Abstract

According to data from the Berne Union’s Insured Export Credit Exposures for 2023, the United States has the largest external debt at $335 billion. This trend indicates that America plays a key role in the world economy. The United States is positioned as a reliable borrower in international transactions, and many countries depend on its markets. America’s foreign debt has been on the rise for the past few decades, especially as government spending surged during the financial crisis and the COVID-19 pandemic. In this environment, the United States maintains a high credit rating compared to other countries, which encourages international capital inflows. On the other hand, rising debt is a cause for concern. The sustainability of America’s foreign debt may come into question, especially as interest rates rise and inflation continues. Additionally, geopolitical tensions and trade frictions may also have an impact, so future trends will require close attention. Overall, America’s external debt will continue to play an important role as an economic indicator.

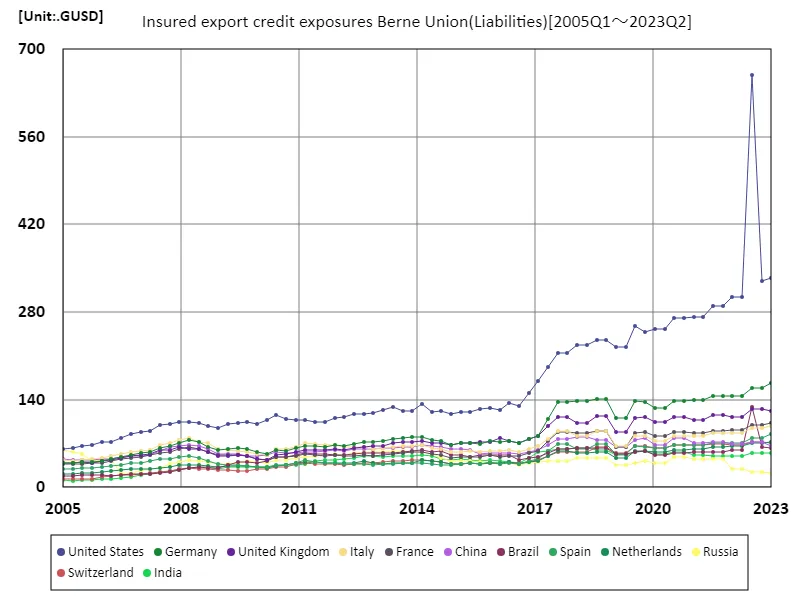

Insured export credit exposures berne union

According to Berne Union data on insured export credit exposures from 2005 to 2023, U.S. liabilities peaked at $659 billion in 2022 but fell to about 50.9% of that amount in 2023. This decrease is likely due to the economic recovery and rising interest rates. As the world’s leading economy, the United States has a large amount of foreign debt backed by international credibility. However, peak liabilities levels reflect the effects of excessive government spending and monetary policies, which increased sharply especially during the financial crisis and pandemic. Against this backdrop, the recent decline in debt is seen as a sign of fiscal consolidation, but risks remain that external shocks and economic uncertainty may have an impact. In addition, competition with other countries is intensifying, and U.S. economic policy must take into account its sustainability. Overall, trends in U.S. liabilities are an important indicator for the global economy and will require continued close monitoring.

The maximum is 659GUSD[2022.75] of United States, and the current value is about 50.9%

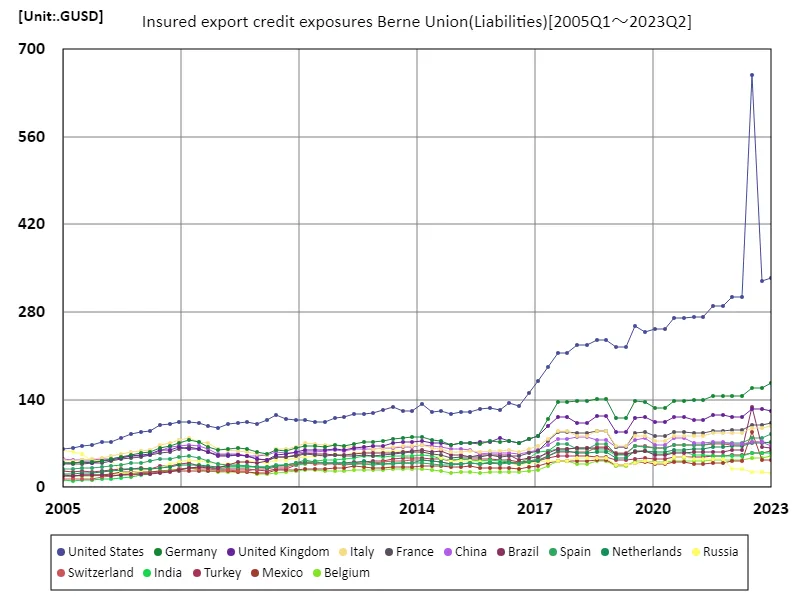

Insured export credit exposures Berne Union (worldwide)

Berne Union’s Insured Export Credit Exposures data from 2005 to 2023 is a key indicator of the state of the American economy. Notably, in 2022, the United States recorded a record high of external debt of $659 billion, but in 2023, that level declined to about 50.9%. This trend can also be seen as a result of people being aware of the risks posed by excessive debt. Liabilities in the United States have increased dramatically in the wake of the 2008 financial crisis and the COVID-19 pandemic. This led governments to take measures to support the economy, which resulted in higher debt levels. However, recent declines indicate signs of economic recovery and moves towards more sound fiscal management. Looking ahead, it will be important to see how U.S. economic policy responds to external shocks. In addition, sustainable economic growth is required amid rising interest rates, inflation, and intensifying competition with other countries. The trend in America’s foreign debt is an important indicator for the global economy and will require continued close monitoring.

