Abstract

As of May 2023, the Cayman Islands leads global external debt in international bonds (non-banks) at 2.67 trillion USD, reflecting its role as a major financial hub. This trend highlights the growing importance of offshore financial centers, where entities issue bonds for global investment. Over the years, such jurisdictions have attracted investments due to tax advantages, regulatory flexibility, and financial secrecy. This increase in debt issuance, however, raises concerns about potential risks tied to market volatility and international regulatory shifts.

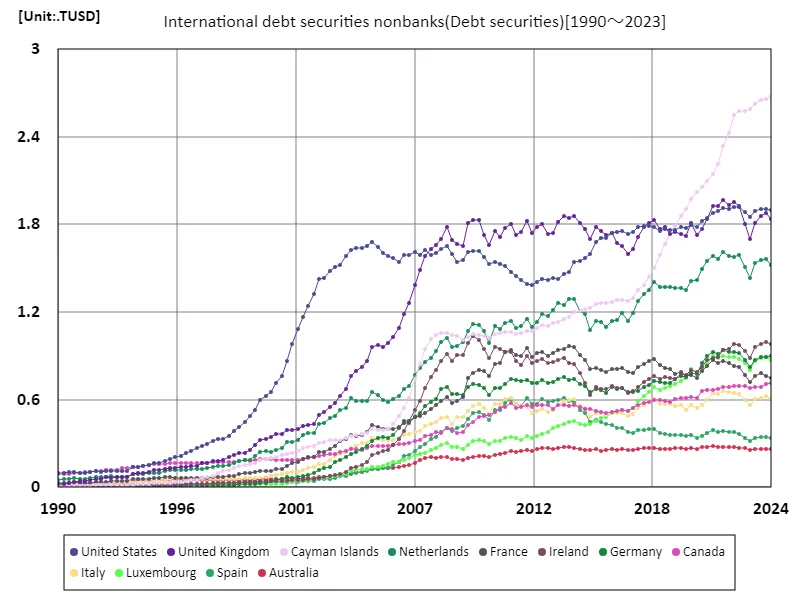

International debt securities nonbanks

As of May 2023, the Cayman Islands’ international debt securities (non-banks) reached a record 2.67 trillion USD, reflecting its key role in global financial markets. Since 1990, the rise in offshore debt issuance, particularly in tax-friendly jurisdictions like the Caymans, has been driven by demand for high-yield, low-regulation investment opportunities. This growth underscores the increasing globalization of finance, with non-bank entities leveraging such securities for capital. However, it also raises concerns about transparency and financial stability in these jurisdictions, especially amid potential regulatory changes.

The maximum is the latest one, 2.67TUSD of Cayman Islands

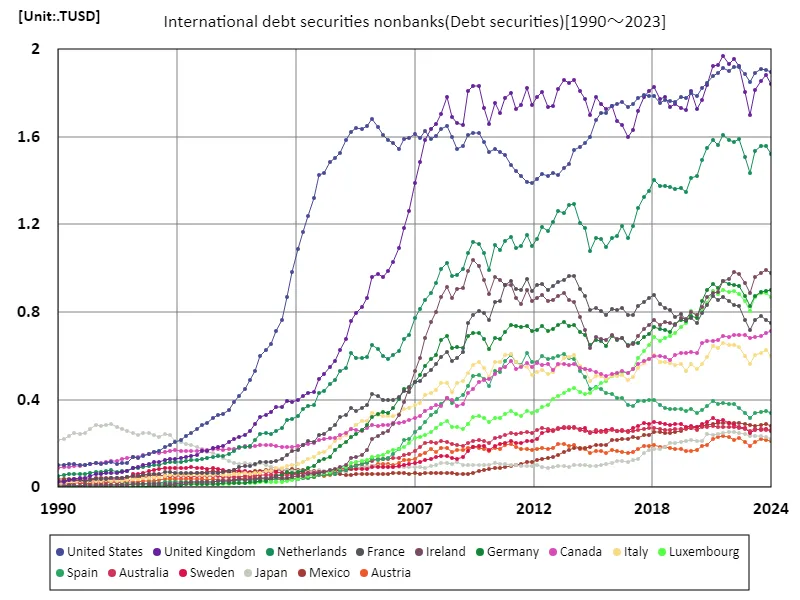

International debt securities nonbanks (worldwide)

As of May 2023, the UK remains a major player in the global market for international bonds (non-banks), with its peak reaching 1.97 trillion USD in 2021. The UK’s prominence in bond issuance reflects its strong financial infrastructure and global investment reach. Since 1990, the trend has been shaped by growing demand for UK-denominated bonds, driven by its stable economy and deep financial markets. Despite a slight decline from its 2021 peak, the UK’s market remains robust, though future trends may be influenced by factors such as post-Brexit dynamics and changing investor sentiment.

