Abstract

As of May 2023, the UK holds the largest amount of short-term international bonds (securities) at 541 GUSD, reflecting its significant role in global finance. Historically, the UK has been a major issuer of these bonds, benefiting from its status as a financial hub. The growth in short-term securities issuance is driven by the need for liquidity and funding flexibility. Other countries, particularly the US and Japan, also show notable participation, though the UK’s dominance highlights its financial infrastructure and the demand for safe, liquid assets in international markets.

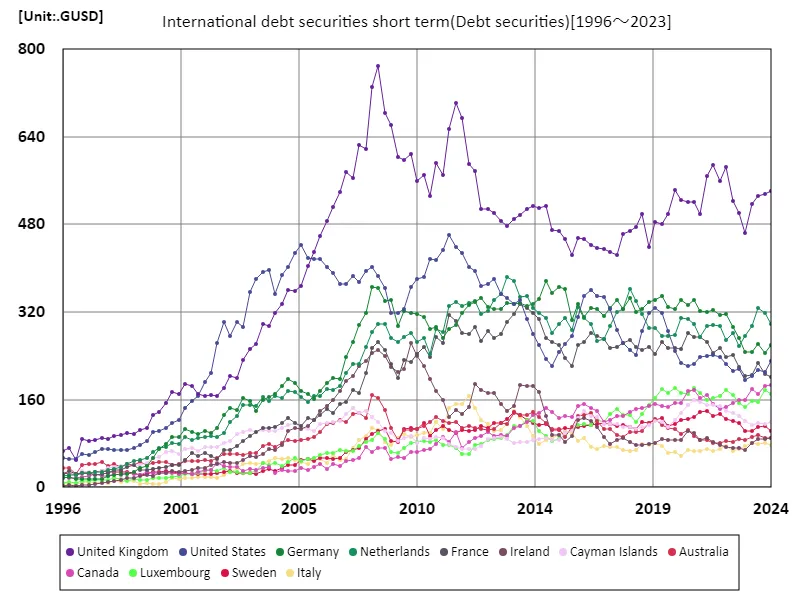

International debt securities short term

Since 1996, international short-term debt securities have seen significant fluctuations, with the UK reaching a peak of 770 GUSD in 2008. This high was driven by the global financial crisis, where demand for short-term liquidity surged. As of May 2023, the UK’s holdings are at 70.2% of this peak, reflecting a decline in reliance on short-term bills due to improved economic conditions and regulatory changes. Despite this decrease, the UK remains a key player in global debt markets, maintaining a significant share in international debt securities, though other economies have also grown their issuance in response to changing financial dynamics.

The maximum is 770GUSD[2008.25] of United Kingdom, and the current value is about 70.2%

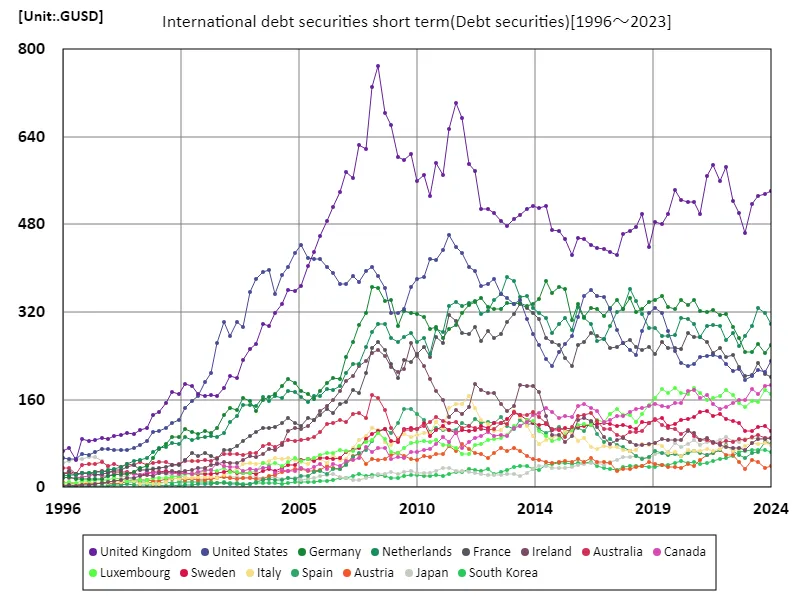

International debt securities short term (worldwide)

