Abstract

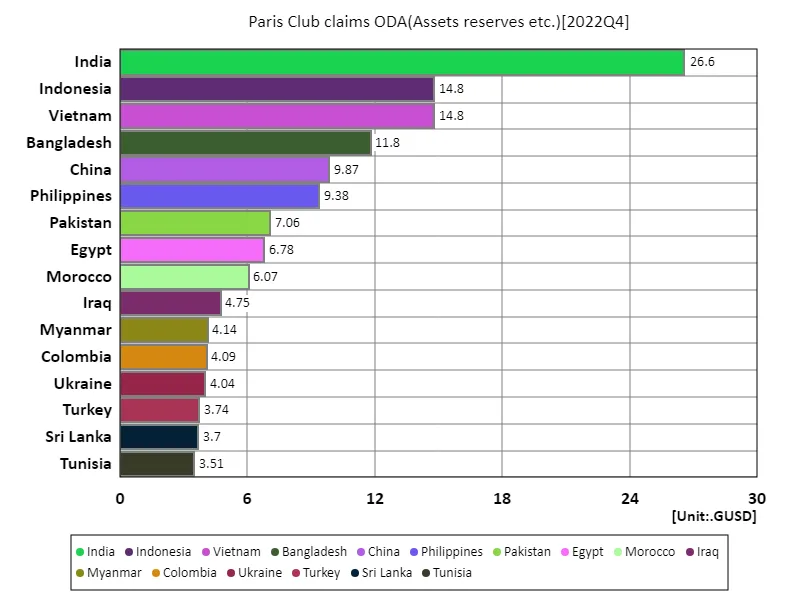

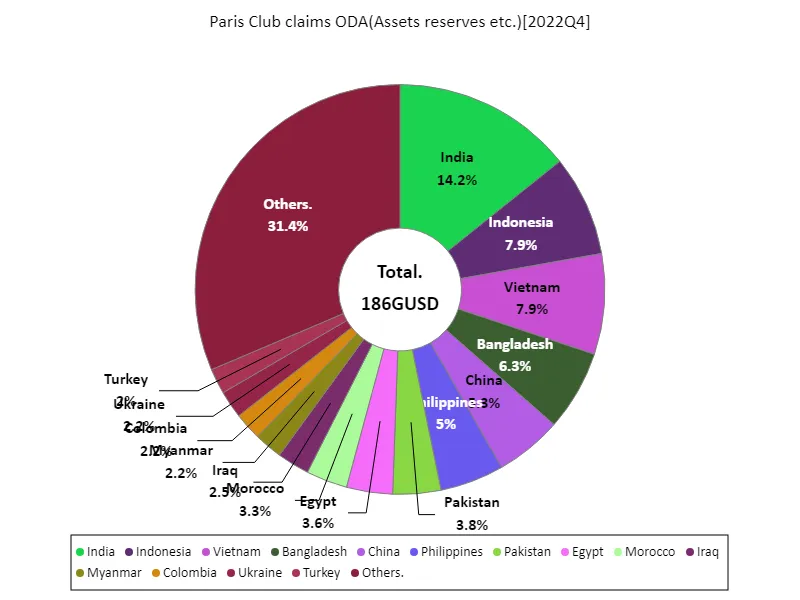

As per the 2022 data, India recorded the highest Paris Club external debt at 26.6 gusd. This trend reflects India’s growing economy and the underlying need for infrastructure development. Over the past few decades, India has experienced rapid economic growth, part of which has been attracting foreign investment. Rising external debt is a common feature, especially among countries that need funds for infrastructure projects and social welfare programs. Many emerging countries require financing for their economic development, resulting in increased borrowing in the form of Official Development Assistance (ODA). Besides India, other countries such as Bangladesh and Nigeria are also seeing a notable increase in external debt, with investment in social infrastructure being given priority. On the other hand, rising external debt also entails risks. Concerns over repayment capacity and the impact of currency fluctuations mean careful management is required to maintain sustainable economic growth. Overall, the Paris Club data highlights the position of emerging countries in the global economy and the importance of international support.

