Abstract

According to 2023 data, the United States has the largest external debt, with short-term liabilities to the Bank for International Settlements reaching $1.82 trillion. This trend suggests that the United States remains a central player in the global economic system. In the United States, short-term loans are an important tool for companies and governments seeking financing flexibility, helping to secure liquidity and expand investment opportunities. Over the past few years, America’s external debt has been on the rise, particularly due to the low interest rate environment and accommodative monetary policy. Meanwhile, other countries, particularly emerging market and developing countries, are also experiencing rising external debt, indicating economic fragility. These trends have the potential to increase global economic uncertainty and risk, requiring countries to be vigilant in managing their external debt. As such, U.S. short-term external debt is an important indicator for understanding the dynamics of the global economy, and it is important to keep a close eye on future trends.

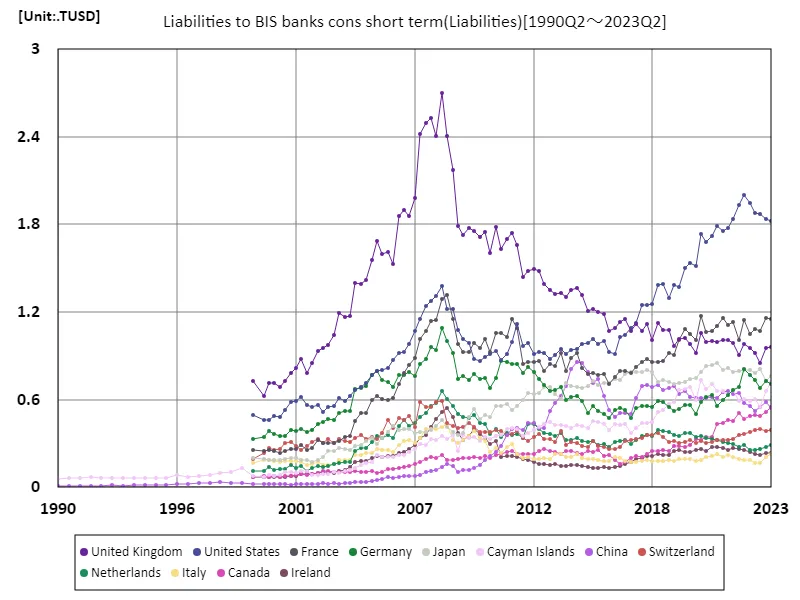

Liabilities to bis banks cons short term

Data from 1990 to 2023 show that short-term liabilities to the Bank for International Settlements show wide variation across countries. In particular, the UK’s record of $2.7 trillion in 2008 was the peak overall and reflected a period affected by the global financial crisis. At this time the British financial system was at the centre of international trade and investment and had high short-term liabilities. However, that level has now fallen to 35.5% of its peak. This decline is likely the result of stronger financial regulation and policies aimed at stabilizing the economy, which have led to an increased emphasis on risk management. Other countries’ short-term liabilities are also fluctuating, with emerging market countries increasing their liabilities rapidly while developed countries are taking a more cautious stance. Overall, short-term liabilities to the Bank for International Settlements are strongly influenced by economic conditions and monetary policy, and are therefore an important indicator for understanding changes in countries’ economic strategies and risk management. It will be necessary to continue to monitor this trend and assess changes in the international economy.

The maximum is 2.7TUSD[2008] of United Kingdom, and the current value is about 35.5%

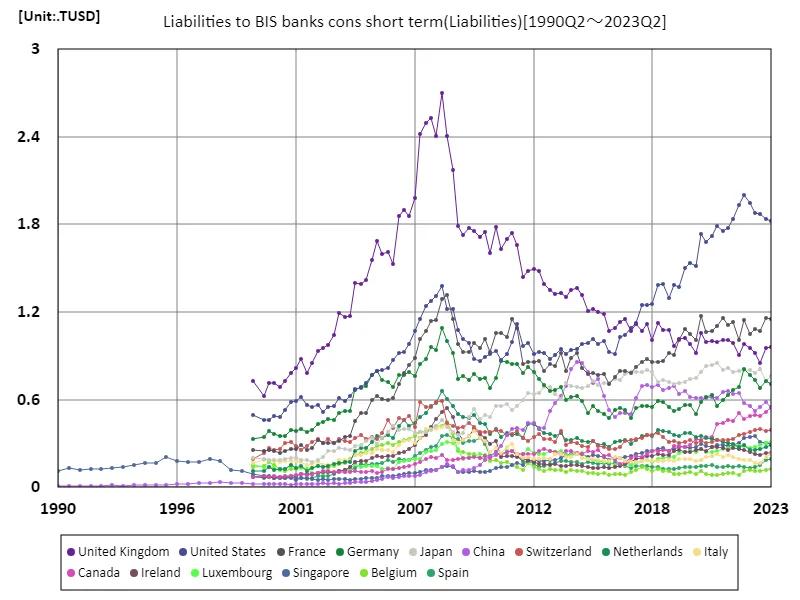

Liabilities to bis banks cons short term (worldwide)

Analyzing data from 1990 to 2023, short-term liabilities to the Bank for International Settlements are an important indicator reflecting changes in the international economy. The UK’s record $2.7 trillion in 2008 was the peak in the wake of the financial crisis and shows the international standing of the country’s financial industry. However, UK liabilities have now fallen to 35.5% of their peak, which can be seen as a result of monetary policy and strengthened regulation. During this period, short-term liabilities in other countries have also shown diverse trends. Particularly in emerging market countries, there has been a notable increase in short-term liabilities for fund raising purposes, which are seen as part of economic growth that entails risks. Meanwhile, developed countries are adopting a more cautious approach in their quest for economic stability. Overall, short-term liabilities to the Bank for International Settlements are an important tool for understanding the dynamics of international finance, as they are strongly influenced by national economic policies and market trends. Going forward, the economic climate will also require tracking this indicator.

