Abstract

In recent years, Argentina’s foreign debt has emerged as a serious problem. According to data for 2023, Argentina’s multilateral loans from the IMF have reached 40.8 GUSD, which is having a significant impact on the country’s economy. Over the past few decades, Argentina has been plagued by budget deficits, high inflation and a string of failed economic policies. As a result, international confidence declined and capital outflows accelerated. Compared to other countries, the size of Argentina’s external debt is unique, particularly in the South American region. As Argentina becomes increasingly reliant on multilateral loans, it is negotiating with the IMF to restructure its debt and negotiate new lending terms. However, the harsh austerity measures that have accompanied this are having a major impact on people’s lives and causing social unrest. Overall, Argentina’s external debt is heavily affected by economic policy instability and external factors, making it urgent to find a sustainable solution. The key to the future will be to advance domestic economic structural reform while working in cooperation with the international community.

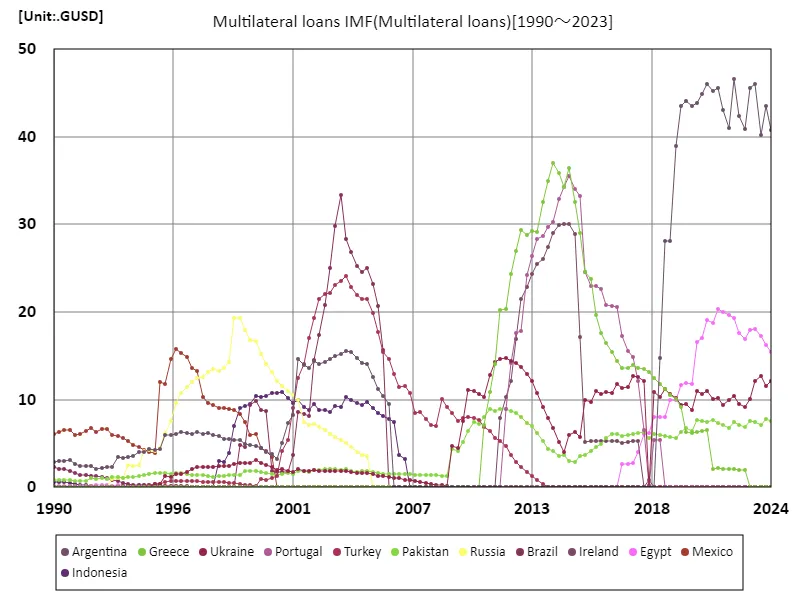

Multilateral loans imf

From 1990 to 2023, international multilateral loans, particularly those from the IMF, have served as important relief for countries facing economic crises and financial instability. Argentina in particular is a prime example of this. In 2022, the largest loan ever was received at 46.6 gusd, reflecting the instability of the economy. This amount shows the high degree of dependency on the size of the country’s economy, and although Argentina has since reduced its lending to 87.5% of its current level, it remains in a tight financial position. The Argentina example shows that multilateral loans can sometimes be an obstacle to economic recovery. Loans with strict conditionalities often impose austerity measures and cuts to social services, lowering people’s living standards and causing social unrest. Furthermore, sustainable economic policies and domestic reforms are essential to restoring international confidence. Overall, while multilateral loans are a crisis management tool, they can also be a drag on long-term economic growth for the countries that receive the loans. In particular, in order to resolve structural problems in the economy, it is important to move away from mere reliance on loans and find a path to independent economic growth.