International short-term bonds saw a peak of 770 GUSD in the UK during 2008, driven by the global financial crisis and the need for liquidity. Since then, the UK’s issuance has declined, reaching 70.2% of its peak level by May 2023. This decrease reflects global changes in financial markets, where regulatory shifts and a stronger economy reduced reliance on short-term debt. Despite this, the UK remains a dominant player, continuing to be a major issuer of short-term securities. Other countries have also increased their presence in global debt markets, contributing to evolving trends in international bond issuance.

The maximum is 770GUSD[2008.25] of United Kingdom, and the current value is about 70.2%

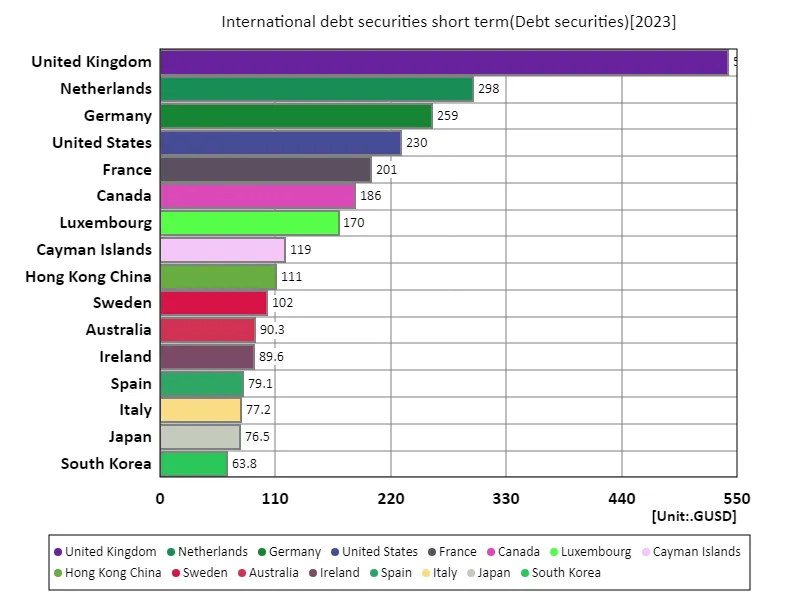

International debt securities short term (worldwide, latest year)

As of May 2023, the UK leads international short-term bonds issuance at 541 GUSD, significantly above the global average of 24 GUSD. The total global issuance stands at 3.25 trillion USD, reflecting the widespread use of short-term debt securities in global finance. The UK’s dominant position highlights its central role in global liquidity management and financial markets. Over time, the issuance of short-term bonds has grown, driven by the need for immediate financing and the shifting dynamics of global trade and investment. The UK’s share, though large, is part of a broader trend of diverse issuances across multiple economies.

The maximum is 541GUSD of United Kingdom, the average is 24GUSD, and the total is 3.25TUSD

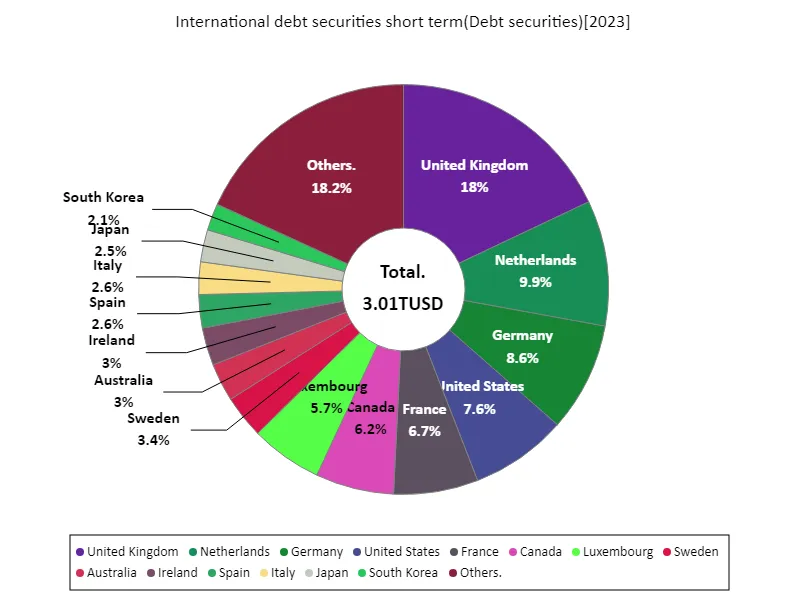

International debt securities short term (worldwide, latest year)

