Abstract

According to data for 2023, Argentina has the largest total multilateral loans at 67.4 GUSD, reflecting the country’s economic difficulties and dependence on international aid. Over the past few decades, Argentina has faced problems such as rising inflation, a weak currency and a shortage of foreign currency, which has increased its need to seek loans from international financial institutions. Compared to other countries, Argentina’s external debt is particularly high, indicating its reliance on bailout loans from the International Monetary Fund (IMF). Multilateral loans are an important source of financing, especially for developing countries, but they can also lead to the accumulation of debt that is difficult to repay. Other Latin American countries are also showing similar trends, with poor economic policies and political instability contributing to rising external debt. For this reason, debt management and economic reforms will be key issues going forward. Overall, the Argentina case highlights the impact of multilateral loans on a country’s economy and the need for prudent fiscal policies to ensure sustainable growth.

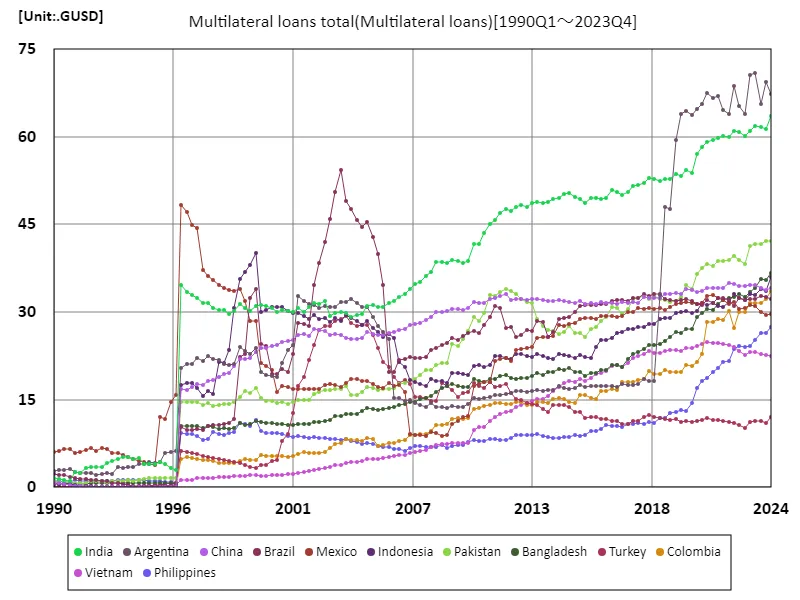

Multilateral loans total

Looking at data from 1990 to 2023, we can see that trends in the total amount of multilateral loans are significantly influenced by the international economic environment and policies. The 71 gusd recorded by Argentina in 2023 was the highest in this period and reflects the country’s economic crisis. Argentina in particular has been forced to seek assistance from international financial institutions due to economic instability and high inflation rates. Argentina’s external debt is at 94.9% of its peak, highlighting the challenges of economic policy and fiscal management. Multilateral loans are an important means of raising funds, especially for developing countries, but their use also carries the risk of leading to the accumulation of debt. Elsewhere, political unrest and economic policy uncertainty are also impacting lending volumes. Overall, multilateral loans since the 1990s have become a barometer of a country’s economic condition, and prudent fiscal management and international cooperation will be required to achieve sustainable growth. Going forward, the Argentina case provides important lessons for considering the complexities and risks of international lending.

The maximum is 71GUSD[2023] of Argentina, and the current value is about 94.9%

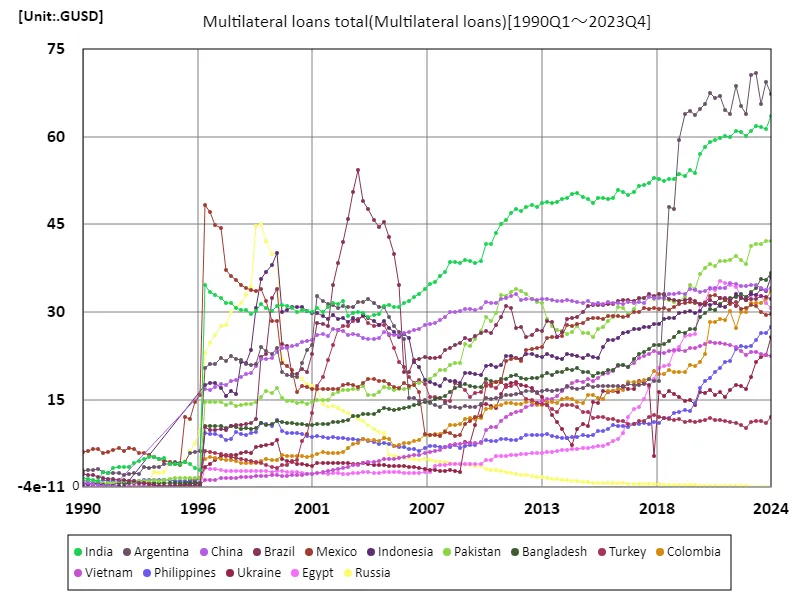

Multilateral loans total (worldwide)

Data on the total amount of multilateral loans from 1990 to 2023 provide a clear picture of fluctuations in the international economy and national fiscal policies. In particular, Argentina’s record of 71 GUSD in 2023 reflects an all-time debt peak and speaks to the country’s severe economic crisis. Argentina is facing economic instability and high inflation, making it indispensable for emergency assistance from international financial institutions. The current external debt is 94.9% of its peak level and this high debt ratio entails significant risks to sustainable economic growth. In other developing countries, political instability and poor economic policies are also affecting multilateral loans, raising concerns about rising debt. Overall, multilateral loans are a good indicator of the health of the economy and signal the need for sustainable fiscal management. The challenge going forward will depend on how these countries achieve sustainable growth and manage their debt. The case of Argentina deserves special attention as a cautionary tale.