The maximum is 46.6GUSD[2022] of Argentina, and the current value is about 87.5%

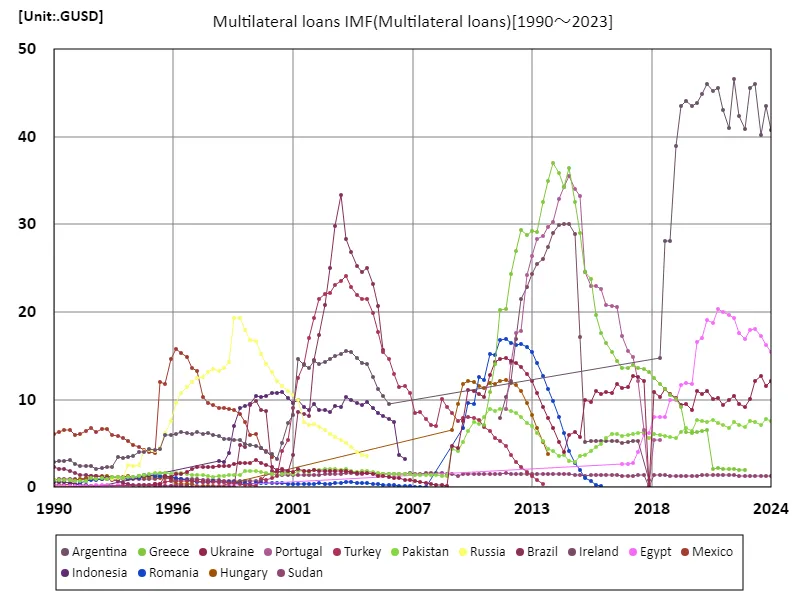

Multilateral loans IMF (worldwide)

Between 1990 and 2023, multilateral loans, especially those provided by the IMF, have served as important relief tools for countries facing economic crises. Argentina in particular is a symbolic example, receiving its largest loan ever of 46.6 gusd in 2022. The loan reflects the country’s severe economic problems, particularly inflation and the currency crisis. Currently, Argentina’s lending volume is down to 87.5% of its peak, but it still exhibits high reliance. This means that relationships with the IMF have a major impact on a country’s economic policies, and loans with strict conditionalities often have a negative impact on people’s lives and social welfare. With austerity measures being called for, it is difficult to restore economic growth, which is causing social unrest. Given this background, IMF lending must go beyond being just a short-term relief measure and must also promote long-term economic structural reform. To achieve sustainable growth, it is important to improve domestic productivity and diversify the economy, rather than relying solely on loans. The Argentine example shows that a balance is needed between international support and domestic reform.

The maximum is 46.6GUSD[2022] of Argentina, and the current value is about 87.5%

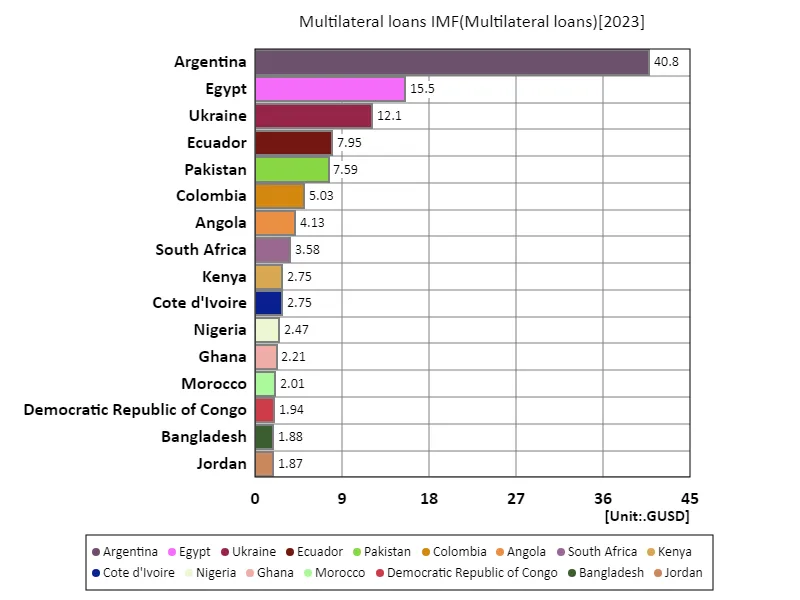

Multilateral loans IMF (worldwide, latest year)