As of May 2023, the UK holds the largest share of international short-term debt securities, with 541 GUSD, significantly above the global average of 23.9 GUSD. The total global issuance stands at 3.01 trillion USD, reflecting the crucial role of short-term bills in international finance. The UK’s dominance highlights its central position in global liquidity management. While the UK remains a major issuer, the overall market has diversified, with other economies contributing to the growth of short-term debt issuance, driven by the demand for flexible, low-risk investment options in an evolving global economy.

The maximum is 541GUSD of United Kingdom, the average is 24.1GUSD, and the total is 3.01TUSD

Main data

| International debt securities short term(Debt securities) [GUSD] | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| United Kingdom | Netherlands | Germany | United States | France | Canada | Luxembourg | Cayman Islands | Hong Kong China | Sweden | |

| 2023.5 | 540.73 | 298.13 | 259.2 | 229.91 | 200.64 | 186.01 | 170.2 | 119.2 | 110.93 | 101.97 |

| 2023.25 | 536.26 | 318.84 | 244.34 | 210.39 | 207.67 | 184.13 | 177.24 | 116.08 | 109.52 | 112.41 |

| 2023.0 | 532.2 | 327.02 | 260.98 | 213.4 | 227.83 | 169.44 | 156.1 | 117.02 | 112.45 | 109.91 |

| 2022.75 | 516.55 | 294.04 | 247.92 | 202.86 | 205.09 | 180.27 | 157.77 | 114.25 | 114.38 | 102.19 |

| 2022.5 | 463.54 | 276.32 | 247.22 | 195 | 203.66 | 159.8 | 146.77 | 120.14 | 111.64 | 102.8 |

| 2022.25 | 500.86 | 258.71 | 272.71 | 216.22 | 219.99 | 158.51 | 154.11 | 129.66 | 127.38 | 116.7 |

| 2022.0 | 522.98 | 281.52 | 292.63 | 213.06 | 241.17 | 153.95 | 168.87 | 135.65 | 130.02 | 121.76 |

| 2021.75 | 584.16 | 268.1 | 315.54 | 225.92 | 237.06 | 146.04 | 177.2 | 139.99 | 134 | 125.09 |

| 2021.5 | 558.46 | 294.22 | 314.47 | 238.29 | 255.11 | 142.68 | 165.78 | 148.69 | 132.21 | 134.45 |

| 2021.25 | 588.23 | 295.84 | 323.65 | 241.85 | 244.8 | 151.9 | 162.69 | 149.46 | 124.88 | 130.93 |

| 2021.0 | 568.61 | 295.07 | 319.75 | 240.55 | 264.88 | 169.03 | 159.8 | 149.76 | 130.25 | 139.75 |

| 2020.75 | 498.04 | 273.81 | 321.11 | 237.74 | 274.5 | 162.74 | 171.68 | 155.94 | 131.2 | 138.03 |

| 2020.5 | 521.12 | 298.5 | 342.69 | 225.53 | 274.44 | 177.23 | 180.99 | 159.37 | 132.73 | 127.7 |

| 2020.25 | 521.45 | 306.67 | 332.05 | 220.73 | 282.4 | 175.44 | 170.69 | 150.09 | 120.35 | 124.24 |

| 2020.0 | 524.13 | 309.18 | 341.2 | 227.23 | 252.36 | 153.32 | 172.82 | 135.89 | 120.36 | 122.54 |

| 2019.75 | 542.7 | 277.5 | 325.7 | 248.56 | 254.31 | 154.81 | 180.87 | 122.44 | 122.59 | 115.22 |

