Abstract

In 2023, cross-border lending, particularly in USD, saw significant changes, with the United States leading at $3.76 trillion. Historically, the U.S. has dominated global lending, reflecting its pivotal role in international finance. The trend in recent years highlights a shift from a decline in 2022 due to Federal Reserve tightening policies to a recovery in 2023. Global credit flows have been influenced by monetary policy shifts, currency fluctuations, and regional credit patterns. For example, dollar credit to emerging markets (EMDEs) remained weak in 2023, while other regions saw mixed results in currencies like the euro and yenBANK FOR INTERNATIONAL SETTLEMENTSBANK FOR INTERNATIONAL SETTLEMENTS.

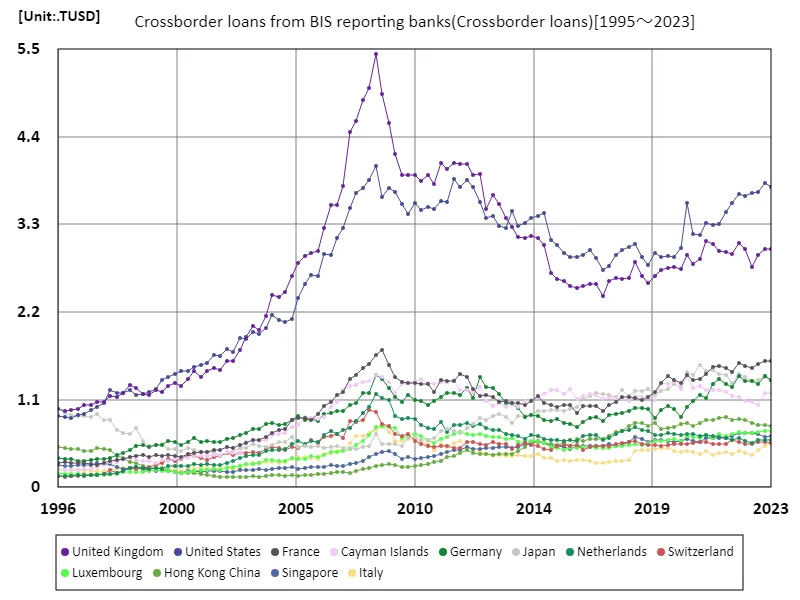

Crossborder loans from bis reporting banks

From 1995 to 2023, cross-border lending saw significant fluctuations, peaking at $5.43 trillion in the UK in 2008. This high was driven by the global financial system’s demand for credit, particularly within the UK’s robust banking sector. However, post-2008, the UK’s cross-border lending fell sharply, currently standing at 55% of its peak. This decline reflects changes in global economic dynamics, including the aftermath of the financial crisis, tighter regulatory frameworks, and shifting investment patterns. Globally, cross-border lending has become more diversified, with the U.S. and other regions taking a larger share of international creditBANK FOR INTERNATIONAL SETTLEMENTSBANK FOR INTERNATIONAL SETTLEMENTS.

The maximum is 5.43TUSD[2008] of United Kingdom, and the current value is about 55%

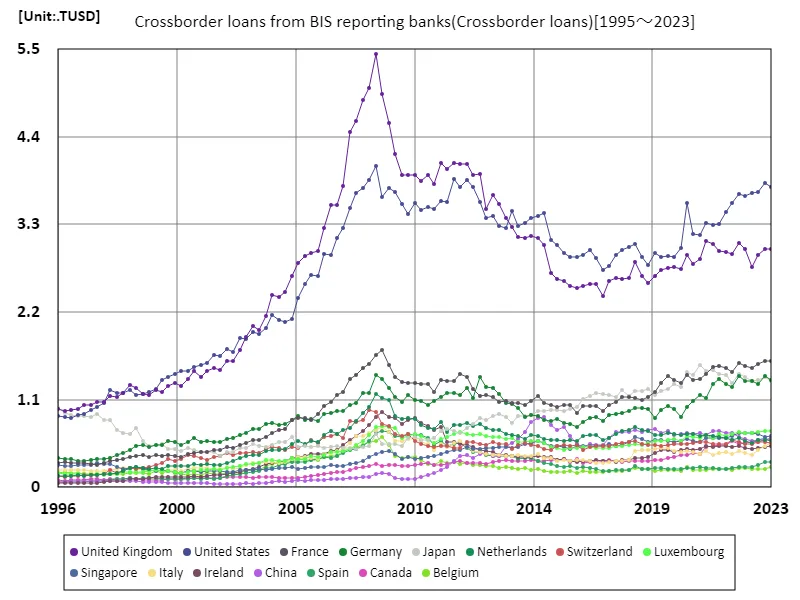

Crossborder loans from bis reporting banks (worldwide)

From 1995 to 2023, cross-border lending, particularly from banks eligible for credit from the Bank for International Settlements (BIS), experienced notable trends. The UK led in 2008 with a peak of $5.43 trillion, driven by global financial flows and the country’s key position in international banking. However, since the 2008 financial crisis, the UK’s lending has declined to 55% of its peak, reflecting tighter regulations and changing financial dynamics. Meanwhile, the U.S. and other regions have increased their share, with global lending becoming more diversifiedBANK FOR INTERNATIONAL SETTLEMENTSBANK FOR INTERNATIONAL SETTLEMENTS.

