Abstract

As per 2021 data, India’s official bilateral loans totalled US$3.04 billion, making it the largest external debtor country. The trend reflects India’s need to fund infrastructure and social welfare programs needed to spur economic growth. India’s external debt also serves as a means of strengthening economic ties with other countries. On the other hand, increasing external debt entails risks in international financial markets. In particular, rising interest rates and fluctuations in exchange rates may affect our ability to repay debt, so caution is required. Over the past few years, African and South Asian countries have shown a similar trend, with these regions becoming increasingly dependent on external financing. Public bilateral loans have been an important driver of economic growth, particularly in emerging markets, but there is ongoing debate about their sustainability and repayment capacity. The international community needs to help these countries manage their debt while exploring strategies for long-term economic growth.

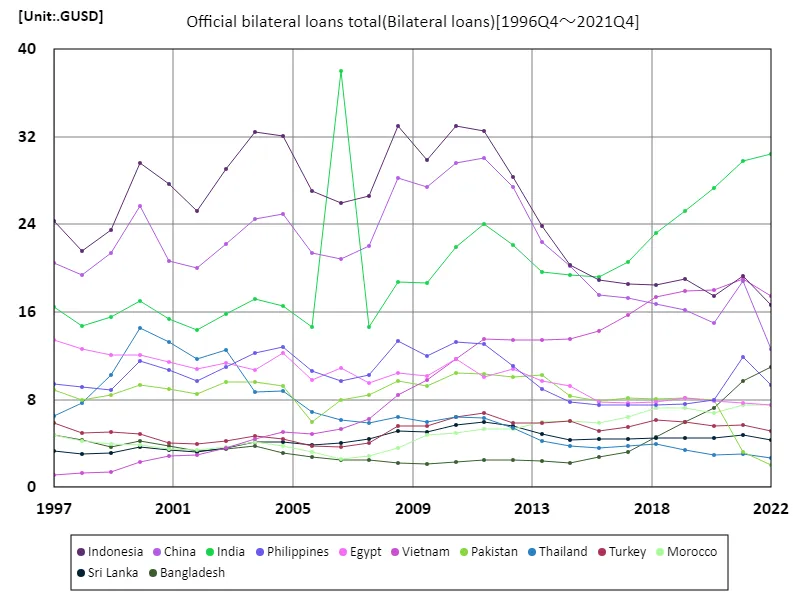

Official bilateral loans total

According to data from 1996 to 2021, India’s total official bilateral loans were highest at US$ 3.8 billion in 2006, on the back of the country’s rapid economic growth. India’s lending has since declined, falling to a level in 2021 that was 80.1% of its peak. These fluctuations are influenced by international capital flows, geopolitical factors, and domestic economic policy changes. Particularly in the mid-2000s, many emerging countries invested in infrastructure development and actively attracted foreign capital. Lending growth then slowed due to the global financial crisis and economic slowdown. In the case of India in particular, the background to this is that internal capital has increased as the economy has grown, resulting in a relative decrease in dependency on external sources. This trend is also being seen in African and South Asian countries, shifting the importance of public bilateral loans across the region. In order to continue to ensure sustainable economic growth, it will be necessary to properly manage loans and explore diverse financing methods. With international cooperation also being called for, each country’s debt management capacity will be a key factor.

The maximum is 38GUSD[2006.75] of India, and the current value is about 80.1%

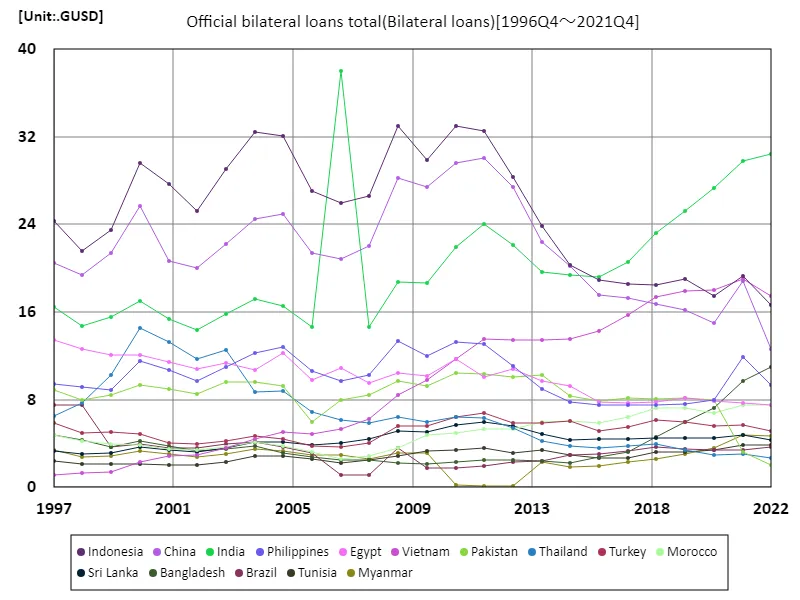

Official bilateral loans total (worldwide)

Data on total official bilateral loans between 1996 and 2021 shows that the highest amount was recorded by India in 2006 at US$3.8 billion. During this period, India experienced rapid economic growth and actively introduced foreign funds for infrastructure development and social development. However, due to subsequent changes in the economic situation and international financial markets, India’s public bilateral loans have shown a downward trend, falling to 80.1% of their peak in 2021. This fluctuation is attributed to slowing economic growth, strengthening domestic demand, and less reliance on external finance. In particular, the Indian government is believed to be pursuing a strategy to reduce dependency on foreign loans as it seeks to utilise internal resources. Similar trends are also being seen in other emerging countries, particularly in Africa and South Asia, where there is an increasing need for countries to reassess their economic policies amid declining international capital inflows. Going forward, effective loan management and diversifying financing options will be key issues in order to achieve sustainable growth.

