Abstract

The data showing that Luxembourg will have the largest import share of insurance and financial services at 47.2% in 2023 reflects the country’s economic structure. Luxembourg is an international hub for the financial industry, which is why imports of insurance and financial services are very high. This is because Luxembourg’s financial industry caters to demand for services from multinational companies and investors, and there is a lot of financial activity both domestically and internationally. Historically, Luxembourg’s financial services industry has expanded in line with increasing globalisation. It is believed that the country’s preferential tax system and relaxed regulations have attracted international financial institutions and insurance companies, resulting in an increase in the import ratio. Although Luxembourg is small, it serves as a centre for financial asset management and investment funds, making it highly dependent on services from abroad. Luxembourg’s high services ratio thus reflects its important position in international financial markets and is closely linked to the globalisation of its economy.

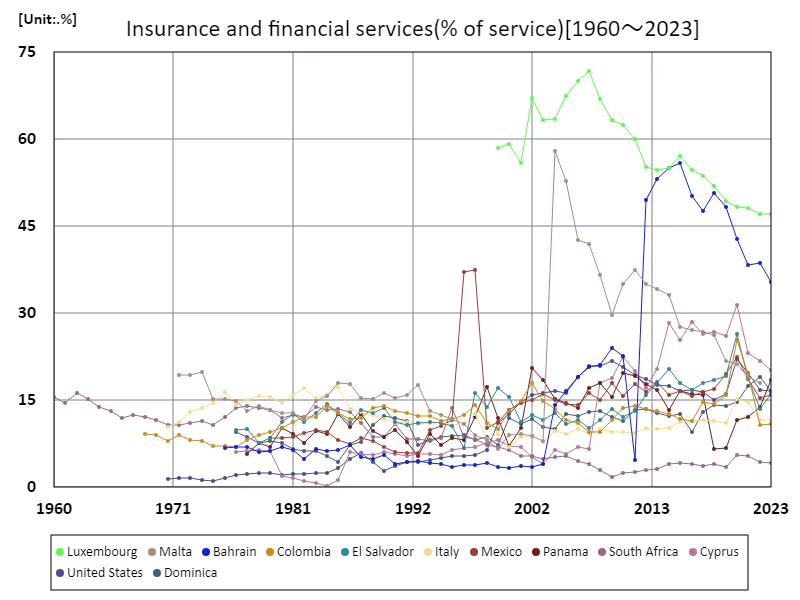

Insurance and financial services (services ratio)

Looking at the data from 1960 to 2023, Luxembourg’s insurance and financial services export ratio shows a notable change. Luxembourg has maintained a high ratio since peaking at 71.8% in 2007, but it currently stands at 65.7%. The decline indicates that the country’s financial industry is entering a period of adjustment after a period of rapid growth. Between the 1960s and the early 2000s, Luxembourg’s financial services industry developed rapidly and the country established itself as an international financial centre. This growth was supported by tax incentives, deregulation, and an influx of foreign capital. Especially from the mid-to-late 2000s, Luxembourg’s export share of financial services increased sharply as global financial markets expanded. However, since the 2008 financial crisis, increased regulation and market changes have forced an adjustment in Luxembourg’s financial services ratios. In addition, in recent years, the ratio has remained high due to the influence of stricter regulations and intensifying competition within the EU. Nevertheless, Luxembourg’s financial industry remains internationally significant and plays a central role in international financial markets.

The maximum is 71.8%[2007] of Luxembourg, and the current value is about 65.7%

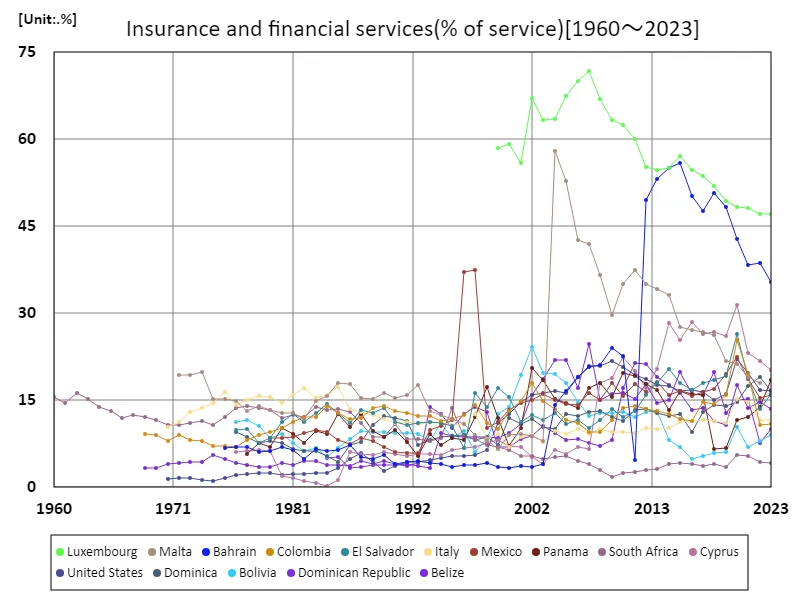

Insurance and Financial Services (Services Ratio) (Worldwide)

Throughout the data from 1960 to 2023, Luxembourg’s insurance and financial services export ratio shows notable fluctuations. In particular, after reaching a peak of 71.8% in 2007, it has now fallen to 65.7%. This fluctuation reflects growth and adjustments in Luxembourg’s financial sector. From the 1960s to the early 2000s, Luxembourg rapidly grew into an international centre for financial services, thanks to favourable tax rates and deregulation. Especially in the mid-2000s, Luxembourg’s financial services ratio increased sharply with the expansion of international financial markets. The peak in 2007 signalled a period of global financial prosperity and rapid growth in Luxembourg’s financial industry. However, since the 2008 financial crisis, the financial industry has faced a tough environment. Luxembourg’s financial services ratios have entered a period of adjustment due to increased regulation and market changes. Additionally, increased competition within the EU and changes in the financial industry are also having an impact. Nevertheless, Luxembourg still maintains a high proportion of financial services and continues to play an important role in international financial markets.