The maximum is 1.97TUSD[2021.25] of United Kingdom, and the current value is about 93.5%

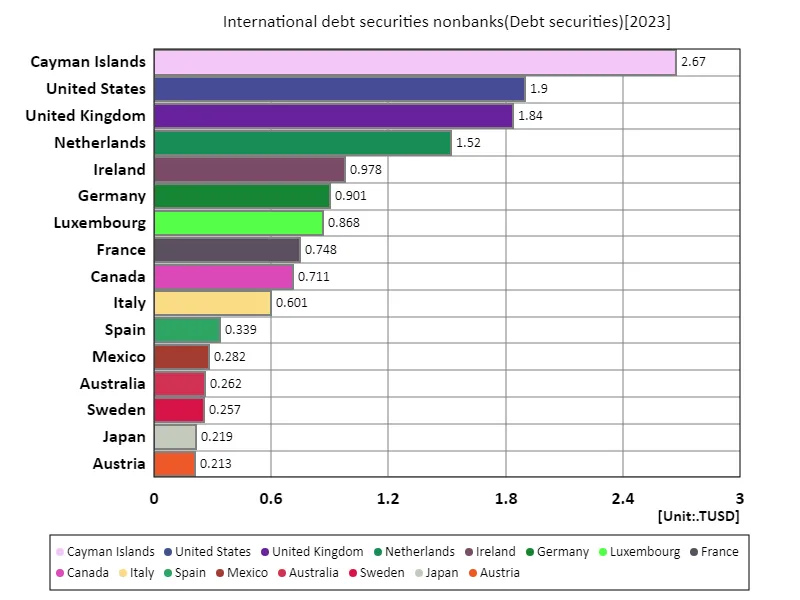

International debt securities nonbanks (worldwide, latest year)

As of May 2023, the global market for international bonds (non-banks) reached a total of 17.9 trillion USD, with the Cayman Islands leading at 2.67 trillion USD. The average bond issuance across countries stood at 116 billion USD, reflecting the global demand for non-bank debt securities. Offshore financial centers, particularly the Caymans, continue to dominate, attracting investors due to favorable tax policies and regulatory environments. This trend highlights the increasing globalization of finance, with significant growth in bond issuance as investors seek diverse opportunities in a low-interest-rate world.

The maximum is 2.67TUSD of Cayman Islands, the average is 116GUSD, and the total is 17.9TUSD

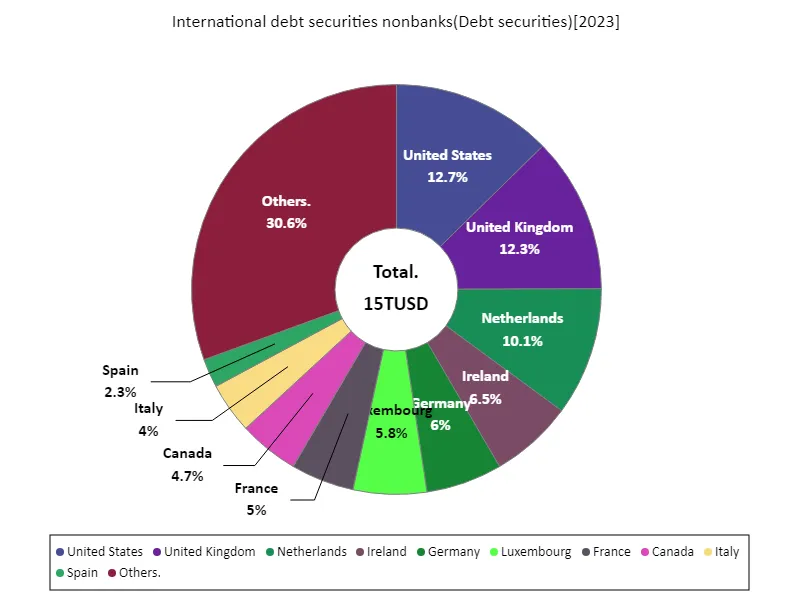

International debt securities nonbanks (worldwide, latest year)

As of May 2023, the United States leads the global market for international bonds (non-banks) with 1.9 trillion USD, representing a significant share of the total 15 trillion USD market. The average bond issuance stands at 103 billion USD, reflecting strong demand for U.S.-denominated debt. This trend underscores the U.S.’s dominant role in global finance, with its deep, liquid markets and stable economic environment attracting both domestic and international investors. Despite fluctuations, the U.S. bond market remains a key driver of global debt securities, shaped by shifting interest rates and evolving investor sentiment.

The maximum is 1.9TUSD of United States, the average is 104GUSD, and the total is 15TUSD

Comments