The maximum is 659GUSD[2022.75] of United States, and the current value is about 50.9%

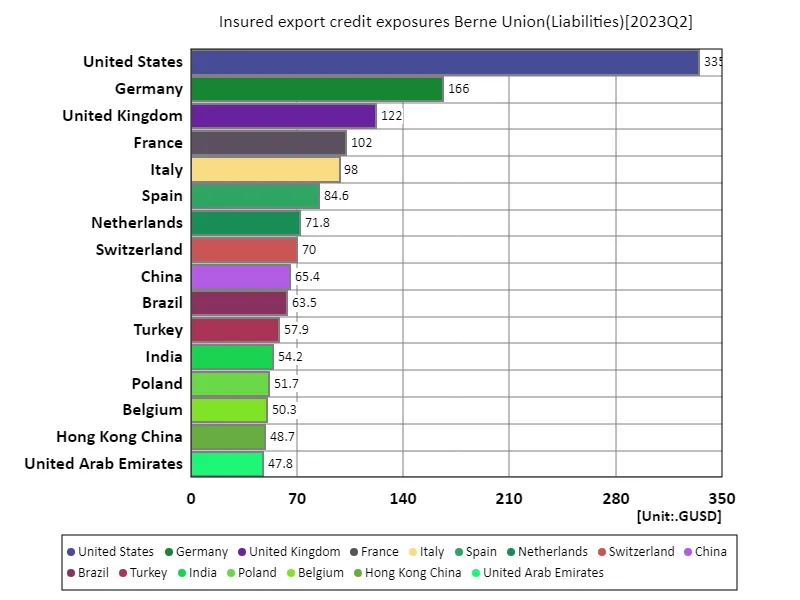

Insured export credit exposures Berne Union (worldwide, latest year)

According to data from the Berne Union’s Insured Export Credit Exposures for 2023, the United States has the largest external debt at $335 billion. The overall total was $2.68 trillion, with an average of $1.15 billion, making it clear that the United States stands out. This trend indicates that the United States is establishing itself as a reliable borrower in the international market. America’s foreign debt has been growing for the past few decades, expanding exponentially especially in the wake of the financial crisis and the pandemic. However, data for 2023 suggests that liabilities are being managed as the global economy recovers. On the other hand, amid increasing competition with other countries and geopolitical risks, the sustainability of America’s liabilities level is being called into question. In particular, rising interest rates and inflation could have an impact, requiring careful consideration in future economic policies. Overall, the U.S. external debt is an important indicator of international economic trends and will require close monitoring.

The maximum is 335GUSD of United States, the average is 11.5GUSD, and the total is 2.68TUSD

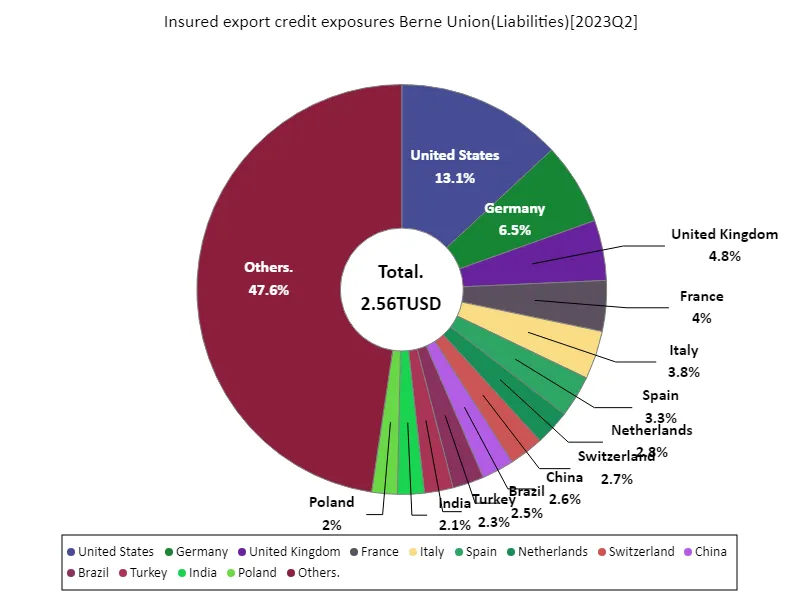

Insured export credit exposures Berne Union (worldwide, latest year)

Berne Union insured export credit exposures 2023 data is a key indicator of trends in liabilities in the international economy. The United States has the largest foreign debt at $335 billion, with the overall total at $2.58 trillion and the average at $1.28 billion. The US’s outstanding figures reflect its influence and credibility in the global economy. Over the past few years, America’s external debt has grown sharply in the wake of the financial crisis and the COVID-19 pandemic, but in recent years there have been signs of progress in debt management as the economy has recovered. Meanwhile, the debt situations of other countries are diversifying, and it is noteworthy that liabilities in emerging markets in particular are increasing. Looking ahead, the level of US liabilities remains a concern, and rising interest rates, inflation and geopolitical risks could have an impact. Amid international capital flows and trade frictions, countries will be required to manage their debts sustainably and will need to reassess their economic policies. Overall, insured export credit exposure remains an important indicator of the health of the global economy and deserves continued attention.

The maximum is 335GUSD of United States, the average is 12.7GUSD, and the total is 2.56TUSD

Comments