Abstract

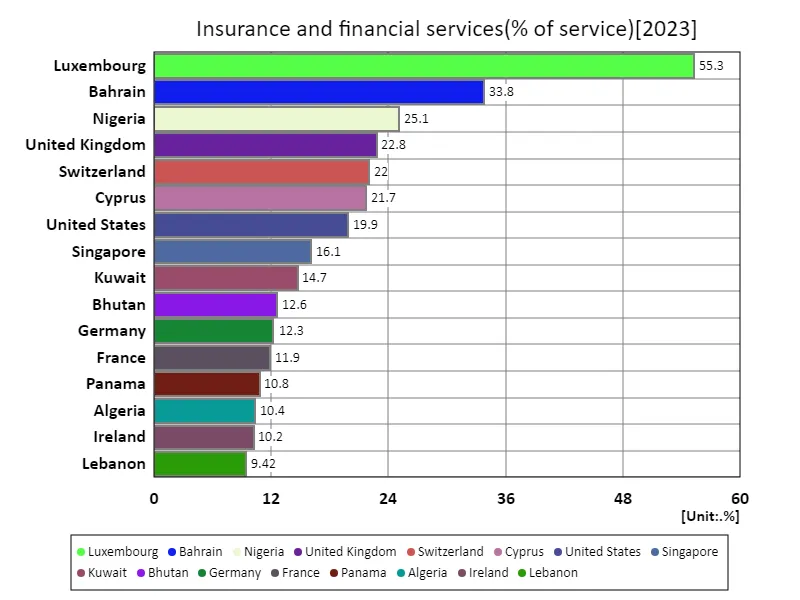

Luxembourg’s high insurance and financial services ratio of 55.3% in 2023 is driven by the structural characteristics of the country’s economy. Luxembourg is known as an international financial center, home to multinational companies and investment funds. As a result, financial services account for a large proportion of the overall economy, and the financial industry is experiencing remarkable development. Tax incentives and an improved business environment also have an impact. Recently, strengthening global regulations and market changes have affected the insurance and finance sector, causing fluctuations in service ratios, but Luxembourg’s characteristically high ratios demonstrate its position.

Insurance and financial services (% of service)

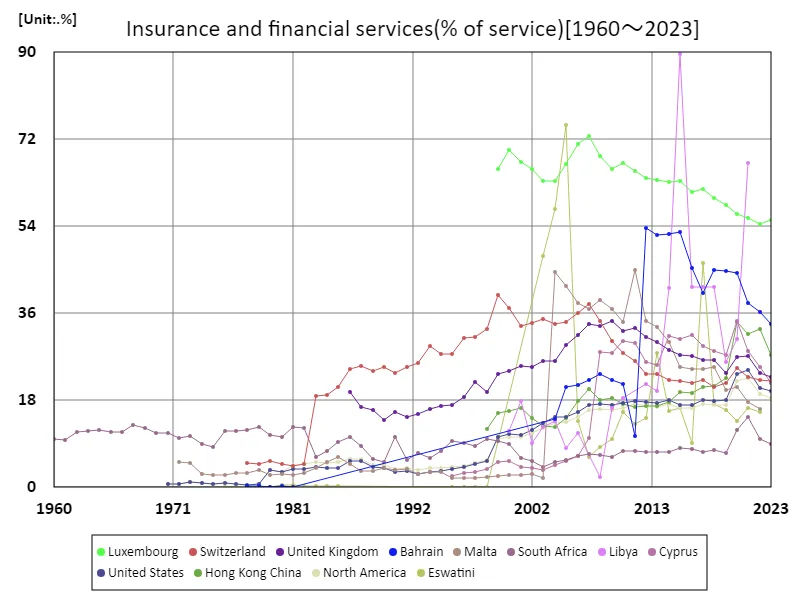

The large fluctuations in Libya’s insurance and financial services ratios from 1960 to 2023 are driven by the country’s historical economic and political transitions. Libya’s services ratio peaked at 89.6% in 2015 because Libya’s economy was dependent on oil revenues, with oil-related insurance and financial services accounting for a large proportion. This high ratio reflects the unique development of Libya’s financial services sector and the importance of financial institutions to managing revenues from oil resources. However, after its peak, Libya was hit by civil war and political instability, causing its economic foundation to become severely shaken. By 2023, the services ratio is expected to fall to 74.8%, due to economic turmoil caused by war, destruction of infrastructure, and instability in financial markets. Thus, fluctuations in the ratio of insurance and financial services in Libya are closely linked to political stability and the overall health of the economy.