| 2019.5 | 498.7 | 276.26 | 328.27 | 285.75 | 254.14 | 146.94 | 171.37 | 109.88 | 112.67 | 112.44 |

| 2019.25 | 481.19 | 276.18 | 348.57 | 318.36 | 264.41 | 147.91 | 178.91 | 118.98 | 122.31 | 127.02 |

| 2019.0 | 485.02 | 290.92 | 342.45 | 326.47 | 243.52 | 152.7 | 162.35 | 120.71 | 108.9 | 123.33 |

| 2018.75 | 438.68 | 291.64 | 338.87 | 318 | 256.88 | 149.03 | 149.54 | 113.7 | 102.95 | 117.49 |

| 2018.5 | 499.5 | 317.15 | 325.72 | 285.29 | 250.74 | 144.2 | 133.9 | 110.43 | 102.95 | 119.34 |

| 2018.25 | 476.1 | 339.36 | 320.01 | 241.5 | 256.76 | 143.54 | 118.71 | 106.77 | 94.95 | 106.19 |

| 2018.0 | 467.6 | 362.35 | 346.05 | 250.29 | 268.32 | 137.19 | 132.87 | 109.98 | 94.25 | 109.68 |

| 2017.75 | 463.14 | 325.13 | 325.22 | 263.86 | 263.42 | 131.07 | 132.75 | 110.84 | 96.37 | 113.59 |

| 2017.5 | 424.2 | 320.22 | 342.33 | 286.83 | 256.75 | 129.5 | 143.31 | 116.2 | 86.81 | 112.1 |

| 2017.25 | 430.07 | 294.08 | 327.99 | 325.76 | 255.22 | 122.07 | 134.17 | 116.1 | 84.25 | 116.21 |

| 2017.0 | 435.55 | 270.21 | 312.36 | 346.97 | 270.77 | 118.46 | 118.38 | 115.61 | 76.49 | 117.39 |

| 2016.75 | 436.47 | 266.38 | 326.08 | 349.86 | 276.4 | 139.98 | 123.66 | 128.49 | 70.72 | 115.84 |

| 2016.5 | 441.85 | 297.63 | 327.21 | 360.74 | 281.37 | 145.01 | 113.74 | 131.06 | 68.8 | 113.32 |

| 2016.25 | 453.94 | 309.89 | 311.35 | 349.8 | 266.03 | 152.34 | 114.93 | 138.44 | 60.86 | 111.05 |

| 2016.0 | 454.93 | 328.99 | 333.82 | 311.59 | 260.45 | 148.52 | 113.97 | 125.62 | 64.47 | 110.75 |

| 2015.75 | 424.28 | 287.69 | 304.95 | 277.05 | 221.06 | 128.87 | 103.86 | 102.74 | 69.17 | 107.06 |

| 2015.5 | 453.31 | 308.33 | 361.41 | 262.38 | 236.49 | 130.3 | 95.59 | 98.89 | 55.84 | 108.99 |

| 2015.25 | 467.25 | 298.96 | 365.54 | 247.79 | 259.87 | 126.23 | 87.42 | 86.79 | 65.01 | 104.36 |

| 2015.0 | 469.88 | 281.71 | 353.91 | 221.16 | 265.67 | 136.82 | 85.37 | 86.02 | 67.28 | 103.93 |

| 2014.75 | 513.88 | 309.04 | 377.38 | 234.54 | 273.19 | 144.5 | 93.38 | 89.74 | 62.94 | 115.93 |

| 2014.5 | 510.42 | 317.67 | 344.38 | 259.02 | 307.61 | 136.32 | 102.26 | 88.61 | 64.3 | 114.51 |

| 2014.25 | 514.27 | 327.7 | 333.83 | 280.72 | 318.57 | 131.82 | 120.86 | 85.68 | 63.39 | 117.16 |

| 2014.0 | 508.82 | 348.34 | 331.84 | 306.77 | 326.43 | 119.27 | 122.64 | 82.09 | 58.54 | 122.38 |

| 2013.75 | 497.47 | 346.52 | 337.19 | 342.72 | 334.26 | 112.29 | 112.74 | 82.29 | 52.48 | 131.54 |