The maximum is 5.43TUSD[2008] of United Kingdom, and the current value is about 55%

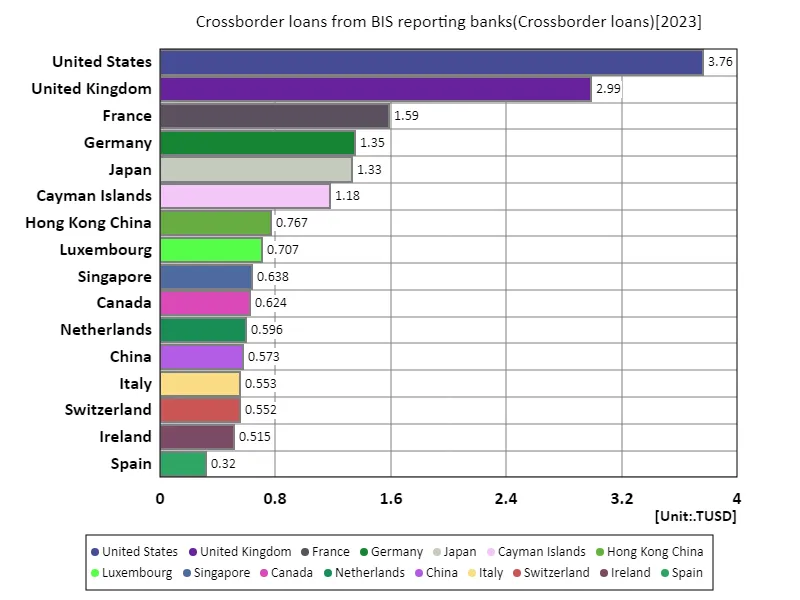

Crossborder loans from bis reporting banks (worldwide, latest year)

As of 2023, cross-border lending reached a total of $22.8 trillion, with the United States leading at $3.76 trillion. The U.S. has maintained dominance in international credit flows, reflecting its significant role in global finance. The average lending figure is $104 billion, indicating widespread global participation across regions. Despite fluctuations, such as the effects of the 2008 financial crisis and recent global economic changes, the overall trend has been a shift toward more diversified lending, with Europe and Asia also seeing notable increasesBANK FOR INTERNATIONAL SETTLEMENTSBANK FOR INTERNATIONAL SETTLEMENTS.

The maximum is 3.76TUSD of United States, the average is 104GUSD, and the total is 22.8TUSD

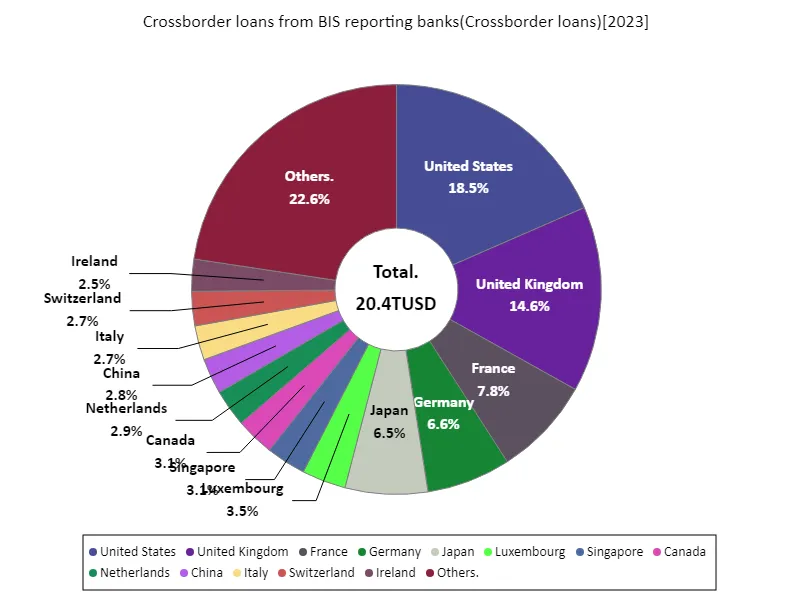

Crossborder loans from bis reporting banks (worldwide, latest year)

As of 2023, cross-border lending among banks eligible for credit from the Bank for International Settlements (BIS) reached a total of $20.4 trillion, with the United States holding the largest share at $3.76 trillion. The average lending amount is $104 billion, showing significant participation across global markets. The U.S. continues to lead, reflecting its central role in international finance. However, cross-border lending trends indicate growing diversification, with Europe and Asia increasingly attracting capital. This reflects a shift towards a more balanced global lending landscapeBANK FOR INTERNATIONAL SETTLEMENTSBANK FOR INTERNATIONAL SETTLEMENTS.

The maximum is 3.76TUSD of United States, the average is 105GUSD, and the total is 20.4TUSD

Comments