The maximum is 38GUSD[2006.75] of India, and the current value is about 80.1%

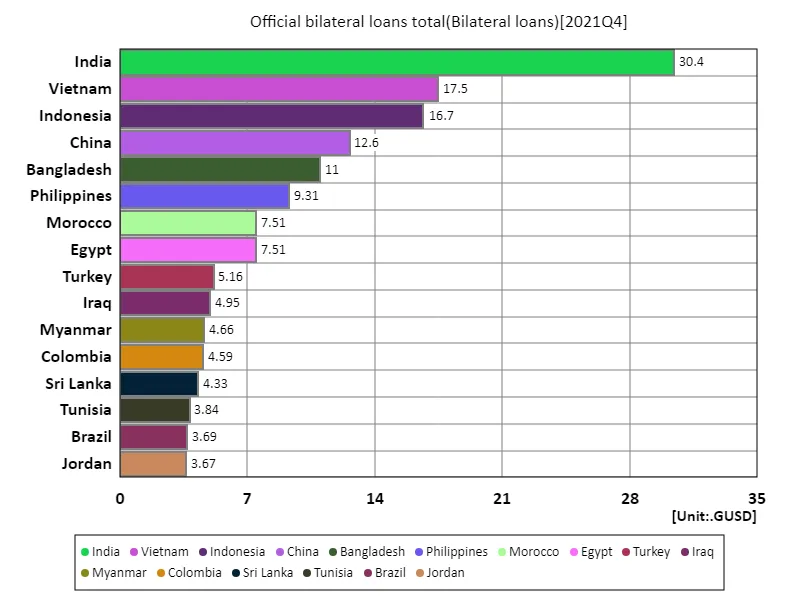

Official bilateral loans total (worldwide, latest year)

According to 2021 data, official bilateral loans totalled USD 20.7 billion, with India being the largest debtor with USD 3.04 billion. This trend reflects the need for infrastructure investment and social development to support India’s economic growth, and is a reflection of the growing demand for external financing from emerging countries in particular. The average figure of US$167 million is also an important indicator of lending conditions in other countries. Many emerging and developing countries need capital, but managing lending risks is a challenge. These countries are increasingly dependent on external financing to sustain their economic growth, but instability in international financial markets and fluctuations in interest rates pose risks to their ability to repay their debts. In recent years, the importance of lending has also increased in African and South Asian countries, with investments being particularly required in areas such as infrastructure development, education, and healthcare. However, to achieve sustainable economic growth, proper management of loans and ensuring diverse financing methods are essential. It has become an important issue to achieve economic stability in each country through international cooperation.

The maximum is 30.4GUSD of India, the average is 1.67GUSD, and the total is 207GUSD

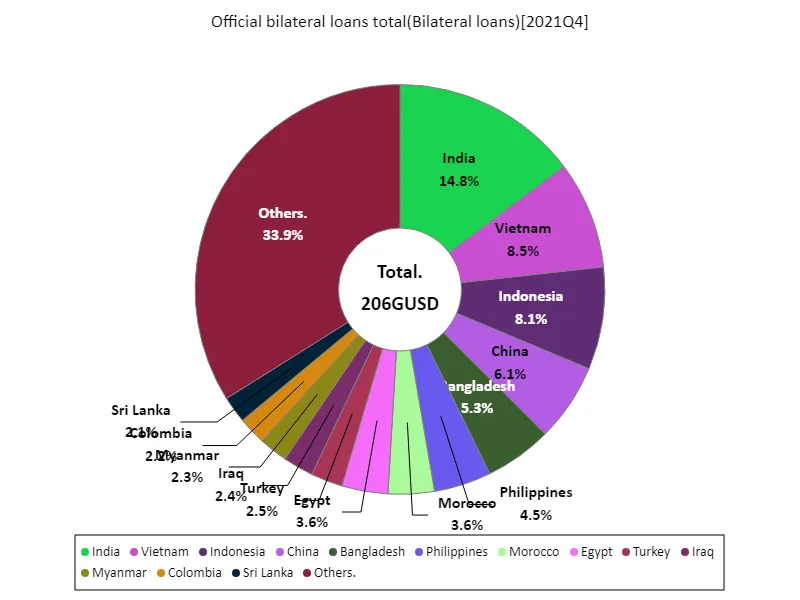

Official bilateral loans total (worldwide, latest year)

As per data for 2021, official bilateral loans totalled USD 20.7 billion, of which India is the largest debtor with USD 3.04 billion. This trend reflects India’s need for financing infrastructure and social development to support its economic growth, especially as emerging economies remain highly dependent on external financing. The average figure of US$170 million indicates that many countries are in need of international financial assistance. Countries in Africa and South Asia in particular need funding for basic areas such as education, health care and infrastructure development. On the other hand, there are risks that these countries’ reliance on loans could affect their economic sustainability. And while cross-border lending can boost economic growth, it also poses challenges in debt management. Fluctuations in international financial markets and rising interest rates could affect borrowing countries’ ability to repay, forcing countries to adopt more cautious lending strategies. Going forward, effective financial management and international cooperation will be essential to achieve sustainable development.

The maximum is 30.4GUSD of India, the average is 1.7GUSD, and the total is 206GUSD

Comments