| 2013.5 | 489.95 | 377.47 | 334.09 | 335.18 | 316.35 | 107.77 | 111.15 | 80.18 | 47.69 | 136.71 |

| 2013.25 | 477.31 | 384.52 | 336.07 | 346.35 | 301.4 | 93.96 | 95.68 | 87.89 | 42.94 | 125.43 |

| 2013.0 | 486.94 | 352.62 | 325.08 | 353.59 | 278.98 | 95.42 | 89.53 | 90.99 | 34.49 | 118.04 |

| 2012.75 | 500.74 | 342.25 | 324.89 | 381.12 | 272.89 | 93.07 | 88.61 | 89.74 | 29.84 | 117.18 |

| 2012.5 | 507.97 | 321.29 | 328.34 | 370.81 | 285.33 | 101.57 | 86.5 | 87.88 | 28.32 | 107.87 |

| 2012.25 | 507.18 | 315.95 | 345.01 | 367.49 | 267.44 | 92.74 | 79.69 | 75.9 | 25.44 | 112.37 |

| 2012.0 | 576.85 | 340.56 | 338.86 | 395.23 | 293.38 | 89.12 | 76.56 | 70.47 | 23.69 | 104.78 |

| 2011.75 | 589.4 | 336.54 | 333.27 | 402.25 | 279.36 | 82.21 | 60.25 | 70.62 | 18.5 | 102.82 |

| 2011.5 | 674.23 | 331.76 | 318.23 | 427.22 | 281.41 | 72.2 | 60.07 | 69.56 | 17.6 | 104.31 |

| 2011.25 | 701.49 | 337.7 | 295.81 | 438.38 | 303.82 | 100.07 | 71.87 | 73.15 | 16.6 | 99.77 |

| 2011.0 | 653.25 | 331.04 | 288.93 | 461.27 | 314.98 | 83.53 | 76.66 | 78.77 | 12.26 | 104.69 |

| 2010.75 | 570.81 | 283.96 | 272.65 | 434.07 | 263.74 | 91.96 | 77.25 | 90.79 | 12.68 | 111.3 |

| 2010.5 | 592.33 | 289.39 | 292.42 | 415.38 | 275 | 79.96 | 87.14 | 92.19 | 12.02 | 104.21 |

| 2010.25 | 531.06 | 242.67 | 288.31 | 416.23 | 238.09 | 70.68 | 82.18 | 88.67 | 9.23 | 93.74 |

| 2010.0 | 571.04 | 271.78 | 310.77 | 384.51 | 255.38 | 68.28 | 84.02 | 89.17 | 10.55 | 117.41 |

| 2009.75 | 558.54 | 265.66 | 315.9 | 380.49 | 243.13 | 64.37 | 81.88 | 81.07 | 7.63 | 105.74 |

| 2009.5 | 608.83 | 280.89 | 317.68 | 365.94 | 229.02 | 64.66 | 80.59 | 92.81 | 7.24 | 107.44 |

| 2009.25 | 598.21 | 274.68 | 321.55 | 326.08 | 232.41 | 53.69 | 71.42 | 89.71 | 9.22 | 106.25 |

| 2009.0 | 603.06 | 264.91 | 295.19 | 318.44 | 199.49 | 55.2 | 63.17 | 83.88 | 9.58 | 83.32 |

| 2008.75 | 661.18 | 273.05 | 341.39 | 318.65 | 225.26 | 51.29 | 65.12 | 99.55 | 11.2 | 85.33 |

| 2008.5 | 683.38 | 297.37 | 339.77 | 363.38 | 251.33 | 71.45 | 88.16 | 103.22 | 9.2 | 106.87 |

| 2008.25 | 770.01 | 297.75 | 364.2 | 385.81 | 266.05 | 70.98 | 98.4 | 119.76 | 8.33 | 102.98 |

| 2008.0 | 730.41 | 283.77 | 365.23 | 402.15 | 254.19 | 65.32 | 86.85 | 127.99 | 7.57 | 96.88 |

