Abstract

According to data for 2023, the United States’ cross-border debenture with bis banks nonbanks will reach USD 1.68 trillion, the largest among major countries. This trend indicates that the United States still plays a central role in the global financial system. In particular, the United States is expanding its lending to other countries, backed by its economic power and international influence. Over the past few decades, America’s foreign debt has been on the rise, especially in developing countries and emerging markets. This allows the United States to support the economic growth of the target countries through the supply of resources and infrastructure development, but at the same time it exposes them to the risk of becoming dependent on debt. Geopolitical factors are also playing a role, leading to changes in lending policies towards certain regions and countries. With competitors such as China and the European Union, the United States is reviewing loans and seeking new alliances to protect its own strategic interests. In this way, bilateral loans reflect the dynamics of the international economy and should continue to be an indicator that deserves attention.

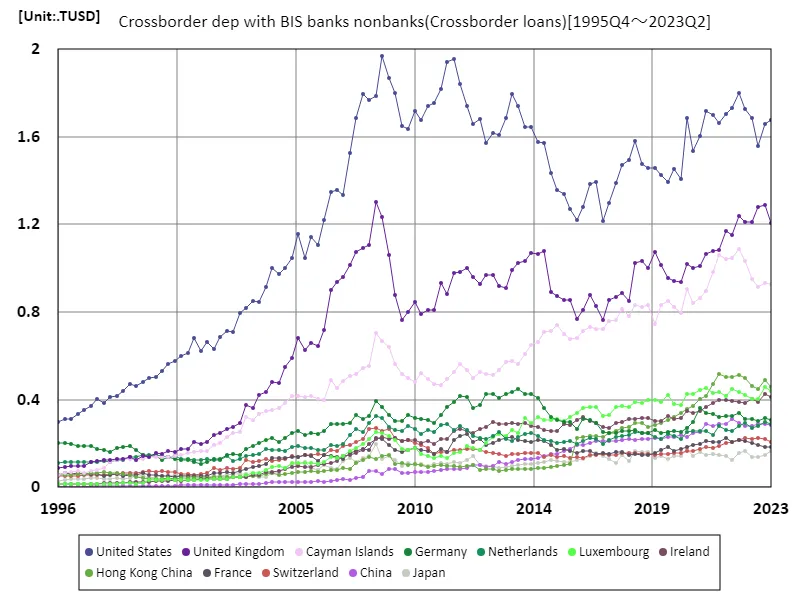

Crossborder dep with bis banks nonbanks

Analysis of crossborder loans and crossborder dep with bis banks nonbanks data reveals trends from 1995 to 2023. In particular, America’s peak of 1.97 trillion USD in 2008 came against the backdrop of a prosperous global economy. During this period, the United States was at the center of the global financial system, providing loans to many countries and supporting their economic growth. However, by 2023, that amount will fall by 85.3% to around USD 1.68 trillion. This decline is likely due to US economic policies and geopolitical changes, with the financial crisis, trade wars, and COVID-19 having a particularly large impact. In addition, competitors such as China and the European Union are also actively lending, intensifying competition in the international financial market. Looking forward, the United States will likely seek strategic partnerships while still prioritizing its own interests. At the same time, lending to emerging markets is also likely to increase, and international capital flows are expected to become increasingly diversified. Overall, cross-border loans are an important indicator of changes in the global economy.

The maximum is 1.97TUSD[2008.25] of United States, and the current value is about 85.3%

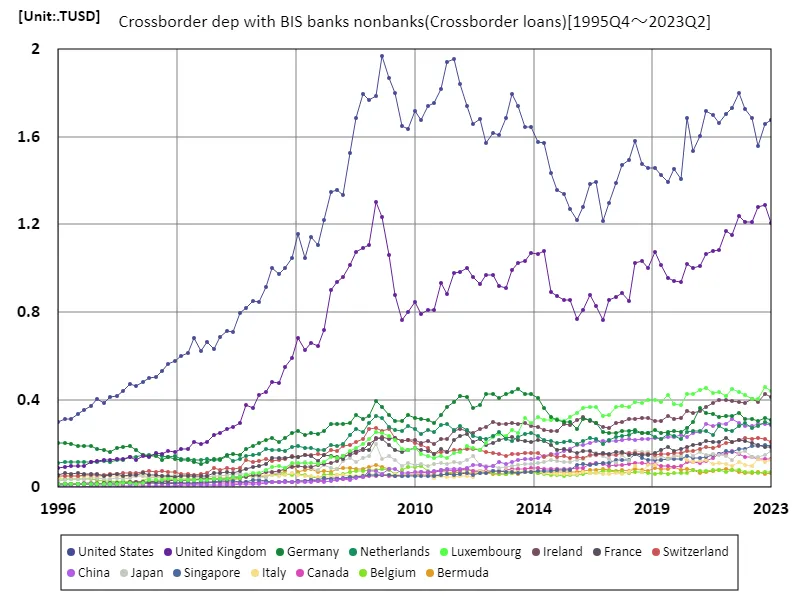

Crossborder dep with bis banks nonbanks (worldwide)

Looking at data on cross-border dep with bis banks nonbanks from 1995 to 2023, the trends in the United States stand out. In particular, in 2008 it reached 1.97 trillion USD, demonstrating its leading role in the global financial system. During this period, the United States promoted economic growth through loans to many countries and built a global economic network. However, by 2023, that amount will fall by 85.3% to around USD 1.68 trillion. This decline is due to a variety of external factors, including the Lehman shock, trade friction, and the impact of COVID-19. Additionally, the rise of rival countries such as China and the European Union has intensified competition in international financial markets. In recent years, lending to emerging markets has been attracting particular attention, and the United States is also seeking to strengthen strategic partnerships. This will diversify international capital flows and may lead to new lending trends in the future. As such, bilateral loans have become an important indicator reflecting changes in the international economy and require continued attention.

