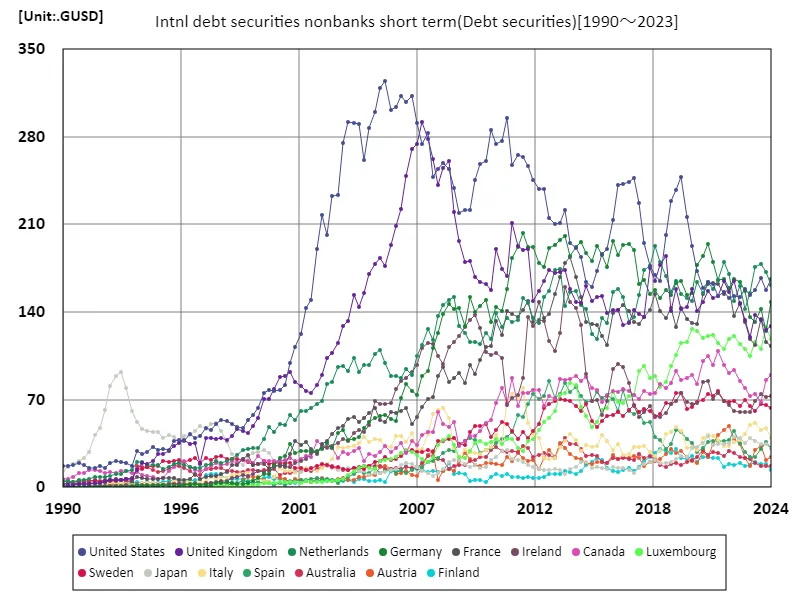

Intnl debt securities nonbanks short term (worldwide)

The maximum is 325GUSD[2005.25] of United States, and the current value is about 51.4%

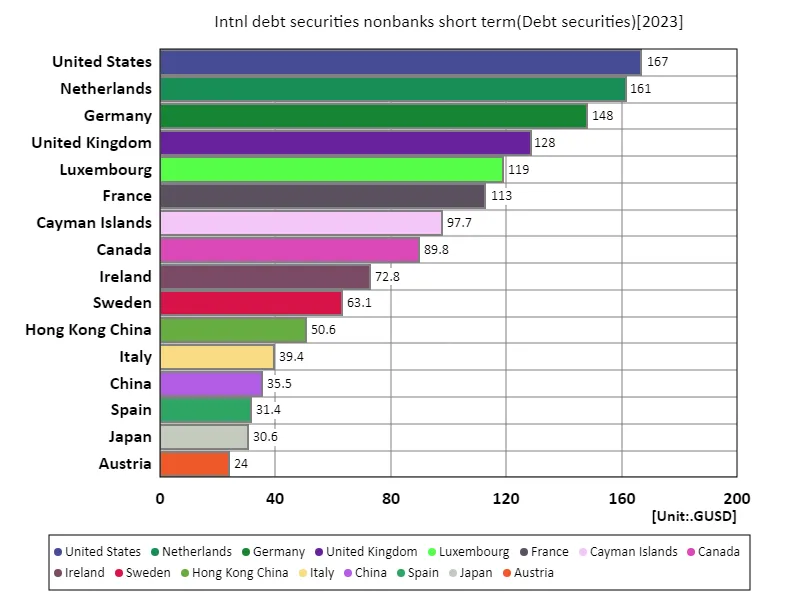

Intnl debt securities nonbanks short term (worldwide, latest year)

The maximum is 167GUSD of United States, the average is 10.7GUSD, and the total is 1.65TUSD

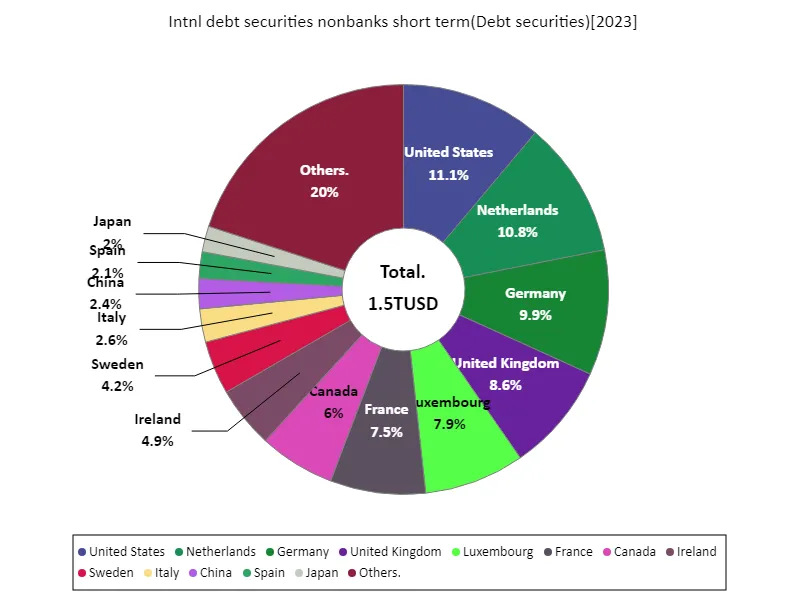

Intnl debt securities nonbanks short term (worldwide, latest year)

The maximum is 167GUSD of United States, the average is 10.4GUSD, and the total is 1.5TUSD

Comments