Abstract

Data for 2023 shows that India has the highest external debt of 63.6 GUSD from multilateral loans and other institutions. This comes as India is experiencing rapid economic growth and increasing infrastructure investment. In recent years, India has been promoting growth in its manufacturing and services sectors and placing emphasis on foreign financing. In particular, loans from international organizations play an important role in infrastructure development, thus strengthening the country’s economic foundations. On the other hand, countries in Africa and Latin America are also using multilateral loans, particularly for investments in infrastructure, education, and health. External funding is a key factor in these regions, as their economic stability is fragile. However, excessive external debt can pose future fiscal risks, calling for sustainable borrowing management. Overall, multilateral loans are an important tool for economic development, but they also require prudent fiscal policy and economic diversification. The case of India in particular highlights the importance of debt management while acting as a source of financing to support growth.

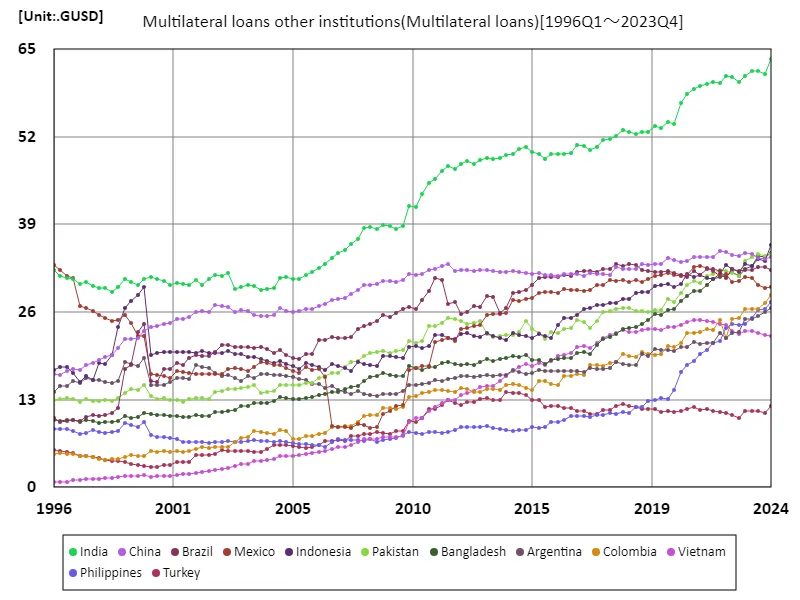

Multilateral loans other institutions

Considering data from 1996 to 2023, multilateral loans and cross-border loans among other institutions have shown remarkable growth, especially in India. In 2023, India will set a record of 63.6 gusd, marking a 100% increase compared to the peak. This growth can be seen as the result of policies aimed at strengthening infrastructure investment and promoting the manufacturing industry. India is experiencing rapid economic growth, which has led to increased inflows of capital from international organisations and foreign countries. In particular, funding from the Asian Development Bank and the World Bank is contributing to the development of social, energy, and transportation infrastructure. This ensures economic stability and sustainable development. At the same time, the use of multilateral loans is increasing in other countries as well, and they are playing an important role as a source of funding for infrastructure development, particularly in developing countries. However, excessive reliance carries financial risks, making borrowing management essential. Overall, multilateral loans are an important tool for promoting economic growth, but they require a strategic approach that takes sustainability into account.

The maximum is the latest one, 63.6GUSD of India

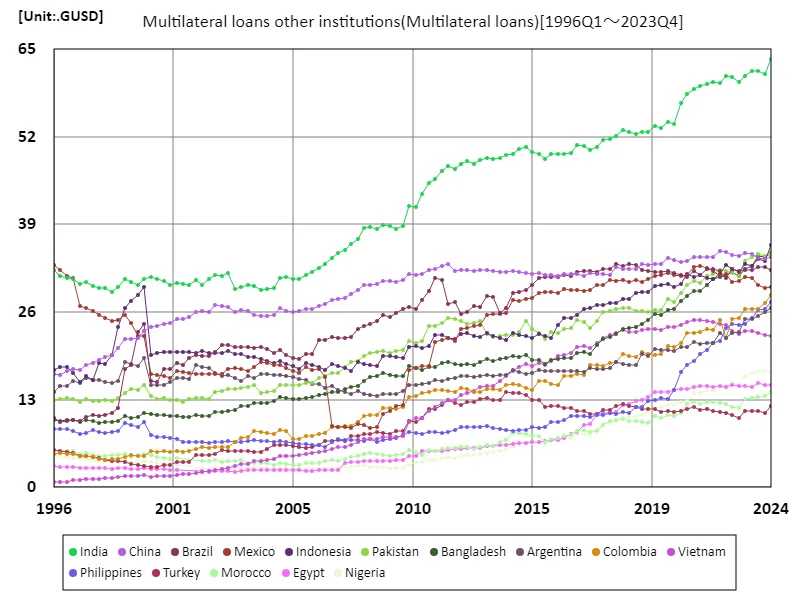

Multilateral loans other institutions (around the world)