According to data for 2023, multilateral loans from the IMF totaled 149 GUSD, with an average of 796 MUSD. Of particular note is Argentina’s loan amount of 40.8 GUSD, which indicates the severity of the country’s economic crisis. Argentina has suffered from inflation and budget deficits for many years and has become increasingly reliant on IMF aid as a bailout. Looking at the overall data, we can see that IMF lending tends to be concentrated in certain countries. In particular, many of these countries have unstable economies or are resource-poor, and these countries are generally required to implement strict austerity measures as a condition of receiving loans. While such policies may provide short-term fiscal stability, they risk causing social unrest and slowing economic growth in the long term. IMF loans are important as part of international economic assistance, but to maximize their effectiveness, it is essential that they are accompanied by sustainable economic reforms and growth strategies, rather than simply providing funds. Countries should use their relationships with the IMF to restructure their economies and put them on sound economic foundations. It is expected that this will enable the country to break away from reliance on loans and achieve independent economic growth in the future.

The maximum is 40.8GUSD of Argentina, the average is 796MUSD, and the total is 149GUSD

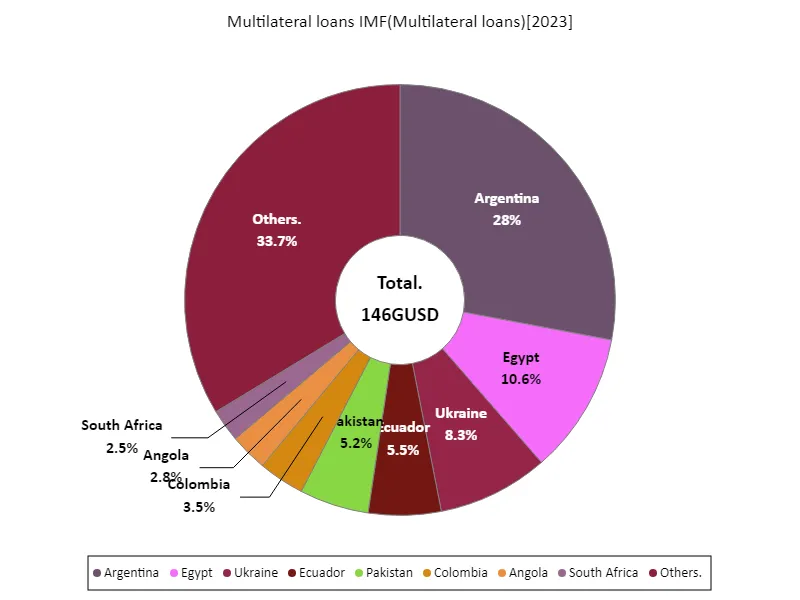

Multilateral loans IMF (worldwide, latest year)

According to data for 2023, multilateral loans from the IMF reached a total of 149 GUSD, with an average of 803 MUSD, of which Argentina received the largest loan with 40.8 GUSD. The situation reflects Argentina’s long-standing economic crisis and financial instability. In particular, inflation and currency depreciation are serious issues, making assistance from the IMF essential. Looking at the overall data, IMF lending tends to be biased towards certain countries, with many of them using it in economically unstable countries. These countries are typically required to undergo fiscal consolidation and structural reform, and are forced to implement austerity measures. However, while such policies may bring fiscal stability in the short term, they run the risk of causing social unrest and slowing economic growth in the long term. In addition, IMF loans go beyond simply providing funds; they also promote international economic policy coordination. With the support of the IMF, each country needs to review its own economic structure and aim for sustainable growth. This is expected to help the country break away from reliance on loans and achieve self-reliant economic growth. An important challenge going forward will be to build a sound economic foundation while taking advantage of our relationship with the IMF.

The maximum is 40.8GUSD of Argentina, the average is 793MUSD, and the total is 146GUSD

Comments