| 2007.75 | 617.09 | 255.81 | 317.37 | 394.31 | 207.97 | 73.55 | 81.88 | 139.64 | 5.91 | 88.85 |

| 2007.5 | 624.62 | 224.28 | 297.04 | 375.12 | 171.59 | 53.04 | 75.74 | 135.07 | 5.65 | 71.01 |

| 2007.25 | 563.82 | 224.54 | 265.64 | 386.06 | 177.58 | 50.53 | 67.1 | 145.31 | 5.94 | 68.03 |

| 2007.0 | 575.21 | 208.86 | 237.65 | 370.36 | 155.29 | 47.27 | 66.28 | 134.35 | 8.46 | 64.08 |

| 2006.75 | 538.93 | 185.78 | 198.59 | 370.88 | 151.26 | 38.51 | 67.55 | 121.07 | 9.87 | 54.06 |

| 2006.5 | 510.9 | 178.12 | 198.75 | 392.05 | 134.96 | 42.69 | 62.78 | 119.55 | 9.46 | 52.18 |

| 2006.25 | 486.26 | 179.67 | 189.94 | 401.83 | 142.6 | 33.94 | 62.88 | 117.47 | 9.81 | 53.15 |

| 2006.0 | 457.97 | 166.15 | 175.78 | 417.33 | 132.64 | 41.69 | 59.04 | 114.87 | 7.38 | 52.82 |

| 2005.75 | 430.08 | 166.63 | 162.01 | 416.79 | 122.57 | 36.3 | 53.16 | 102.65 | 6.25 | 48.89 |

| 2005.5 | 404.07 | 154.9 | 170.05 | 419.38 | 126.26 | 31.4 | 51.2 | 106.4 | 8.97 | 52.06 |

| 2005.25 | 367.36 | 165.73 | 175.74 | 442.17 | 112.67 | 35.98 | 48.82 | 107.66 | 8.35 | 50.68 |

| 2005.0 | 357.66 | 174.63 | 189.9 | 427.44 | 118.18 | 30.55 | 53.18 | 116.88 | 9.38 | 40.14 |

| 2004.75 | 360.38 | 175.65 | 197.73 | 402.83 | 126.29 | 29.11 | 45.7 | 113.6 | 8.56 | 40.05 |

| 2004.5 | 333.87 | 163.64 | 184.52 | 387.26 | 117.35 | 31.93 | 39.12 | 108.88 | 7.17 | 35.67 |

| 2004.25 | 319.07 | 166.12 | 170.18 | 353.52 | 109.86 | 26.07 | 43.98 | 103.14 | 8.18 | 30.33 |

| 2004.0 | 294.1 | 156.71 | 163.96 | 396.68 | 107.65 | 36.5 | 40.28 | 103.51 | 6.39 | 32.65 |

| 2003.75 | 298.25 | 165.74 | 159.52 | 392.79 | 107.76 | 34.68 | 44.76 | 104.68 | 7.6 | 30 |

| 2003.5 | 262.21 | 148.99 | 138.44 | 380.07 | 100.76 | 30.88 | 29.96 | 101.47 | 7.84 | 25.03 |

| 2003.25 | 252.16 | 149.89 | 156.72 | 355.82 | 93.17 | 33.58 | 25.23 | 105.33 | 7.62 | 26.38 |

| 2003.0 | 232.86 | 151.05 | 162.15 | 293.51 | 83.97 | 29.41 | 26.44 | 100.79 | 8.86 | 26.85 |

| 2002.75 | 200.35 | 129.71 | 140.41 | 301.06 | 74.66 | 37.07 | 27.91 | 97.97 | 7.71 | 26.06 |

| 2002.5 | 202.82 | 118.33 | 145.42 | 276.77 | 68.8 | 37.3 | 28.23 | 85.19 | 7.72 | 29.72 |

| 2002.25 | 181.47 | 98.74 | 131.62 | 301.32 | 68.83 | 38.3 | 35.87 | 80.7 | 7.19 | 27.91 |

| 2002.0 | 166.16 | 91.79 | 107.79 | 264.31 | 51.82 | 44.91 | 30.43 | 74.43 | 7.98 | 25.5 |