Looking at data for multilateral loans and other institutions from 1996 to 2023, India’s growth is particularly notable. In 2023, a record of 63.6 gusd was recorded, marking a 100% increase compared to the peak. This reflects the emphasis India is placing on investing in infrastructure and social development as it accelerates its economic growth. During this period, multilateral loans have increased across the region, particularly as developing countries seek funding from international organizations. India, in particular, is promoting the inflow of foreign capital through government policies and is implementing a large number of infrastructure projects and projects that contribute to sustainable development. However, increasing reliance on multilateral loans has raised concerns about financial risks and repayment burdens. Therefore, countries including India need to pursue sustainable borrowing management and diversify their economies. Overall, while multilateral loans are an important factor supporting economic growth, we are entering an era in which strategic financial management is required.

The maximum is the latest one, 63.6GUSD of India

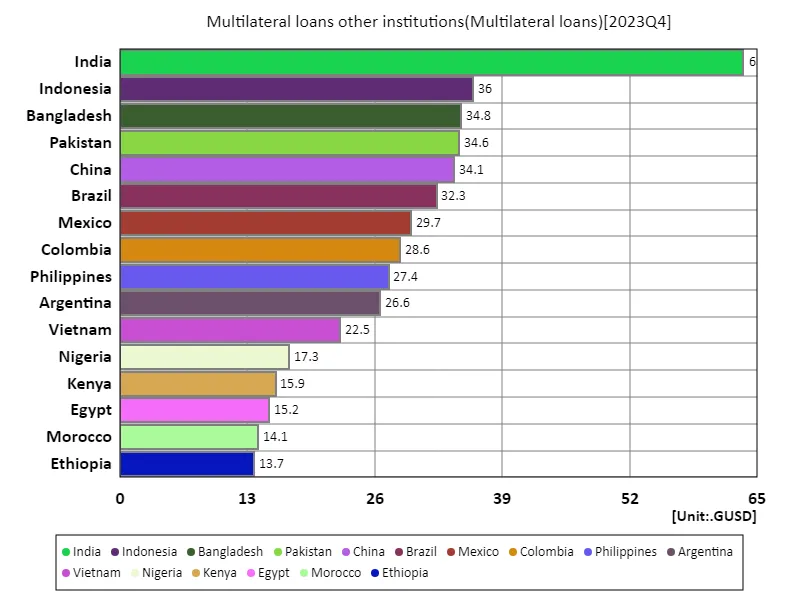

Multilateral loans other institutions (worldwide, latest year)

Based on data from 2023.75 years, multilateral loans and other institutions have become important financing instruments in the global economy. In particular, India received the largest loan of 63.6 GUSD, which is a key factor supporting the country’s infrastructure development and economic growth. On the other hand, the overall average was 4.85 gusd and the total was 757 gusd, indicating that many other countries were also providing comparable amounts of lending. This trend is especially evident in developing and emerging markets. These countries are taking advantage of multilateral loans to strengthen their economic foundations and are investing in infrastructure, education, and health care. In particular, as the need for climate change countermeasures and sustainable development increases, financing from international organizations is becoming increasingly important. However, there are concerns that increased reliance on loans will increase financial risks and repayment burdens. Therefore, recipient countries are required to develop strategies to ensure effective use of funds and sustainable economic growth. Overall, multilateral loans are an important driver of growth and should be managed appropriately within economic policies.

The maximum is 63.6GUSD of India, the average is 4.85GUSD, and the total is 757GUSD

Multilateral loans other institutions (worldwide, latest year)

According to data from 2023.75, multilateral loans and other institutions play an important role in the global economy. Notably, India received the largest loan of 63.6 gusd, reflecting the country’s fast growing economy and infrastructure development needs. The overall average was 4.98 gusd, with the total reaching 757 gusd, indicating that many countries are taking advantage of this funding. A recent trend is for developing countries and emerging markets to actively use multilateral loans to invest in infrastructure, education, and health. Lending from international organizations has become an important source of funding, especially as climate change and sustainable development challenges emerge. However, increased reliance on loans can pose financial risks and repayment burdens. Therefore, countries need to develop strategies aimed at efficient use of funds and sustainable economic growth. Overall, multilateral loans are an essential tool for promoting growth, and their management and utilization will be key challenges for future economic development.

The maximum is 63.6GUSD of India, the average is 4.98GUSD, and the total is 752GUSD

Comments