Paris club claims oda

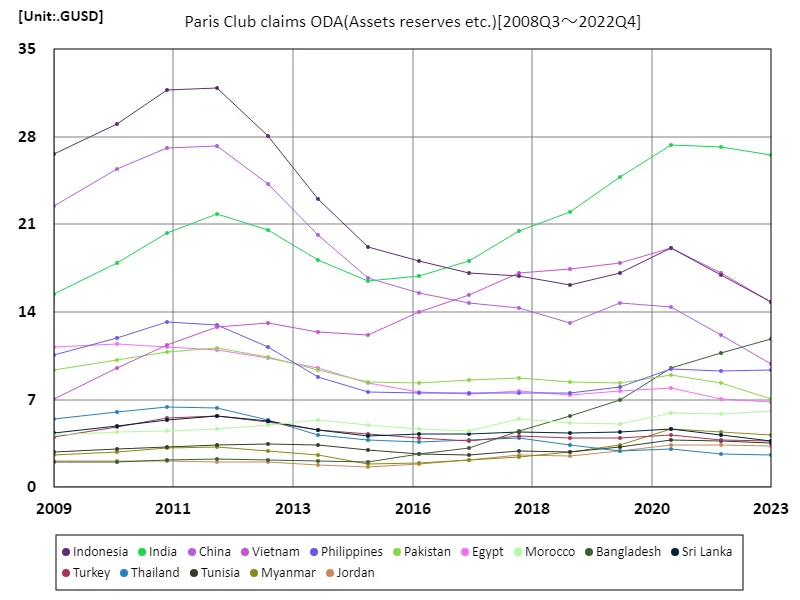

Data on Paris Club cross-border loans from 2008 to 2022 show a number of interesting features, particularly in the case of Indonesia. In 2011, Indonesia recorded the highest external debt at 31.9 gusd, but since then, due to economic fluctuations and changes in the international economic environment, it has now fallen to 46.4% of its peak. The decline suggests that Indonesia is prioritizing fiscal consolidation and making strategic adjustments to reduce external dependency. During this period, other emerging economies showed similar trends, with Asian countries in particular experiencing increased demand for infrastructure investment and strong cross-border lending. However, in countries like Indonesia, the role of international aid is changing as greater emphasis is placed on managing borrowing and ensuring ability to repay. Furthermore, there are moves towards economic diversification and self-sufficiency, and policies aimed at sustainable growth are underway. Overall, the Paris Club data provides insight into how emerging economies are approaching managing external debt risks while pursuing economic development. This trend reflects a new paradigm in the international financial system.

The maximum is 31.9GUSD[2011.75] of Indonesia, and the current value is about 46.4%

Paris club claims oda (worldwide)

Paris Club ODA claims data for 2008-2022 is particularly noteworthy, with particular attention to Indonesia’s performance. In 2011, Indonesia recorded the highest external debt at 31.9 gusd, but due to subsequent economic policies and international influences, it has now fallen to a level of 46.4%. This decline reflects the country’s focus on economic health and efforts to reduce external dependency. During this period, demand for infrastructure investment has risen across emerging markets, leading many countries to turn to external financing, but strategies such as Indonesia’s that take into account ability to repay are becoming more important. In particular, changes in the global economic environment and the impact of the COVID-19 pandemic have created a need for fiscal management and economic diversification. In addition, due to Indonesia’s geographical and economic characteristics, regional cooperation is important in the use of ODA, and the country is strengthening its ties with ASEAN countries. Overall, the Paris Club data shows how emerging economies are re-evaluating external debt management and the role of international support as they strive for sustainable economic growth. These trends will also influence future developments in the international economy.

The maximum is 31.9GUSD[2011.75] of Indonesia, and the current value is about 46.4%

Paris club claims oda (worldwide, latest year)

The 2022 Paris Club ODA claims data is a key indicator of external debt trends in the global economy. Data for that year shows that India recorded the highest amount at 26.6 gusd, with an overall total of 187 gusd and an average of 1.54 gusd. The size of India’s debt reflects its growing economy and the need for infrastructure investment, particularly as a rapidly developing emerging market. To date, many emerging countries have focused on infrastructure development and social development by utilizing external loans. However, changes in the international situation and economic instability have made debt management increasingly important. In particular, concerns about the impact of inflation and exchange rate fluctuations on repayment ability have led countries to seek more cautious borrowing strategies. In addition, as the use of ODA increases, awareness of the Sustainable Development Goals (SDGs) is also growing. In particular, there is a need to address climate change and social issues, and the form of international assistance is also changing. Overall, the Paris Club data highlights emerging economies’ efforts to manage external debt risks and strive for sustainable development in their pursuit of economic growth.

The maximum is 26.6GUSD of India, the average is 1.54GUSD, and the total is 187GUSD

Paris club claims oda (worldwide, latest year)

The 2022 Paris Club ODA claims data provides an important indicator for cross-border loans. Data for that year showed that India recorded the highest amount of 26.6 gusd, resulting in a total of 187 gusd and an average of 1.55 gusd. India’s high debt reflects its fast-growing economy and need for infrastructure development, particularly investments in energy and transport infrastructure. As a general trend, emerging countries have been using international funds to promote infrastructure projects, but at the same time, external debt risks have also increased. Financial management is becoming increasingly important as many countries strive to reduce external dependency and achieve sustainable economic growth. In particular, economic uncertainty and geopolitical risks have called for prudent borrowing policies. Trends in cross-border lending also have an impact on responses to climate change and social challenges. Lending with an awareness of the Sustainable Development Goals (SDGs) is on the rise, and transparency regarding how funds are used is being emphasized. Overall, the Paris Club data highlights emerging economies’ commitment to good external debt management and sustainable development in their pursuit of economic growth.

The maximum is 26.6GUSD of India, the average is 1.55GUSD, and the total is 186GUSD

Comments