The maximum is 89.6%[2015] of Libya, and the current value is about 74.8%

Insurance and Financial Services (% of service) (Worldwide)

According to data from 1960 to 2023, the ratio of insurance and financial services in Libya shows notable fluctuations. In particular, Libya’s services ratio reached 89.6% in 2015, reflecting its economic structure dependent on oil revenues. Libya’s abundant oil resources have led to a high demand for oil-related insurance and financial services, resulting in these services making up a very high proportion of GDP. However, Libya’s economy was subsequently hit hard by political turmoil and civil war. This has reduced the insurance and financial services share to 74.8% from its 2015 peak. This fluctuation reflects a relative decline in the importance of financial services due to instability in Libya’s financial markets, damage to infrastructure, and declining foreign capital. Thus, the fluctuations in the ratio of insurance and financial services in Libya indicate that oil dependency and political stability are important factors in the economy. While the high rate at its peak reflected Libya’s economic prosperity, the current decline speaks to the country’s economic difficulties.

The maximum is 89.6%[2015] of Libya, and the current value is about 74.8%

Insurance and financial services (% of service) (Worldwide, latest year)

According to 2023 data, the highest service ratio for insurance and financial services is in Luxembourg at 55.3%, indicating that the country’s economic structure is highly dependent on the financial industry. Luxembourg has established itself as an international financial centre, attracting multinational companies and investment funds and with a notable proportion of financial services. In comparison, the global average is 5.58%, a very low figure compared to Luxembourg. This difference highlights Luxembourg’s unique position in global financial markets. The overall combined service ratio of 608% suggests that some countries recorded higher ratios. This means that while certain countries and regions have a high reliance on financial and insurance services, resulting in significantly higher ratios for individual countries, there are large differences on average. As a trend to date, as economic globalization progresses, countries that act as financial centers tend to have higher service ratios. At the same time, many countries still have a relatively low share of insurance and financial services as a proportion of GDP. This is due to differences in each country’s economic characteristics and industrial structure.

The maximum is 55.3% of Luxembourg, the average is 5.58%, and the total is 608%

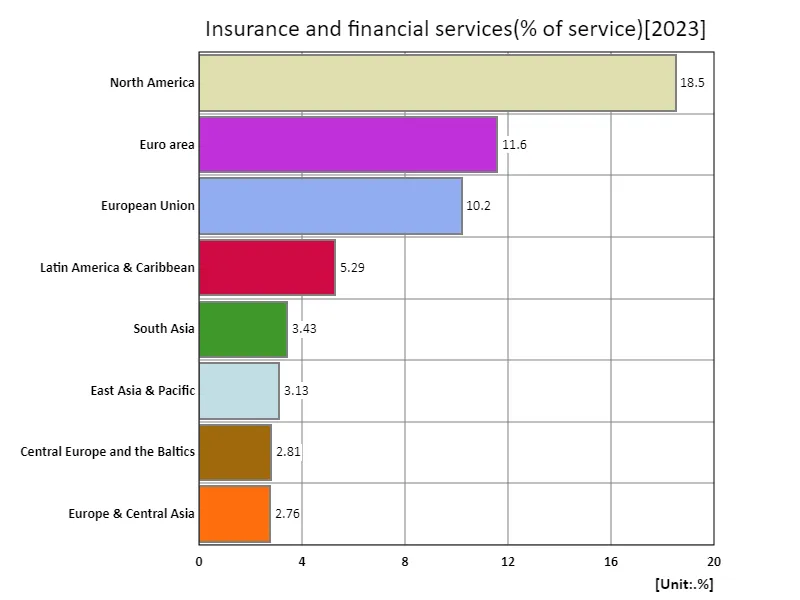

Insurance and financial services (% of service) (region, latest year)

According to 2023 data, North America has the highest service ratio for insurance and financial services at 18.5%, indicating the region’s strong influence in the financial industry. North America is known as a global financial center, home to many major financial institutions and insurance companies, and financial services play an important role in economic activity. Meanwhile, the global average service ratio is 7.22%, which is significantly lower than in North America. This difference reflects North America’s economic structure, which is heavily dependent on the financial industry, while in many regions financial services account for a relatively low proportion of GDP. The overall total of 57.7% indicates that while some countries and regions recorded high rates, the average rate was relatively low. Historically, areas with a growing financial industry have tended to have higher service ratios. In particular, the proportion of financial services is increasing as the economy becomes more globalized and financial markets mature. Conversely, there are regions with lower ratios due to less diversified economies or a relatively small financial sector.

The maximum is 18.5% of North America, the average is 7.22%, and the total is 57.7%

Comments