Abstract

Data for May 2023 shows the UK has external debt of US$3.32 trillion in international debt securities all maturities, reflecting the trend over the past few years. In particular, amid an unstable global economic environment, many developed countries continue to maintain low interest rate policies, which keeps borrowing costs down. The UK has taken advantage of its position as a financial centre to attract capital from abroad, but at the same time, this has resulted in the accumulation of a huge external debt. Additionally, a large portion of the debt is earmarked for long-term investments and infrastructure projects in pursuit of stable yields. However, due to slowing economic growth and increasing geopolitical risks, risks from rising interest rates and exchange rate fluctuations may increase in the future. Additionally, the impact of the UK’s post-Brexit economic policies on debt should also be closely watched. Overall, the international bond market is a complex mix of factors, and fluctuations in each country’s external debt will have a significant impact on future economic conditions.

International debt securities all maturities

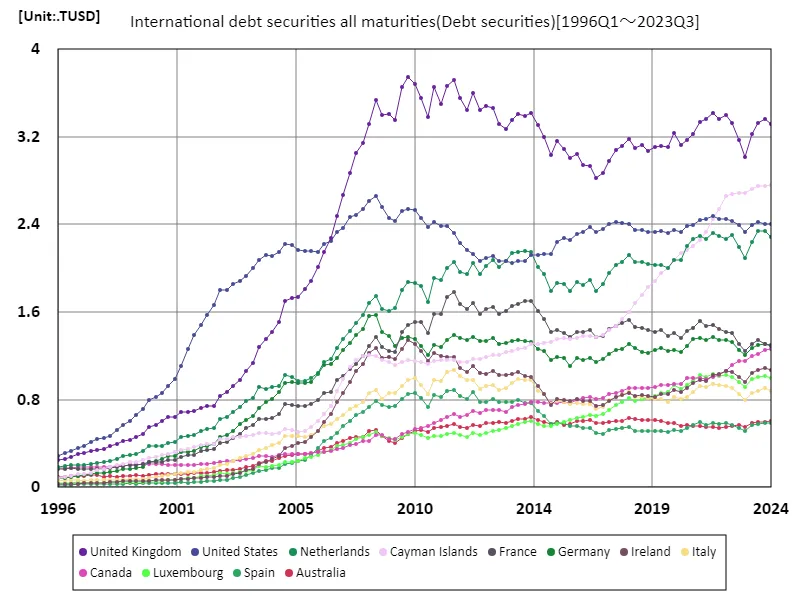

Looking back at data on international debt securities all maturities from 1996 to May 2023, the UK peaked at US$3.74 trillion in May 2009. This period marks a sharp rise in debt as a result of sustained low interest rates and encouraging borrowing against the backdrop of the post-financial crisis recovery. By 2023, it will reach 88.7% of this peak, or about US$3.32 trillion. This trend is influenced by changes in global economic conditions and monetary policies. In particular, rising inflation rates and interest rate hikes have become more pronounced in recent years, raising concerns about rising borrowing costs. Furthermore, the UK’s external debt reflects the confidence of foreign investors, and international capital inflows have contributed to economic growth. However, the investment environment is changing due to post-Brexit uncertainties and geopolitical risks. Overall, the UK’s international bond market reflects past changes in monetary policy and economic conditions, and it will be important to keep a close eye on future interest rate trends and the impact of economic policies on external debt.

The maximum is 3.74TUSD[2009.5] of United Kingdom, and the current value is about 88.7%

International debt securities all maturities (all countries around the world)