The maximum is 2.7TUSD[2008] of United Kingdom, and the current value is about 35.5%

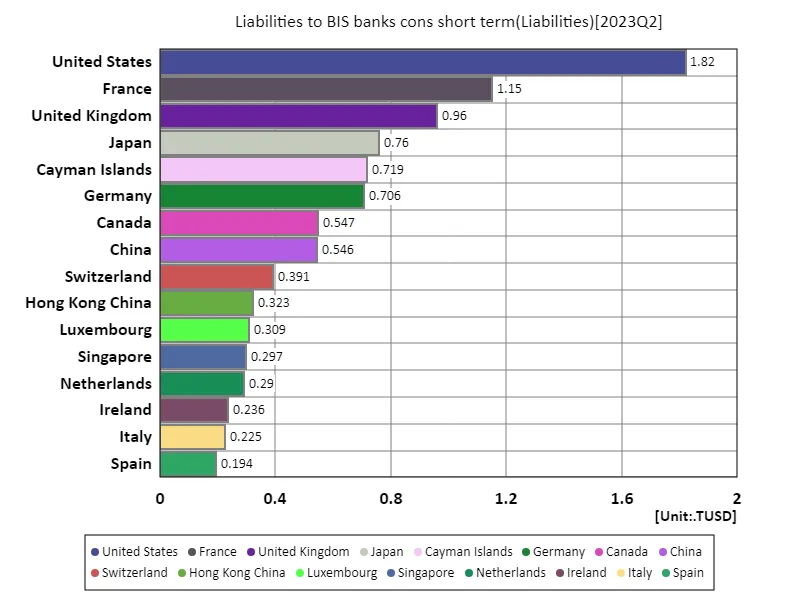

Liabilities to bis banks cons short term (worldwide, latest year)

According to data for 2023, the United States has the largest number of short-term liabilities to the Bank for International Settlements at $1.82 trillion, with the overall total at $12 trillion, and the average at $5.48 billion. U.S. liabilities reflect its still central role in the global financial system and remain an important tool for businesses and governments seeking financing flexibility. Compared to past data, short-term liabilities in the United States are on the rise, reflecting the low interest rate environment and monetary easing policies. Meanwhile, elsewhere, emerging markets are rapidly increasing short-term liabilities while developed countries are taking a more cautious stance. These trends reflect different countries’ approaches to economic policy and market stability. Overall, short-term liabilities to the Bank for International Settlements are an important indicator of the health and risks of the global economy and are a key factor in understanding changes in countries’ economic strategies and monetary policies. It will be necessary to continue to follow this trend and gain deeper insight into fluctuations in the international economy.

The maximum is 1.82TUSD of United States, the average is 54.8GUSD, and the total is 12TUSD

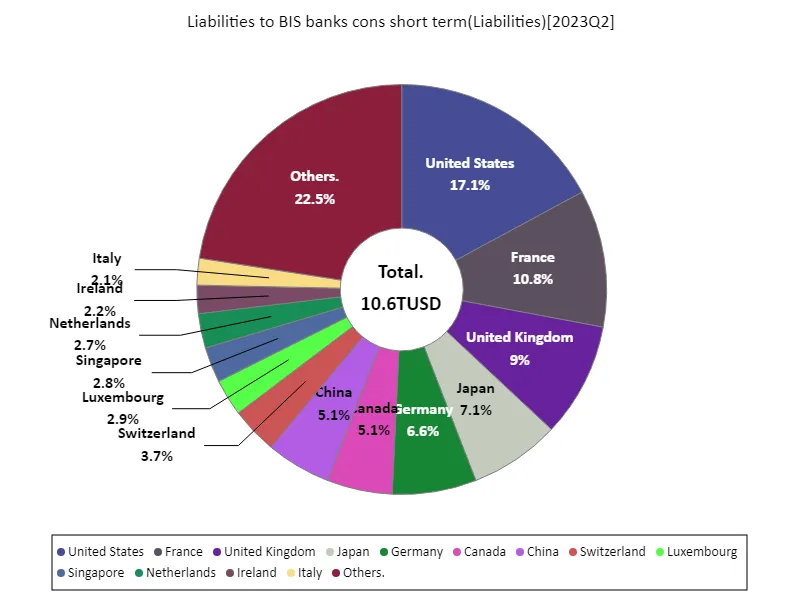

Liabilities to bis banks cons short term (worldwide, latest year)

According to data for 2023, the United States has the largest number of short-term liabilities to the Bank for International Settlements at $1.82 trillion, for a total of $10.6 trillion, and an average of $5.43 billion. This situation shows that the United States is at the center of the global economy and places great importance on short-term funding to ensure liquidity. In the United States, liabilities have increased due to low interest rate policies and monetary easing, and are particularly used by companies and governments as a means to raise funds quickly. Looking elsewhere, we are seeing short-term liabilities increasing, especially in emerging markets. These countries need capital to fuel economic growth and face increasing liabilities at risk. Meanwhile, developed countries are becoming more cautious and are taking steps to preserve their fiscal health. Overall, short-term liability to the Bank for International Settlements are an important indicator of global economic trends and national monetary policies. Looking ahead, it will be necessary to keep a close eye on this trend and understand the changes in international finance.

The maximum is 1.82TUSD of United States, the average is 54.6GUSD, and the total is 10.6TUSD

Comments