| 2001.75 | 168.3 | 94.06 | 99.66 | 208.24 | 56.95 | 31.24 | 31.07 | 73.41 | 7 | 24.44 |

| 2001.5 | 167.16 | 91.58 | 102.11 | 192.91 | 63.33 | 31.37 | 29.82 | 73.69 | 8.66 | 23.96 |

| 2001.25 | 171.22 | 89.36 | 98.21 | 166.82 | 56.37 | 27.72 | 25.76 | 66.67 | 9.6 | 24.13 |

| 2001.0 | 185.61 | 85.67 | 101.85 | 157.97 | 61.88 | 24.36 | 23.74 | 72.58 | 7.91 | 24.96 |

| 2000.75 | 187.91 | 91 | 106.54 | 144.74 | 49.37 | 26.18 | 23.41 | 69.46 | 8.02 | 26.91 |

| 2000.5 | 170.83 | 79.78 | 92.43 | 123.38 | 39.91 | 24.75 | 20.1 | 61.65 | 6.16 | 26.78 |

| 2000.25 | 174.24 | 81.27 | 91.48 | 117.54 | 40.15 | 26.84 | 19.65 | 65.55 | 5 | 28.43 |

| 2000.0 | 153.04 | 73.8 | 79.96 | 108.39 | 37.82 | 26.08 | 16.61 | 63.74 | 6.21 | 29.02 |

| 1999.75 | 137.05 | 71.19 | 70.02 | 102.92 | 34.59 | 26.46 | 17.79 | 54.77 | 8.16 | 27.54 |

| 1999.5 | 132.76 | 63.87 | 54.27 | 100.43 | 34.01 | 26.19 | 17.19 | 53.35 | 8.56 | 28.23 |

| 1999.25 | 107.77 | 54.37 | 38.23 | 85.28 | 32.48 | 28.79 | 14.24 | 44.8 | 6.71 | 23.58 |

| 1999.0 | 104.23 | 50.73 | 35.05 | 76.64 | 31.61 | 22.53 | 13.15 | 40.16 | 8.28 | 23.07 |

| 1998.75 | 97.55 | 48.32 | 27.91 | 71.6 | 40.52 | 24.44 | 14.73 | 39.95 | 5.8 | 25.82 |

| 1998.5 | 99.92 | 43.28 | 23.84 | 68.31 | 37.3 | 26.13 | 12.36 | 39.73 | 5.09 | 28.04 |

| 1998.25 | 95.04 | 36.71 | 23.47 | 68.44 | 32.05 | 22.9 | 15.7 | 38.89 | 4.52 | 28.4 |

| 1998.0 | 94.32 | 33.22 | 22.2 | 67.32 | 32.2 | 24.54 | 16.3 | 36.92 | 4.23 | 27.68 |

| 1997.75 | 89.09 | 31.31 | 20.14 | 69.4 | 25.4 | 21.48 | 13.75 | 35.78 | 4.34 | 27.23 |

| 1997.5 | 90.7 | 28.35 | 15.75 | 69.65 | 24.21 | 21.14 | 13.59 | 29.92 | 4.31 | 29.07 |

| 1997.25 | 86.02 | 28.06 | 15.57 | 64.07 | 23.04 | 23.49 | 13.17 | 26.95 | 4.45 | 27.89 |

| 1997.0 | 84.24 | 26.23 | 14.59 | 58.89 | 25.58 | 21.37 | 12.17 | 28.62 | 3.54 | 25.1 |

| 1996.75 | 88.49 | 26.02 | 15.99 | 61.15 | 26.89 | 19.33 | 12.22 | 29.57 | 2.7 | 26.17 |

| 1996.5 | 49.03 | 22.85 | 15.44 | 51.38 | 23.57 | 16.1 | 7.5 | 23.33 | 1.48 | 22.08 |

| 1996.25 | 71.87 | 22.79 | 17.96 | 52.2 | 28.98 | 16.19 | 10.09 | 28.65 | 1.37 | 26.58 |

| 1996.0 | 66.43 | 21.53 | 17.81 | 53.83 | 23.84 | 18.18 | 8.64 | 26.39 | 1.72 | 25.1 |

Comments