The maximum is 71.8%[2007] of Luxembourg, and the current value is about 65.7%

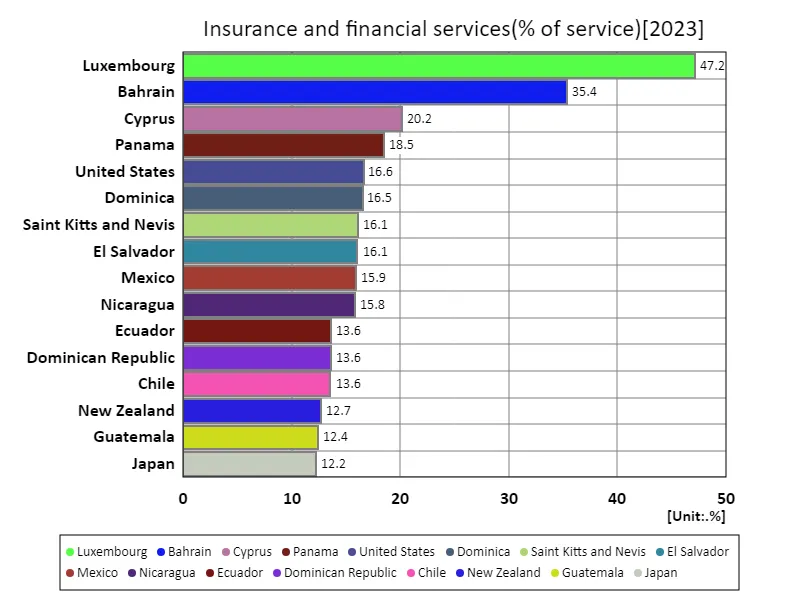

Insurance and financial services (% of services) (Worldwide, latest year)

According to 2023 data, Luxembourg stands out in terms of the export share of insurance and financial services at 47.2%, compared to an overall average of 7.76% and a total of 861%. The data reflects Luxembourg’s economic structure and its status as an international financial centre. Since the 1950s, Luxembourg has established itself as an international hub for the financial industry. In particular, tax incentives and deregulation attracted foreign financial institutions and insurance companies, dramatically increasing the proportion of financial services in the country. After peaking in the 2000s, the ratio has remained high since the 2010s, but has shown some adjustments recently. On the other hand, Luxembourg’s high ratio compared to the global average of 7.76% reflects the country’s unique economic structure. The high export ratio of insurance and financial services is largely due to Luxembourg’s deep involvement in international financial markets and its role as a global investment centre. The total figure of 861% is an aggregate of data from several countries and highlights the peculiarity of Luxembourg’s ratio. As such, Luxembourg’s economy is heavily dependent on financial services, and their influence remains strong.

The maximum is 47.2% of Luxembourg, the average is 7.76%, and the total is 861%

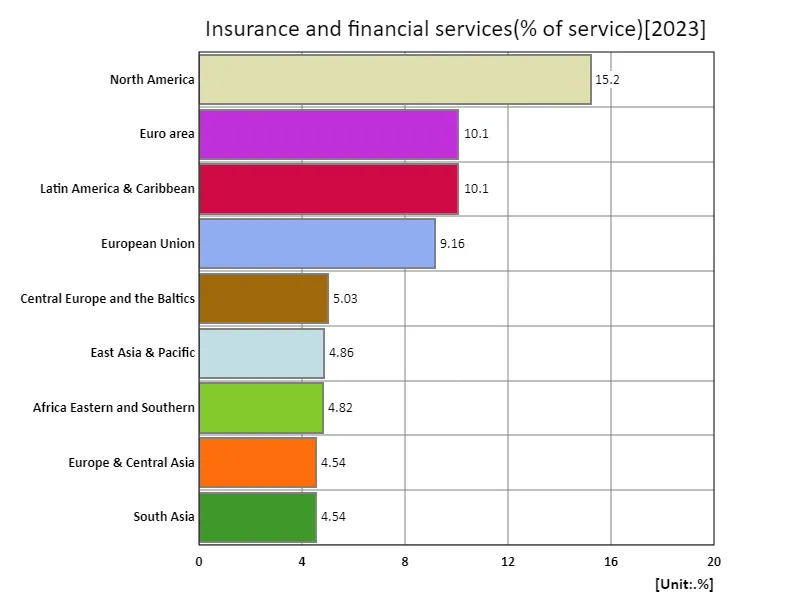

Insurance and financial services (% of services) (region, latest year)

According to 2023 data, North America has the highest ratio of services to insurance and financial services products sold at 15.2%, compared to an overall average of 7.59% and a total of 68.3%. This figure reflects the importance of financial services by region and the structure of the market. North America’s high ratio reflects the region’s role as an international financial center. The United States in particular is the center of the global financial market and has an enormous scale and influence in financial services. The North American financial industry has long promoted technological innovation and globalization, and is a major exporter of financial products and services. This results in North America’s service ratio being significantly higher than other regions. On the other hand, the overall average is 7.59%, indicating that the proportion of financial services is relatively low in many regions. This indicates that the core of the economy is not necessarily specialized in the financial industry, and that in many countries financial services are not a major industry. The 68.3% total also represents a combined percentage across multiple regions around the world, highlighting the important role financial services play in the economy overall, but its influence varies significantly by region.

The maximum is 15.2% of North America, the average is 7.59%, and the total is 68.3%

Comments