Abstract

Terms of trade (%) is an important indicator of price competitiveness and market efficiency in trade between countries and regions. Data from April 2024 showed Taiwan recording a high figure of 95.4%, suggesting that Taiwan’s manufacturing and export-led economic structure remain competitive in the international market. In particular, against the backdrop of the development of the semiconductor industry, it plays an important role in the global supply chain. Over the past few years, the overall Asian region has shown improving trading conditions, with China and South Korea also maintaining high figures. In contrast, in some developed countries, slowing economic growth and inflationary pressures are impacting trade conditions. In particular, Japan is under pressure to strengthen its competitiveness as trading conditions have become unstable due to deflation and the weak yen. In the future, trading conditions are likely to change due to international trade and geopolitical trends, and countries will need to consider policies that respond to market changes. In countries like Taiwan, increasing innovation and competitiveness is essential to maintaining high trade terms.

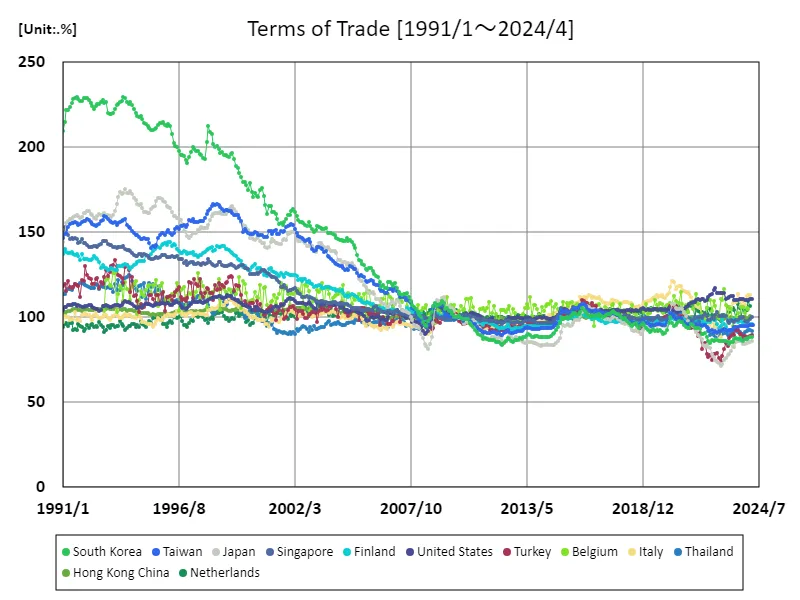

Trading terms(%)

Looking back at the data on trade terms (%) from January 1991 to April 2024, South Korea stands out with an astounding figure of 229% in December 1993. This peak reflected South Korea’s rapid economic growth and expanding exports, particularly due to improved competitiveness in the semiconductor and electronics sectors. However, current trading terms are down 38.5% from their peak. This decline is due to changes in the global economy, particularly the rise of other countries, trade tensions, and structural problems at home. Since the 1990s, Asia has experienced economic growth and many countries have improved their trading conditions. However, in recent years, concerns about the US-China trade war and the impact of COVID-19 have brought uncertainty to economic indicators in each country. In particular, South Korea is facing increasing competition and is being forced to reassess its economic structure, which is dependent on manufacturing. In addition, since trading conditions are strongly influenced by the balance of international demand and supply, it is necessary to closely monitor future trends. South Korea is currently exploring strategies to utilize its advanced technological capabilities to regain competitiveness in new markets.

The maximum is 229%[1993年12月] of South Korea, and the current value is about 38.5%

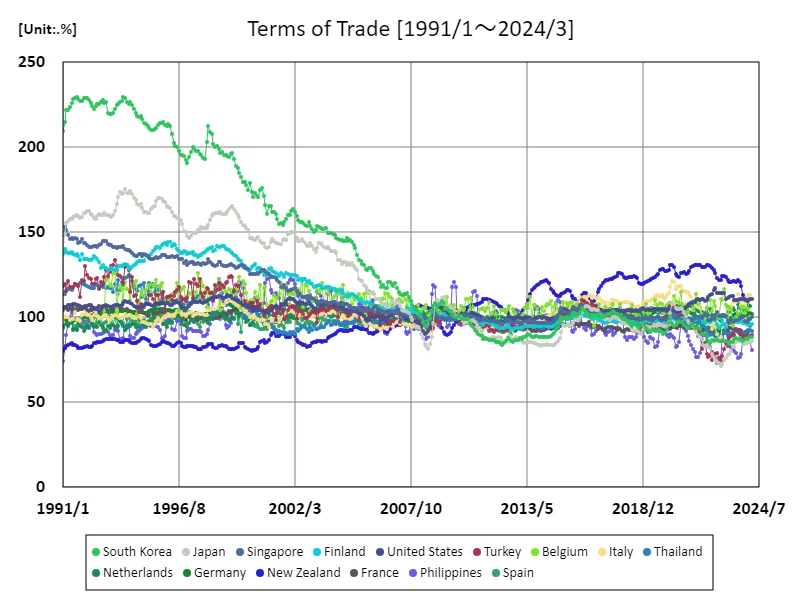

Trading terms (%) (Worldwide)

Analyzing data on trade terms (%) from January 1991 to March 2024, it stands out that South Korea recorded a high level of 229% in December 1993. This peak was the result of South Korea’s rapid growth and export-led economy, particularly due to its competitiveness in the fields of electronics and semiconductors. However, current terms are at 38.5%, a significant drop from previous peaks. This decline is due to intensifying international competition, external factors, and changes in the domestic economic structure. Since the 1990s, South Korea has played a part in the economic growth of Asian countries. However, in recent years, the rise of China and other emerging countries has put pressure on South Korea’s competitiveness. In addition, the US-China trade friction and the COVID-19 pandemic have increased uncertainty in the global economy and made trading conditions more volatile. Going forward, South Korea will need to explore strategies to improve trading conditions through technological innovation and expansion into emerging markets. Economic diversification and a shift to high value-added industries will be key to achieving sustainable growth.

The maximum is 229%[1993年12月] of South Korea, and the current value is about 38.5%

Comments