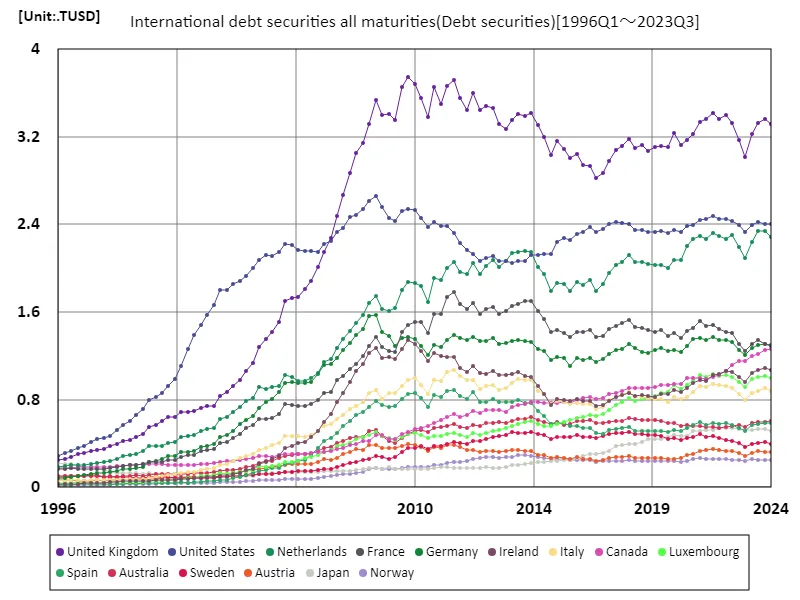

Looking at data on international debt securities all maturities from 1996 to May 2023, the UK reached a peak of US$3.74 trillion in May 2009. The main factor in this period was the continued low interest rate environment resulting from the monetary easing policies following the Lehman Shock, which encouraged borrowing. By 2023, it will be 88.7% of this peak, or about US$3.32 trillion, calling for prudent fiscal policy as debt rises during the economic recovery. The past few years have been characterized by global economic instability and geopolitical risks. In particular, the uncertain economic environment following Brexit has affected investor confidence and led to changes in foreign capital inflows. Additionally, recent years have seen rising inflation and interest rates are rising, raising concerns about debt sustainability. Going forward, a key focus will be how these factors affect the UK’s international bond market, particularly the balance between interest rate policy and economic growth.

The maximum is 3.74TUSD[2009.5] of United Kingdom, and the current value is about 88.7%

International debt securities all maturities (worldwide, latest year)

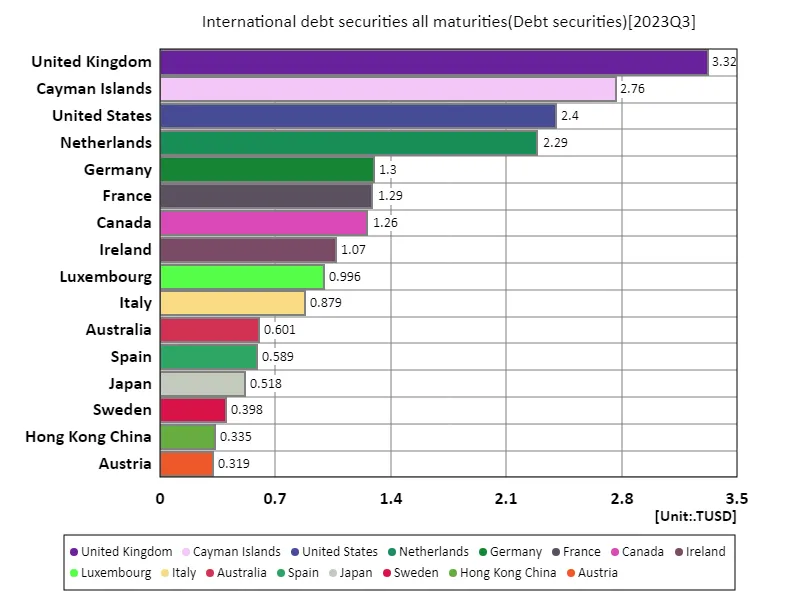

According to data for May 2023, the total market for international debt securities all maturities reached US$25.3 trillion, with the UK recording US$3.32 trillion as the country with the largest debt. The figures demonstrate that the UK continues to maintain its position as a financial centre, encouraging capital inflows from abroad. The average debt amount is US$18.7 billion, reflecting differences in countries’ economic size and creditworthiness. International bond markets have undergone a variety of ups and downs over the past few decades. In particular, the low interest rate environment following the Lehman Shock encouraged corporate and government borrowing, leading to an increase in total debt. Meanwhile, recent increases in inflation and interest rates have raised concerns about debt sustainability. Additionally, geopolitical risks and economic uncertainty are impacting and shifting investor confidence is also on the rise. Future trends in debt markets will depend heavily on interest rate policies and economic growth prospects. In particular, we will need to pay close attention to how each country’s fiscal and economic policies affect its debt. These developments will also affect investor strategies in international capital markets.

The maximum is 3.32TUSD of United Kingdom, the average is 187GUSD, and the total is 25.3TUSD

International debt securities all maturities (worldwide, latest year)

Based on data as of May 2023, the market for international debt securities all maturities totals US$22.1 trillion, of which the UK is the country with the largest debt, recording US$3.32 trillion. The average debt size is US$17.5 billion, reflecting each country’s economic size and credit risk. Historically, international bond markets have changed in response to financial crises and economic fluctuations. In particular, after the Lehman Shock in 2008, many countries adopted low interest rate policies, leading to increased borrowing by companies and governments. This led to a rapid increase in total debt, with the expansion particularly notable in developed countries, including the UK. Recent developments have seen rising inflation and interest rates increase, raising concerns about debt sustainability. In addition, the economic environment is becoming more complex as geopolitical risks and economic uncertainty are affecting investor confidence and causing changes in capital inflows. Future trends in the international bond market will be influenced by interest rate policies and the economic policies of each country. In particular, how countries will pursue growth while maintaining fiscal health will be a key focus for debt markets.

The maximum is 3.32TUSD of United Kingdom, the average is 177GUSD, and the total is 22.1TUSD

Comments