The maximum is 71GUSD[2023] of Argentina, and the current value is about 94.9%

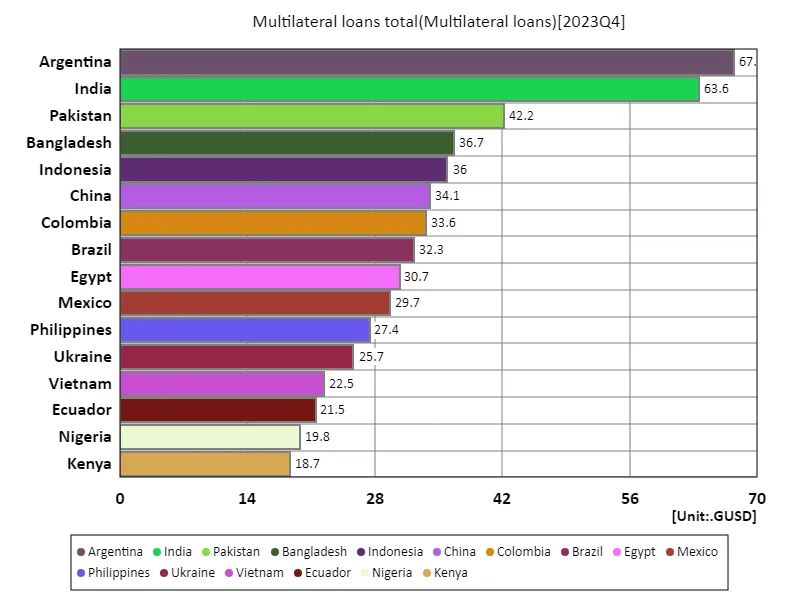

Multilateral loans total (worldwide, latest year)

According to data for 2023, the total amount of multilateral loans is 906 GUSD, of which Argentina has the largest debt with 67.4 GUSD. This situation reflects Argentina’s economic instability and high inflation, making it essential that the country receive assistance from international financial institutions. The average score is 4.74 GUSD, which indicates that while multilateral loans are an important source of financing for developing countries, they depend on successful debt management and economic policies. Multilateral loans are an important tool for supporting countries, especially those with fragile economic growth, but they also carry the risk of overborrowing and repayment burdens that could have a negative impact on the economy. Furthermore, amid the influence of the international economic environment and geopolitical factors, each country must strive for sustainable growth. The case of Argentina in particular teaches us the importance of economic policy in the context of increasing dependence on international lending. Going forward, how countries manage their debt and maintain economic stability will be key issues shaping international financial dynamics.

The maximum is 67.4GUSD of Argentina, the average is 4.74GUSD, and the total is 906GUSD

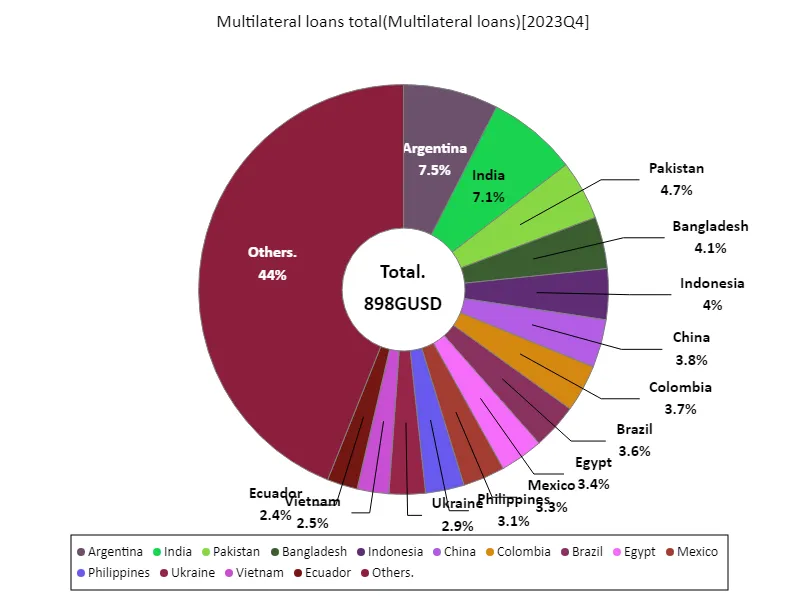

Multilateral loans total (worldwide, latest year)

According to data for 2023, the total amount of cross-border loans and multilateral loans is 906 GUSD, of which Argentina has the largest debt at 67.4 GUSD. The situation reflects Argentina’s economic difficulties, which have led to growing problems such as high inflation, a weak currency and a shortage of foreign currency. As a result, the country is in a strong position to seek assistance from international financial institutions. The average multilateral loan is 4.84 GUSD, making it an important means of raising funds for developing countries. However, this debt buildup is often associated with poor economic policy and political instability, requiring particularly prudent fiscal management on the part of borrowing countries. Argentina’s example also shows how dependency on international loans can affect sustainable growth, and countries need to focus on debt management and economic reforms. A major challenge for each country will be how to achieve stable growth while adapting to future changes in the international economic environment. These developments will be important factors that will affect the international financial system as a whole.

The maximum is 67.4GUSD of Argentina, the average is 4.83GUSD, and the total is 898GUSD

Comments