The maximum is 1.97TUSD[2008.25] of United States, and the current value is about 85.3%

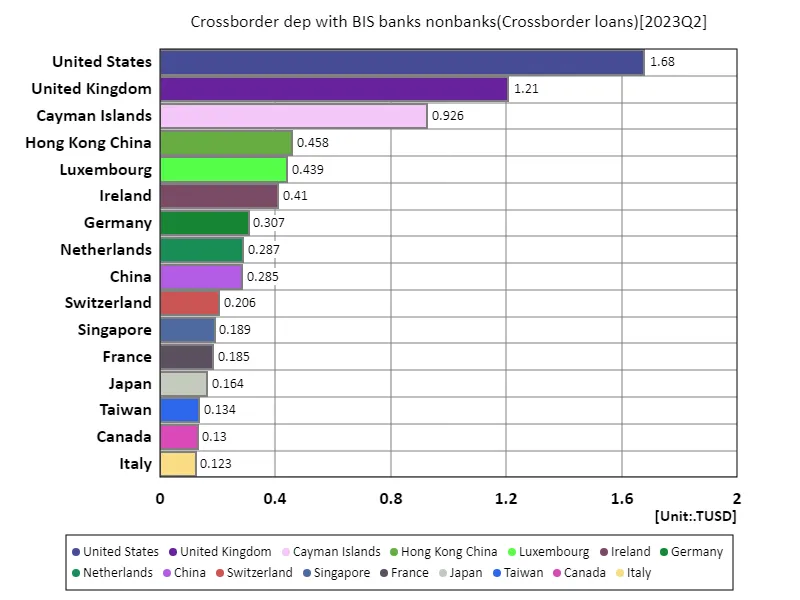

Crossborder dep with bis banks nonbanks (worldwide, latest year)

The cross-border dep with bis banks nonbanks picture based on 2023 data reflects complex trends in the global economy. The United States is the largest lender with USD 1.68 trillion and continues to play a key role in the international financial system. This amount indicates that the country is making strategic loans to maintain its influence in other countries while also taking into account its relationships with competitors. The overall total is 8.88 trillion USD, with an average of 4.06 billion USD, which gives us an idea of the global flow of funds. In particular, lending to emerging markets is on the rise, and developed countries, including the United States, are stepping up financing to support economic growth. This trend is fuelling a global economic recovery and contributing to infrastructure and resource development in developing countries. Additionally, recent geopolitical tensions and responses to environmental issues are influencing lending directions. This has led countries to place greater emphasis on risk management and sustainable investment. Bilateral loans are expected to continue to be an important indicator of the international economy and to have a significant impact on the economic policies and strategies of each country.

The maximum is 1.68TUSD of United States, the average is 40.6GUSD, and the total is 8.88TUSD

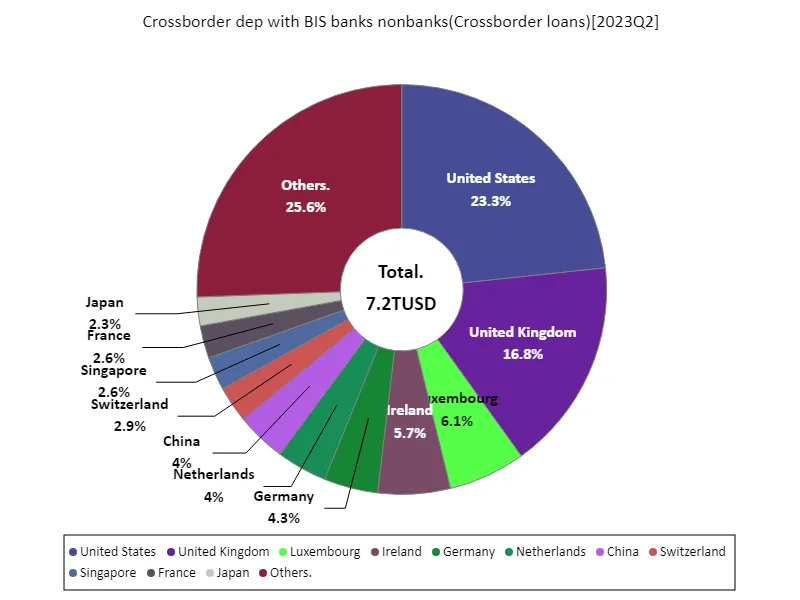

Crossborder dep with bis banks nonbanks (worldwide, latest year)

The cross-border loans cross-border dep with bis banks nonbanks situation based on 2023 data reflects changes in the international economy. The United States is the largest lender with USD 1.68 trillion and maintains international influence. This amount demonstrates the United States’ commitment to promoting economic growth through lending to emerging markets and developing countries. The overall total is 7.2 trillion USD, with an average of 3.67 billion USD, which gives us an idea of international capital flows. In particular, a recent trend has been an increase in lending to emerging markets, which is important for countries seeking to develop infrastructure and secure resources. Additionally, with geopolitical and environmental concerns growing in focus, lending aligned with the Sustainable Development Goals is on the rise. Moreover, amid increased competition, countries such as China and the European Union are also actively lending, shifting the balance in international financial markets. This has enabled the countries to strengthen strategic partnerships and ensure economic stability. Bilateral loans will continue to be an important indicator for understanding the dynamics of the international economy, and their trends will require close attention.

The maximum is 1.68TUSD of United States, the average is 36.9GUSD, and the total is 7.2TUSD

Comments